Article by: ETO Markets

The Japanese yen gets some momentum and somewhat recovers from its recent steep losses, which have brought it to its lowest level since November 2023 when compared to the US dollar the day before. The Bank of Japan is reportedly considering raising rates in July, although an increase in October is thought to be the most likely. Furthermore, the positive domestic data gives the JPY a little boost despite rumours that Japanese authorities may step in to stop any further decline in the value of the national currency. The USD/JPY pair is heavily pressured downward by this as well as the selling bias in the US dollar following the FOMC meeting.

the Australian dollar gained ground for the second straight day, most likely helped by encouraging jobless figures out of Australia. In parallel, the Federal Open Market Committee's decision to keep interest rates at 5.5% during Wednesday's policy meeting resulted in a notable decrease in the value of the US dollar. The AUD/USD pair gained support from this decision. The US Federal Reserve Chair Jerome Powell's dovish statements during the press conference following the meeting further put further negative pressure on the currency.

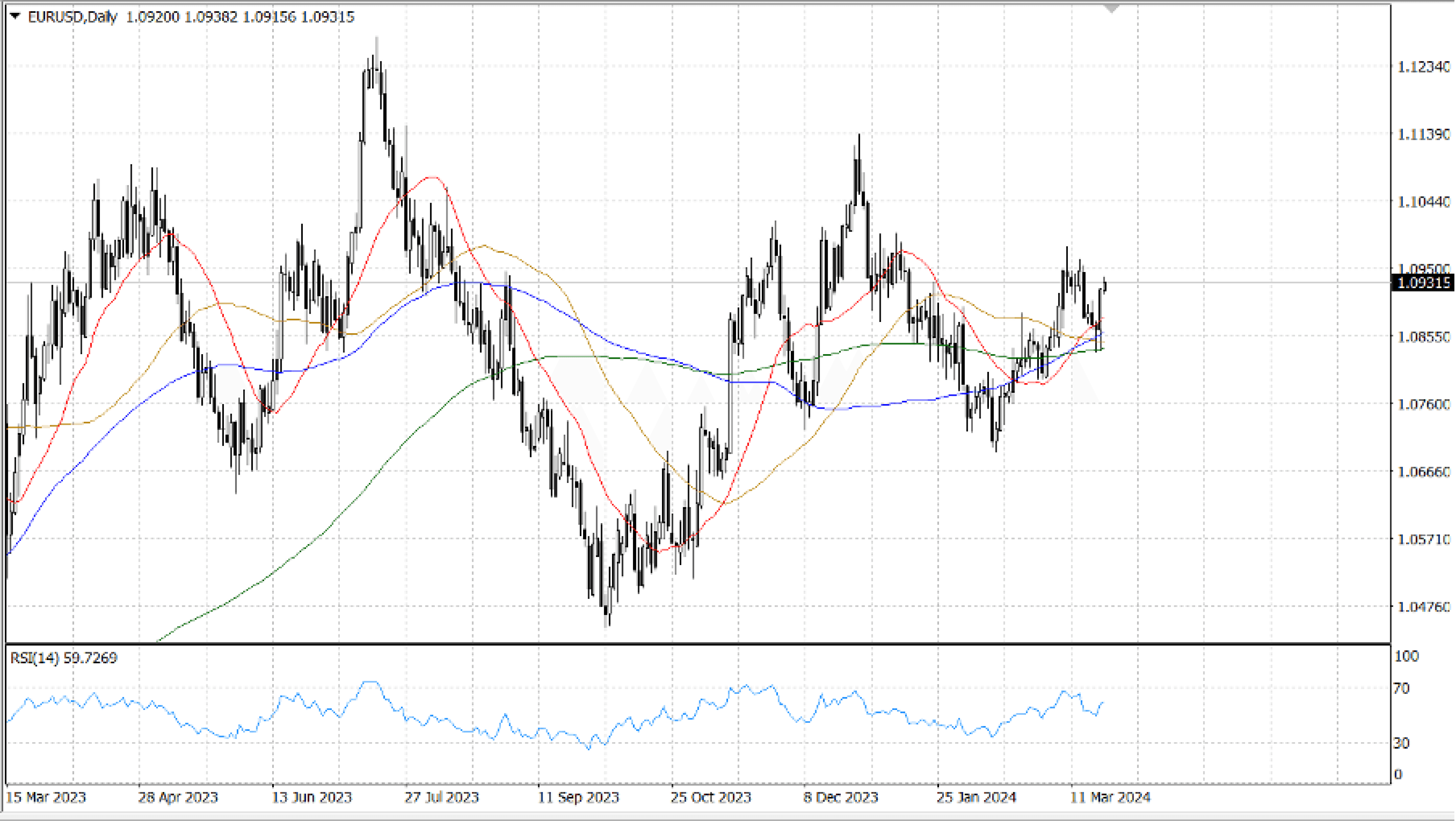

Taking a closer look at the overall macro environment, the Federal Reserve and the European Central Bank are expected to begin their easing cycles, possibly as early as June. The two central banks may adopt different tactics as a result of the anticipated differences in the rate at which further interest rate cuts occur. However, it is not anticipated that the ECB will fall much behind the Fed.

The upward resistance for EUR/USD is expected to be tested at the March 8 high of …, the weekly high of …, and the psychological barrier of ... From here, further gains can bring the price back to its December 2023 peak of ...

A stronger decline to the 2024 low of … could be triggered by a sustained breach below the pivotal 200-DMA at ... From here, the weekly low of …, the 2023 bottom of …, and the round level of … are in order of decreasing value.

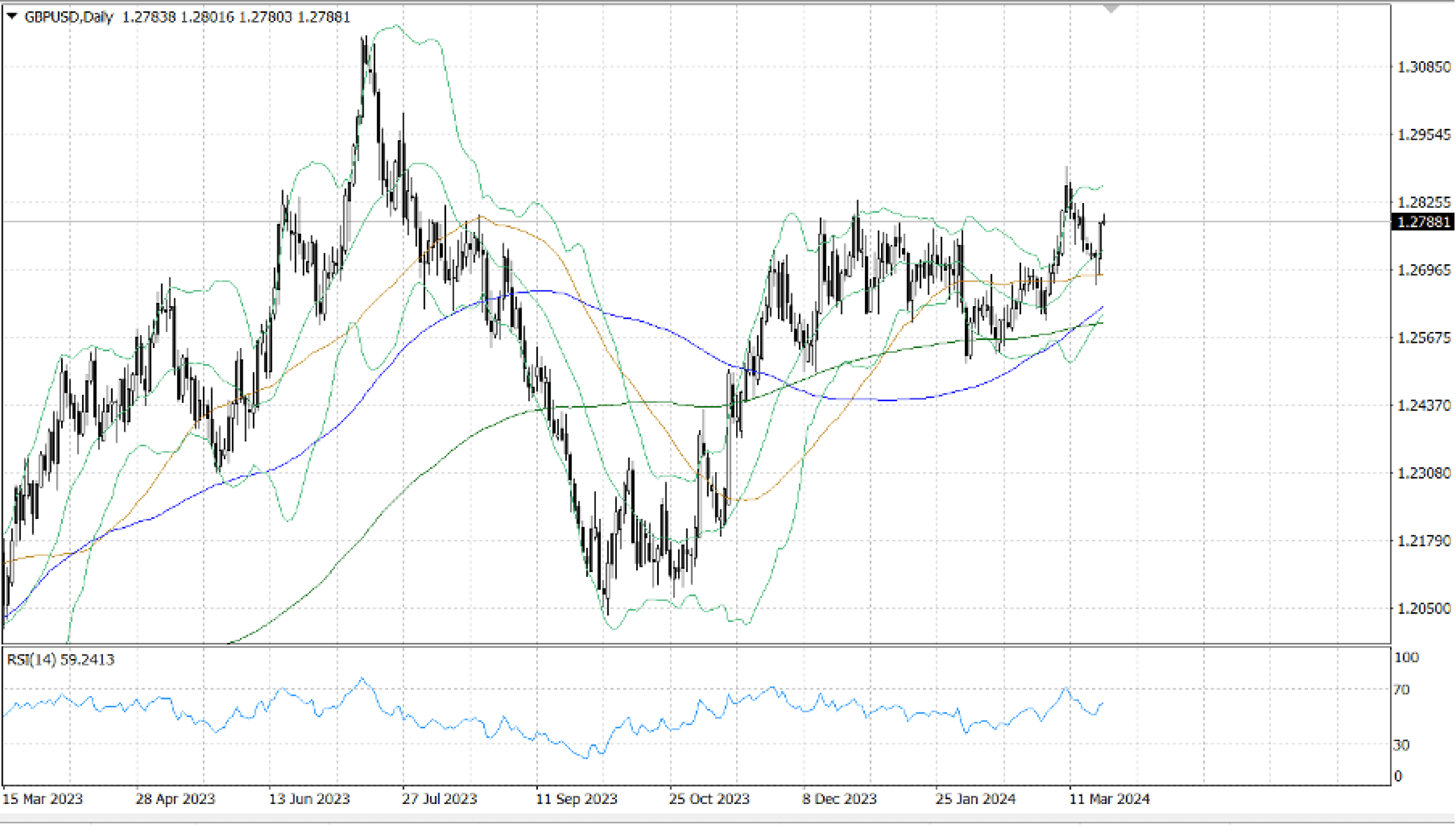

According to figures released on Wednesday by the UK's Office for National Statistics, inflation in February decreased to 3.4% annually from 4% in January based on changes in the Consumer Price Index. This result was below the market expectation of 3.6% and was the lowest since September 2021. In addition, the ONS stated that the Core CPI increased by 4.5% during the same time frame, as opposed to 5.1% in January and the 4.6%.

The upper boundary of the Bollinger Band and a psychological level of … coincide to form the major pair's immediate upside barrier. A significant break above the latter will trigger a rally that will peak at … on March 14 and eventually reach … on March 11 and the … round number.

The first support level, on the other side, is situated at …, the 100-EMA. The low on March 20 at … is the extra downside filter to keep an eye on. Any further selling will result in a decline to the Bollinger Band's lower bound.