CES 2026 ran from January 4 to January 9 in Las Vegas. The core theme was clear: AI is accelerating its shift from cloud-centric computing toward on-device intelligence and real-world, physical applications. Chipmakers rolled out new platforms across AI servers, AI PCs, and advanced process nodes. Markets reacted fast, with clear divergence in stock pricing.

ETO Markets reviews key moves by major chipmakers at CES 2026 and the resulting market reactions.

NVIDIA at CES 2026: Vera Rubin Production, BlueField-4 Ships

NVIDIA pivoted further toward system-level AI platforms. Vera Rubin entered mass production, alongside the launch of the BlueField-4 DPU. The company introduced the Alpamayo inference model for L4 autonomous driving. It also launched robotics simulation models and unveiled the DGX Spark and DGX Station desktop AI systems.

On January 5, U.S. semiconductor equipment and materials stocks rallied. AMKR rose nearly 9%. KLA gained more than 7%. ASML, LRCX, and AMAT climbed over 6% and hit record highs. NVIDIA closed at USD 188.12, down 0.39%.

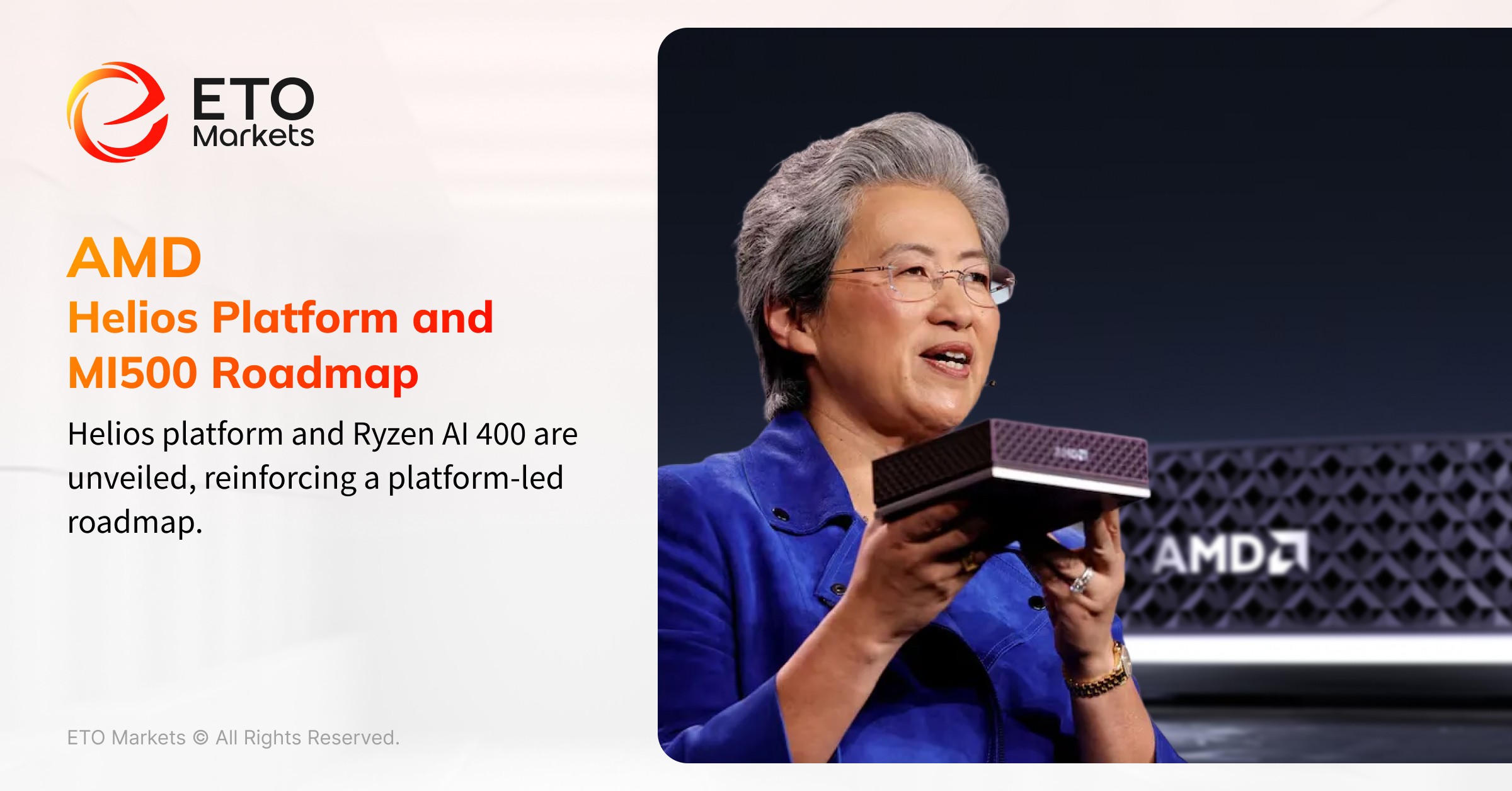

AMD CES 2026 Strategy: Helios Platform and MI500 Roadmap

AMD extended its platform strategy with the launch of Helios, a rack-scale AI system using full liquid cooling. The platform integrates MI455 GPUs, EPYC “Venice” CPUs, and Pensando accelerators. AMD also outlined the MI500 roadmap based on 2nm process technology and HBM4E.

On the client side, AMD positioned 2026 as the AI PC scale-up year. Ryzen AI 400 processors will launch in Q1, followed by Ryzen AI Halo mini PCs in Q2.

Despite backing from major clients including Open AI, AMD shares fell 3.5% after the keynote. Markets stayed cautious on timing. MI500 will not arrive until 2027, and Helios needs time to translate into material revenue.

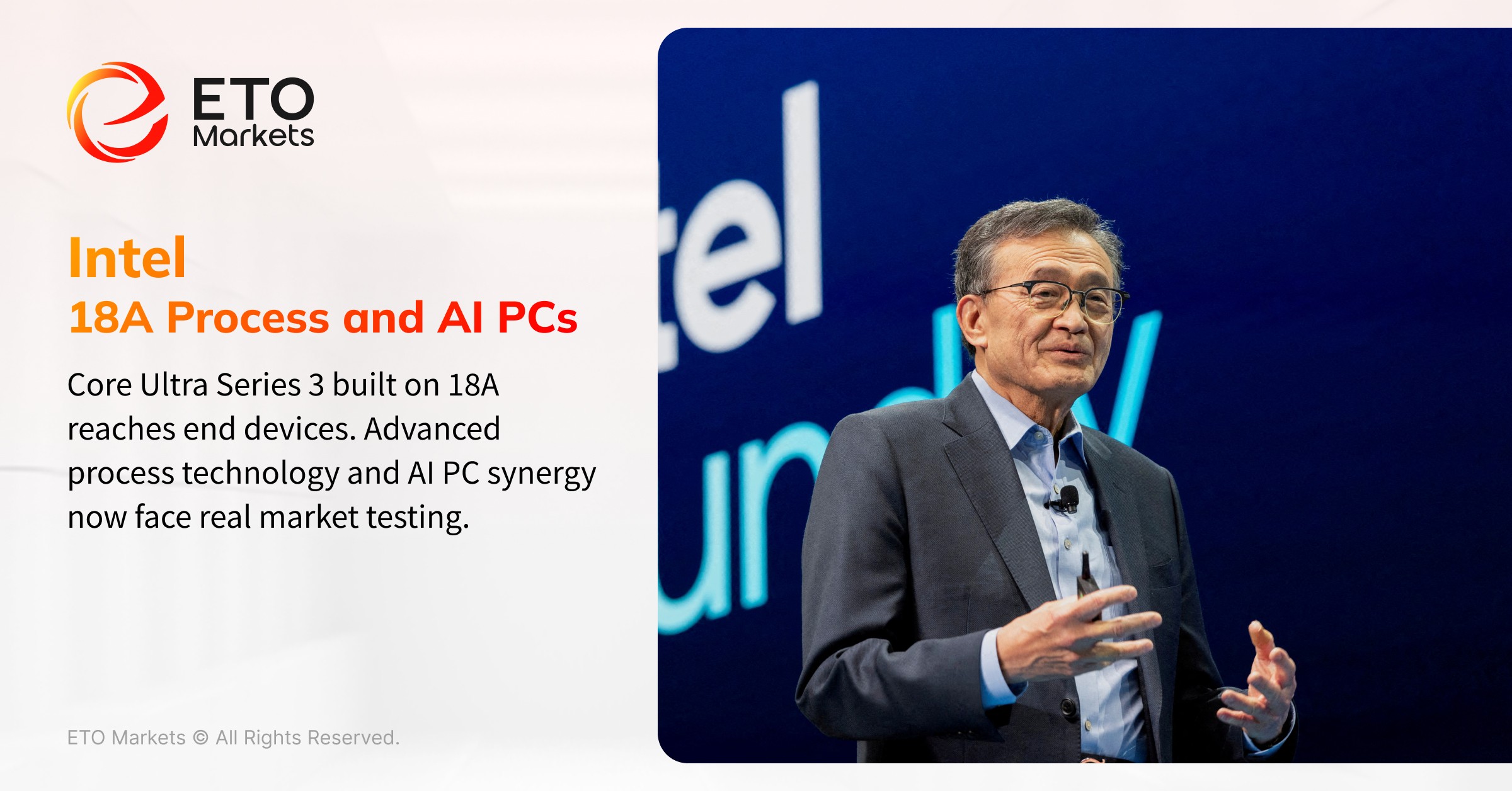

Intel CES 2026 Update: 18A Process and AI PCs

Intel focused on strengthening on-device AI at CES, launching Core Ultra Series 3 processors built on its 18A process. The lineup adds X9 and X7 models with integrated GPUs and NPUs. Notebook shipments begin in late January, edge systems expected in Q2.

Intel shares rose more than 6% on January 7 as markets priced in improving PC competitiveness.

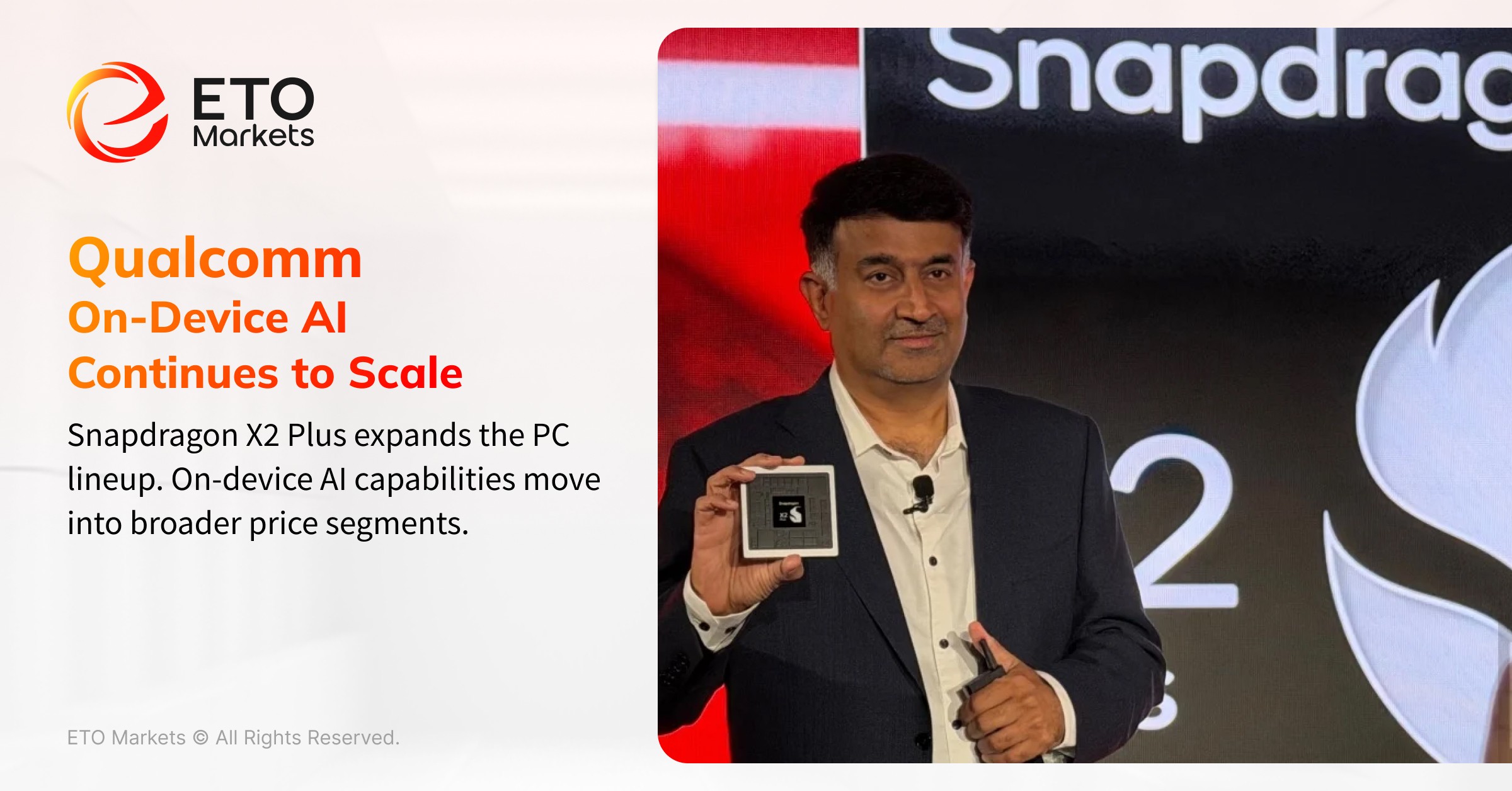

Qualcomm CES 2026: Snapdragon X2 and On-Device AI

Qualcomm expanded its PC portfolio with Snapdragon X2 Plus. The chip comes in six-core and ten-core versions. Performance gains reach up to 35%, while power consumption drops 43%. On-device AI is supported by an NPU delivering up to 80 TOPS.

On January 5, Qualcomm shares rose 1.93% to USD 176.31. The stock touched USD 178.85 intraday, with volume up more than 37% day over day.

TSMC: Advanced Nodes Anchor the Supply Chain

TSMC emerged as the quiet winner of CES 2026.

As the core manufacturing hub, its advanced nodes were used across many headline launches. AMD’s Ryzen AI 400, Qualcomm’s Snapdragon X2 series, and NVIDIA’s Blackwell-based products all rely on TSMC’s 3 nm and 5 nm processes. Even Intel sourced parts of its new Core Ultra processors from TSMC using N3E technology.

Goldman Sachs raised its TSMC target price. On January 5, TSMC shares in Taiwan surged up to 6.9%, marking the largest daily gain since last April.

CES 2026: Delivery Speed Sets Valuations

CES 2026 did not alter the long-term trajectory, but it exposed widening timing gaps across the sector. Markets are pricing execution speed and revenue visibility.

ETO Markets will continue tracking global technology shifts and their impact on capital markets, helping investors navigate uncertainty.

Read more market insights at ETO Markets Trendwatch.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products. ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.