Article by: ETO Markets

The price of gold is trading above $2,300 during the Asian session on Thursday, setting a new record. The US ISM Services PMI data for March came in below expectations, and dovish Fed language raised hopes of a rate cut and gold prices. Next up, some more Fedspeak and US statistics.

According to a survey released by the Institute for Supply Management, the US service sector's growth stalled in March. This increases speculation that the Federal Reserve would begin reducing interest rates in June, which would cause the yields on US Treasury bonds to drop sharply and negatively impact the value of the greenback.

The Japanese Yen gains a little bit versus the US dollar in an attempt to consolidate the small gain it made the day before from the neighbourhood of a multi-decade low. The Japanese government's growing threat of intervention keeps the home currency somewhat supported. In addition, the overnight decline in the US dollar to a level close to a one-week low helped to contain the USD/JPY pair around the 152.00 round-figure barrier.

Following better Judo Bank Purchasing Managers Index data reported on Thursday, the Australian dollar is rising for the third straight session. Better Building Permits data that were made public by the Australian Bureau of Statistics further supported the AUD's gain.

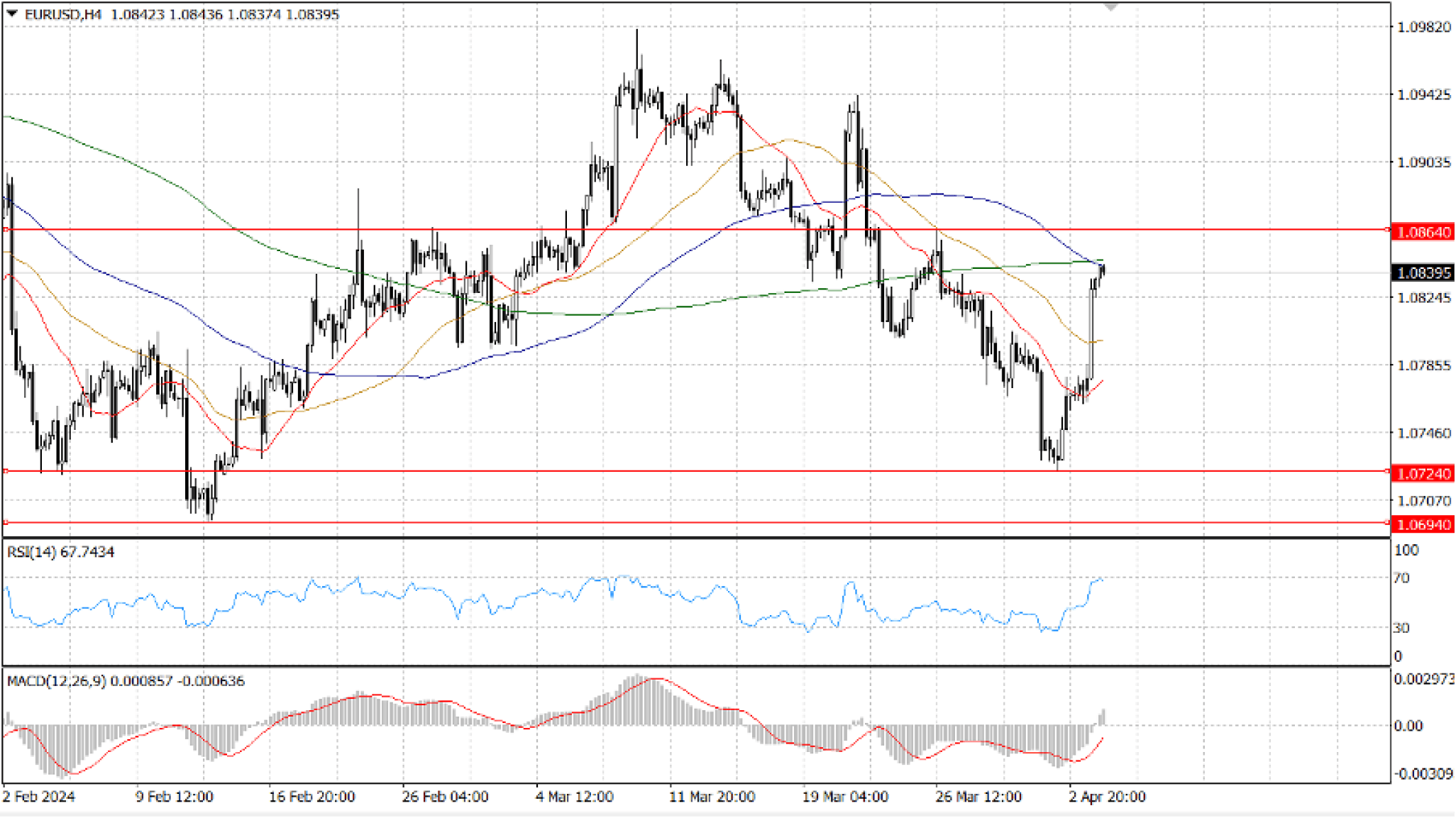

It is anticipated that the European Central Bank and the Federal Reserve would start easing cycles, potentially in June. The two central banks may adopt different tactics as a result of the anticipated differences in the rate at which further interest rate cuts occur. However, it is expected that the ECB would not fall behind the Fed by far.

The 4-hour chart indicates a robust recovery from the recent lows at ... The 200-SMA, which is located around … ahead of … , is the first level of resistance. The next discernible downward barrier in the other direction seems to be … , which is followed by ... Relative Strength Index increased over 67, and Moving Average Convergence Divergence recovered and flirted with positive territory.

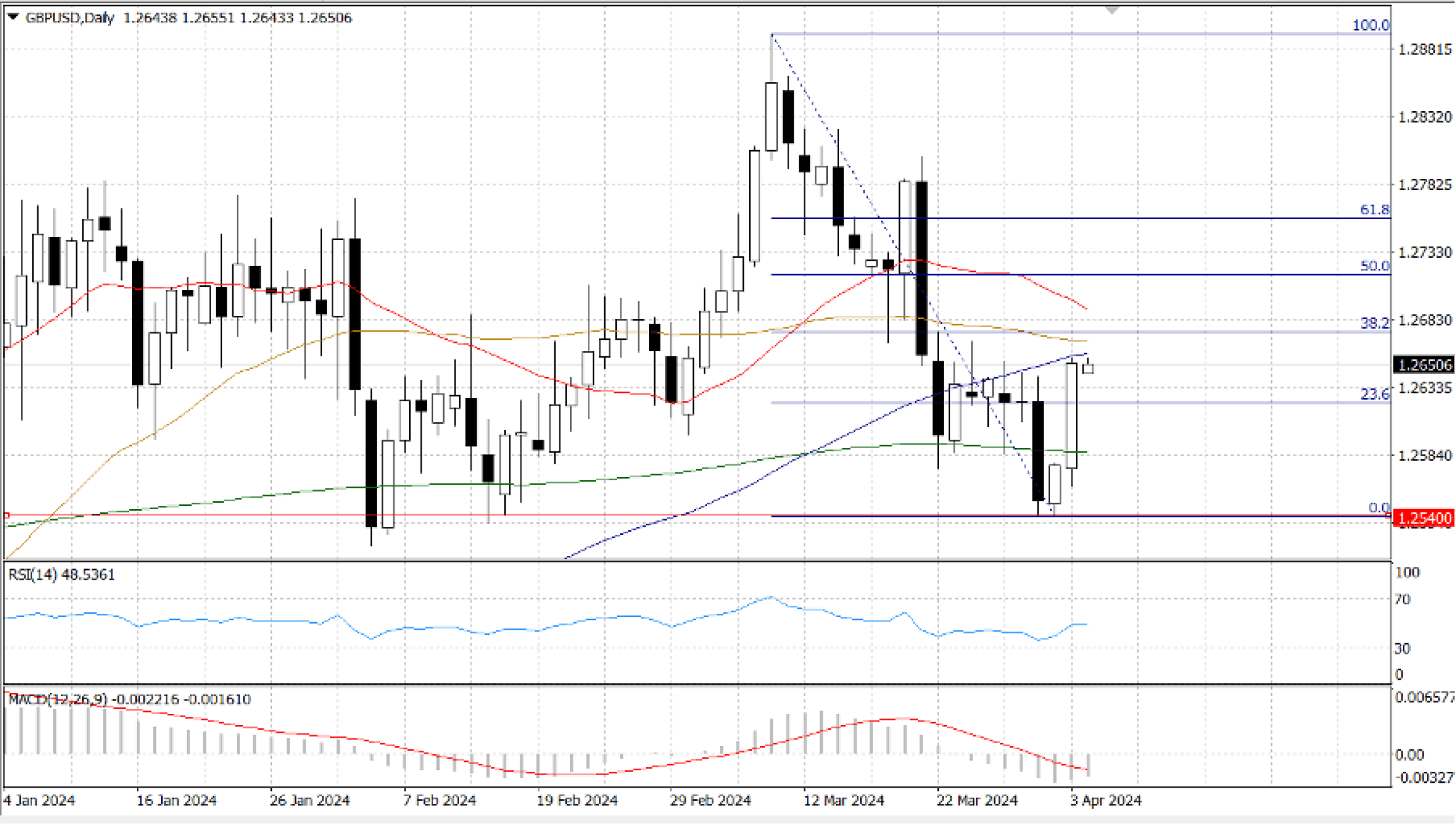

Money market futures traders presently see a two-thirds chance of seeing the Bank of England cut rates by 25 basis points in June. In a similar vein, traders on the other side of the Atlantic have fully priced in a July 25 basis point reduction by the Federal Reserve. The British Pound is predicted to decline in response to the anticipated rate drop by the BoE in June. The GBP/USD pair may be undermined as a result of this.

The 4-hour chart's Relative Strength Index remains below 50, and the GBP/USD pair keeps moving within a regression channel that is declining, indicating a bearish bias. More significantly, the pair closed below the current 200-DMA, which is at ... On the negative side, it appears that static support emerged at …. prior to ... If the GBP/USD pair is able to recover …, the next resistance levels might reach … , which is the Fibonacci 38.2% retracement and ...