In this week, in Japanese market, the USD/JPY dropped over 1% in early North American trading, settling at …, as US inflation data revealed a continued slowdown in core inflation. The Bureau of Labor Statistics reported a 0.4% MoM rise in CPI, exceeding estimates, while core inflation grew by 0.2% MoM and 3.2% YoY, slightly below expectations. This droves the US 10-year Treasury yield down by 12 bps to 4.661%, boosting the Yen. Earlier, BoJ Governor Kazuo Ueda signalled potential rate hikes if economic conditions improve, emphasizing the importance of Spring wage talks. Meanwhile, US Fed officials are set to speak ahead of key economic data releases later this week.

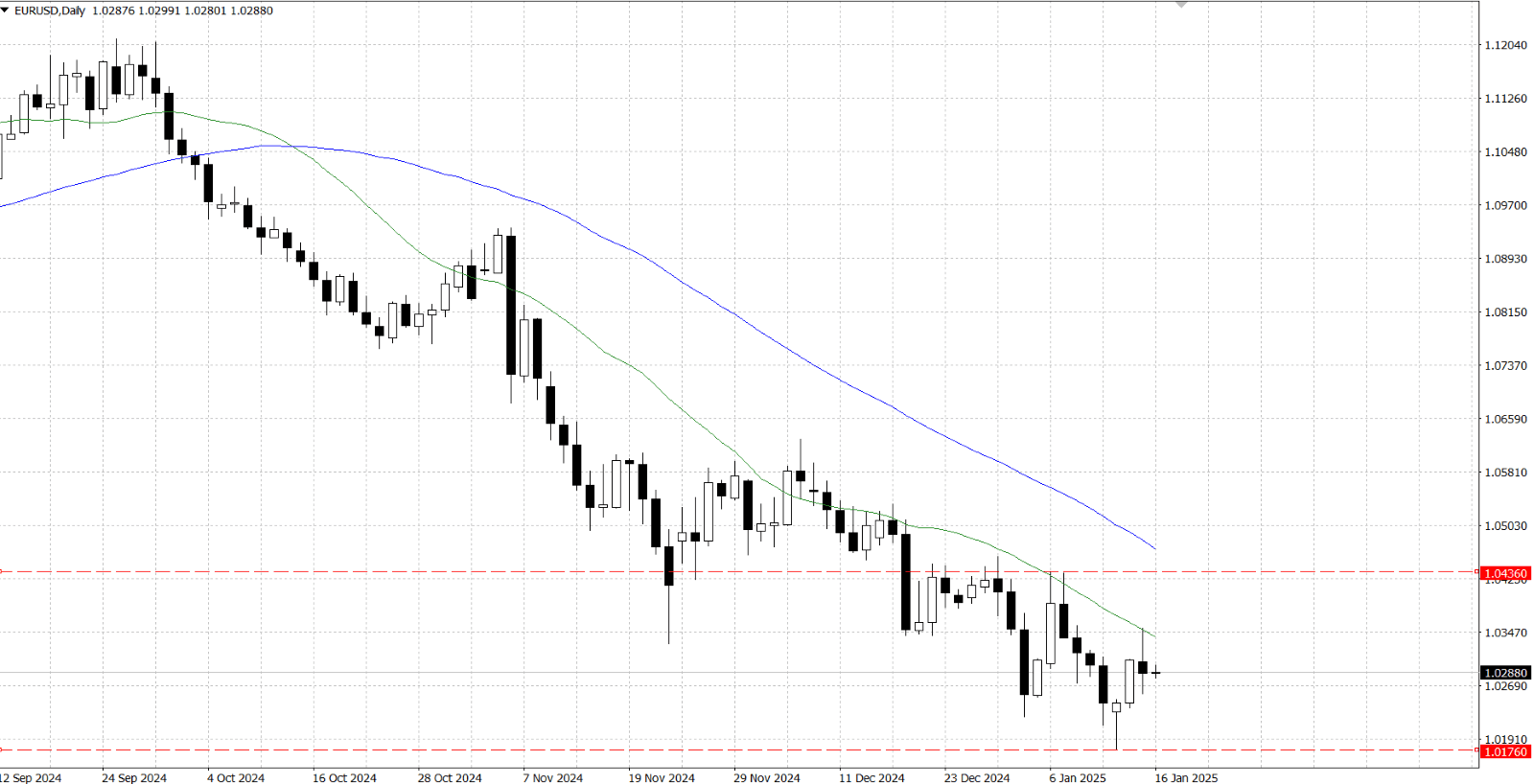

In Europe markets, the EUR/USD saw a mixed performance on Tuesday, initially climbing above …after US inflation matched December estimates but later retreating to … due to a rebound in the US Dollar. The US Dollar Index briefly dipped below … before recovering, driven by investor repricing of potential Fed rate cuts, though the probability remains low at 3%. Fed Chair Jerome Powell reiterated the commitment to reducing inflation to 2%, balancing gradual Labor market adjustments with inflation concerns. Meanwhile, the ECB is expected to continue its rate-cutting strategy to support growth despite eurozone inflation risks, particularly in Germany. Trade policy uncertainties and potential tariffs under President-elect Donald Trump add further complexity, potentially boosting the USD and weighing on the EUR/USD pair. Key upcoming events include eurozone inflation data and Fed policymakers' speeches, with the euro facing ongoing challenges from monetary policy divergence, Germany’s economic slowdown, and broader geopolitical risks.

The EUR/USD extended losses for the second straight session on Thursday, trading around … during Asian hours, as expectations of further ECB policy easing weighed on the pair. ECB official Olli Rehn suggested that monetary policy could move out of restrictive territory by midsummer, reflecting the Eurozone's weak economic outlook. However, the euro briefly gained as the US Dollar weakened following cooler-than-expected US inflation data for December, sparking speculation of two potential Fed rate cuts in 2024. US CPI rose 2.9% YoY in December, with Core CPI increasing 3.2% YoY, slightly below forecasts. The Fed’s Beige Book highlighted moderate consumer spending growth driven by strong holiday sales but noted a slight decline in manufacturing activity due to tariff-related inventory buildup.

The EUR/USD remains under pressure within a broader bearish trend, with critical support at … (YTD low) and parity at …. Resistance levels to watch include … (2025 high), … (55-day SMA), and … (December peak), while a sustained bearish outlook persists below the 200-day SMA at …. In shorter timeframes, interim resistance is seen at … and …, with support levels extending to … and …. Momentum indicators show weakening daily RSI near 40, though the ADX at 36 suggests the bearish trend remains strong.

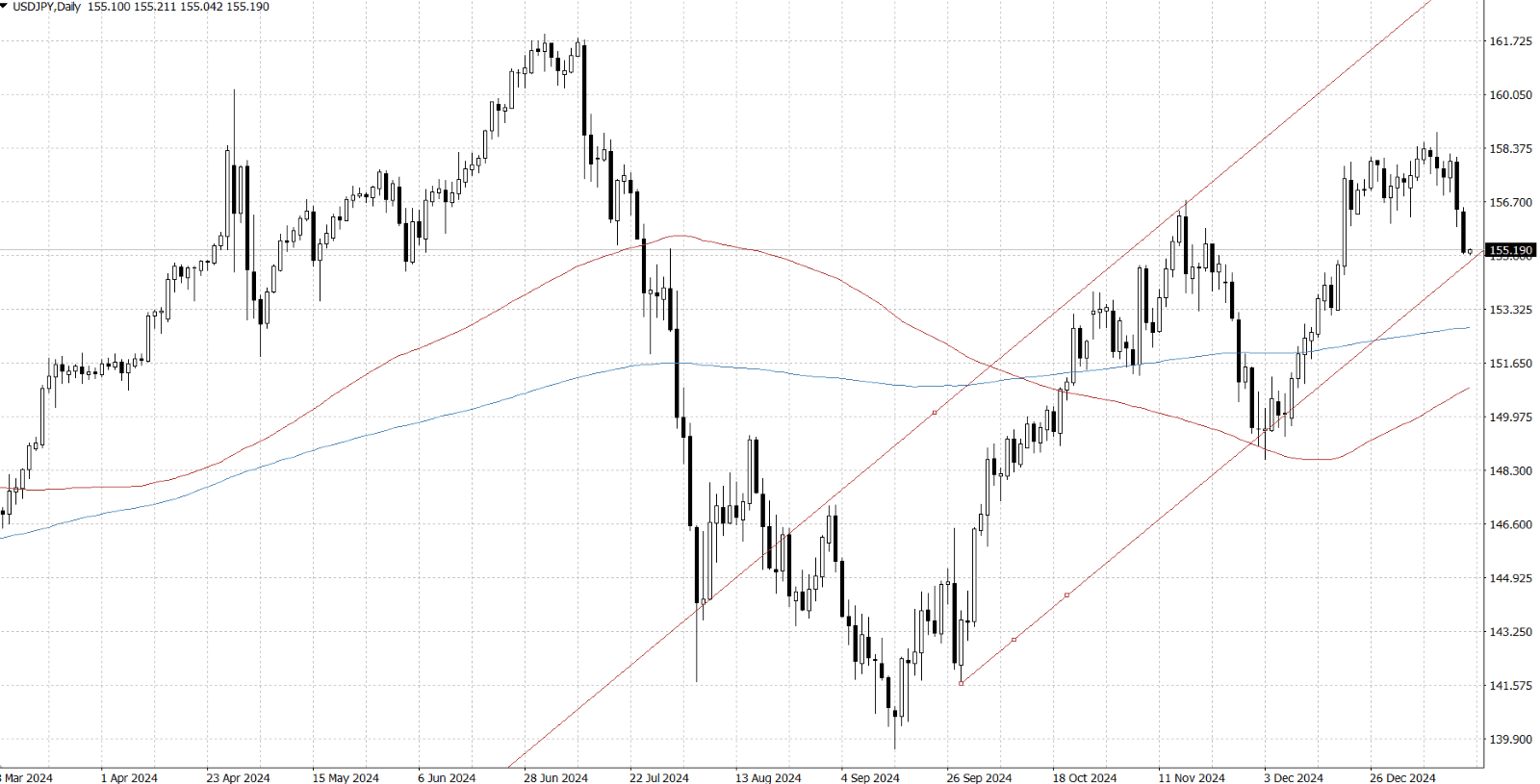

The USD/JPY pair recovered above the … mark in Thursday’s European session after trimming intraday losses, supported by dip-buying in the US Dollar and easing concerns over President-elect Donald Trump’s trade tariffs. Expectations of two Fed rate cuts this year, along with a potential pause in its rate-cutting cycle, kept risk sentiment upbeat, undermining the safe-haven appeal of the Japanese Yen. However, JPY depreciation remains limited as bets grow for a Bank of Japan (BoJ) rate hike at its January 23-24 meeting, bolstered by Governor Kazuo Ueda’s and Deputy Governor Ryozo Himino’s hawkish comments. Japanese 10-year bond yields climbed to 12-year highs, narrowing the US-Japan yield differential amid retreating US Treasury yields following softer-than-expected US CPI data. The US Dollar's decline on Wednesday, driven by the inflation report, contributed to USD/JPY's earlier drop, while traders now await US macro data and the BoJ's upcoming policy decision for further direction.

The USD/JPY pair remains at a critical juncture, with key support near the … psychological level. A break below this could expose the …-… region, marking the lower boundary of a four-month-old ascending channel. A decisive breach of this level would signal a bearish trend, potentially driving the pair below … and toward the …-… support zone. On the upside, resistance is seen at …, followed by …-… and …. Sustained buying above … could shift the bias back to bullish, targeting … and potentially retesting the multi-month peak around …-….