Article by: ETO Markets

Following decreased expectations for an impending change in the Federal Reserve's policy stance, any significant rebound in the price of gold still looks elusive. In fact, following the announcement of positive US Retail Sales data on Wednesday that indicated a robust US economy, market players further reduced their expectations for an interest rate drop in March. This benefits the USD bulls and maintains support for higher US Treasury bond yields. Therefore, it would be wise to hold off on declaring that the XAU/USD has formed a near-term bottom unless there is significant follow-through buying.

The likelihood of a rate cut has dropped significantly from above 70% to 57%. Because stock market models are now pricing in fewer rate cuts for the year, US Treasuries are selling off, which is driving up yields. On Wednesday, rates increased by more than 2% for the second day in a row. At one point during the day, the 2-year bond yield even increased by 3%. Of course, rising yields typically follow stock prices in the opposite way, and this situation is no exception.

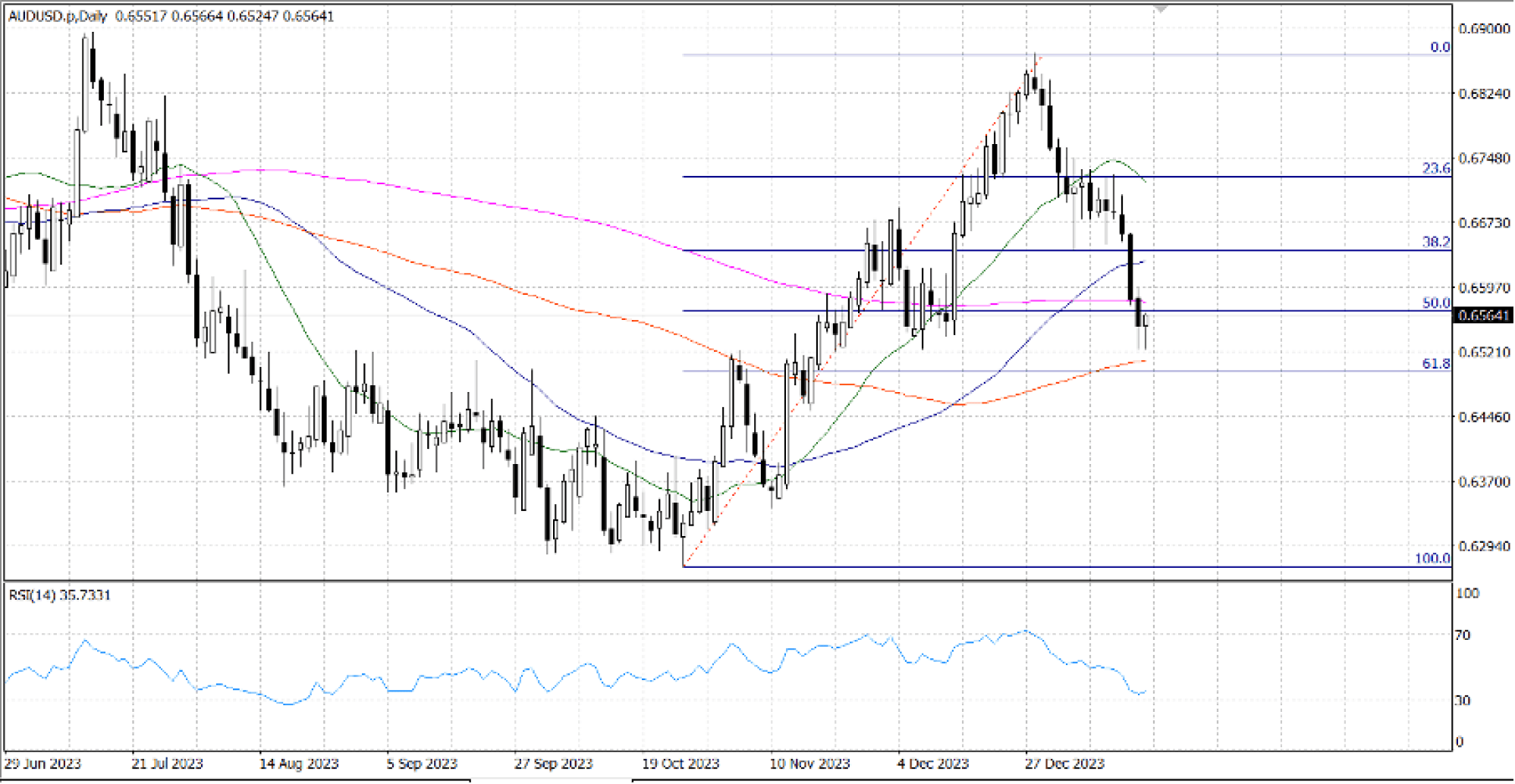

The mild data from Australia that was made public on Thursday doesn't seem to be supporting the Australian dollar in any way. January's seasonally adjusted unemployment rate kept steady at 3.9%, in line with estimates for December, while consumer inflation expectations stayed stable at 4.5%. The number of employed people fell by 65.1K, according to the Employment Change figures, despite the 17.6K rise that was predicted.

From a geopolitical standpoint, a more significant drop in the price of crude oil is being resisted by the ongoing disruption in supplies in the Red Sea. Many corporations have had to reroute their cargo around Africa due to the attacks on ships in the Red Sea, which were coordinated by the Houthi forces led by Iran. This has resulted in longer voyage times and higher expenses. The United States launched another series of strikes against Houthi targets in Yemen on Wednesday in retaliation for these attacks on shipping.

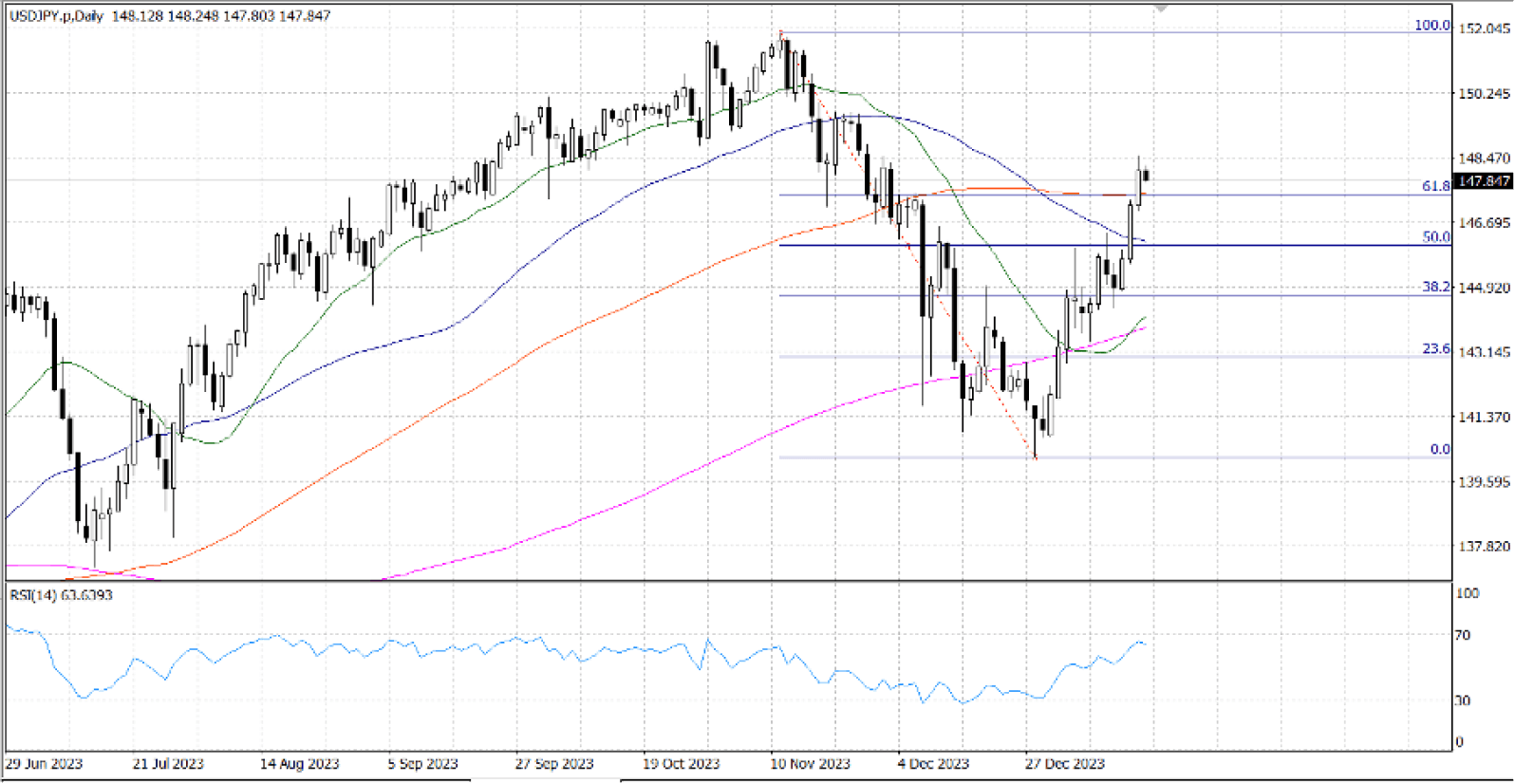

The JPY's relative safe-haven status is attributed, in part, to a generally softer risk tone, which has been reinforced by muted US Dollar price movement. Nevertheless, speculation that the Bank of Japan is unlikely to abandon its ultra-dovish attitude in the wake of Japan's terrible earthquake on New Year's Day, declining rates of inflation in Tokyo, and slower wage growth has kept the upside limited.

Bullish traders saw a new catalyst in the overnight sustained breakout and acceptance over the … confluence hurdle. The area in question includes the 100-DMA and the 61.8% Fibonacci retracement level of the decline that occurred in November and December. This should serve as a crucial turning point. Any slide after that is more likely to draw in new customers when it gets close to the round number of ...

The depressing data from China's economy for the month of December, which was released during early trading on Wednesday, included the following: the GDP Growth Rate increased below consensus by 5.2% in the October–December period, the Unemployment Rate increased slightly to 5.1%, Retail Sales increased less than predicted by 7.4%, and the House Price Index decreased by 0.4% compared to the same month in 2022. Positively, YoY expansion in industrial production was 6.8%.

The AUD/USD pair is trading close to … , with the immediate support level around … following. The AUD/USD pair may move through the area around the psychological level at … and the 61.8% Fibonacci retracement level at … if the latter is broken. The psychological resistance may be near the … level.