Article by: ETO Markets

The FOMC Minutes' cautious tone on the rate of interest rate decreases put pressure on the US Dollar Index to decline on Wednesday, even though US Treasury yields rose. The minutes of the meeting made clear that more proof of deflation was required in order to allay worries about upside risks. Fund futures suggest that almost 70% of the market expects the Fed to decrease rates at its June meeting.

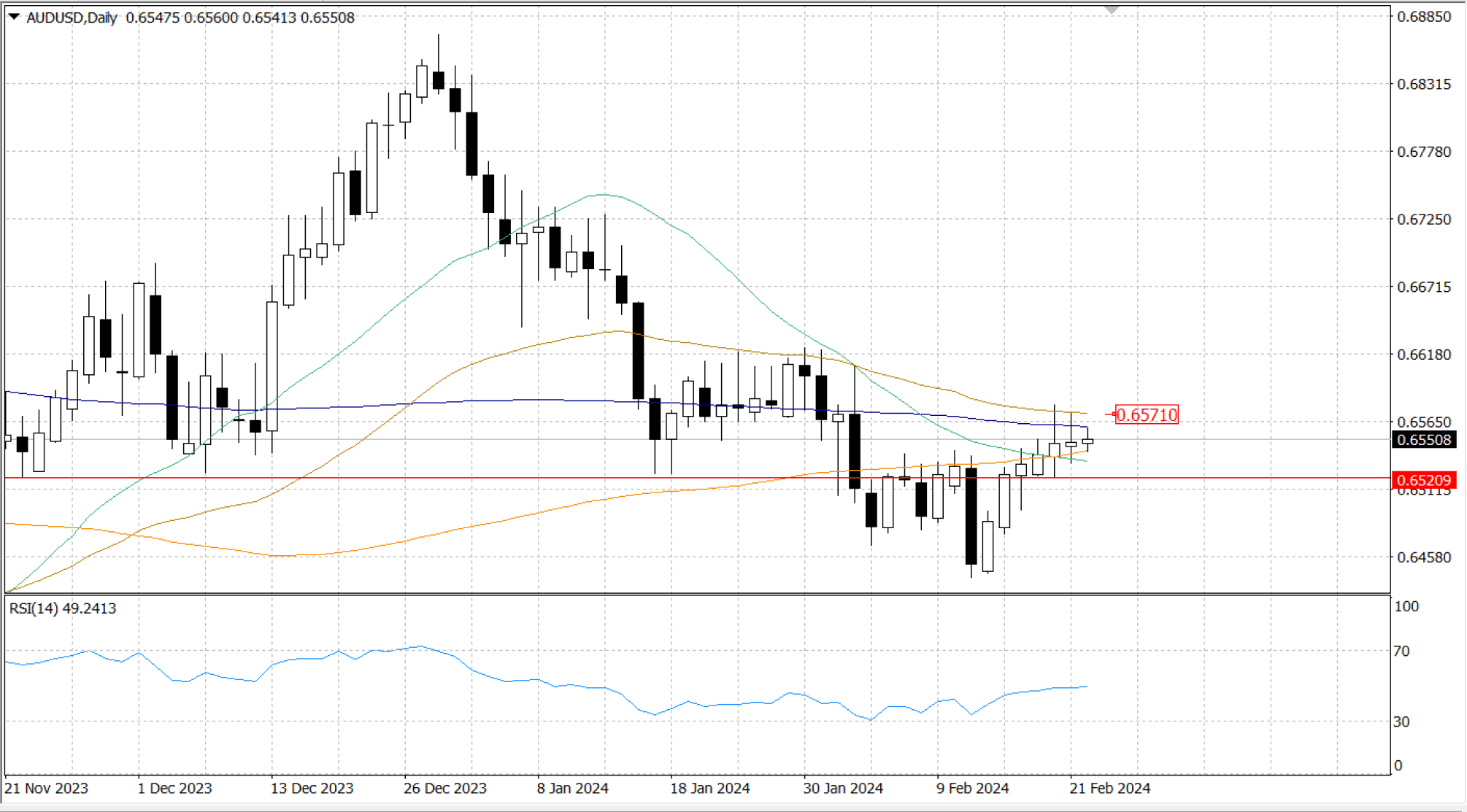

The Australian dollar may face difficulties due to weaker Aussie money markets, as the S&P/ASX 200 Index declines for the third straight day amid negative sentiment. The Federal Open Market Committee Minutes, which were recently released and cautionary about interest rate decreases, could delay the start of a cycle of easing. Further shifting market sentiment toward the likelihood of no upcoming rate cuts were the minutes from the Reserve Bank of Australia's meeting earlier this week.

For the second consecutive day on Thursday, the Japanese Yen is still under attack versus its US counterpart and trades close to the weekly low despite a lack of follow-through selling. During the October–December quarter, the Japanese economy unexpectedly shrank for the second consecutive quarter, confirming a technical recession. It appears that expectations of an impending change in the Bank of Japan's policy position in the upcoming months have been shattered by this.

Israel carried out airstrikes on Hezbollah in Lebanon and Houthi attacks on a second commercial ship in the Red Sea. Israel has received advice from the US not to assault Rafah on the ground without a plan in place to protect civilians. WTI prices are rising as a result of growing concerns about the availability of crude oil due to the unrest in the Middle East.

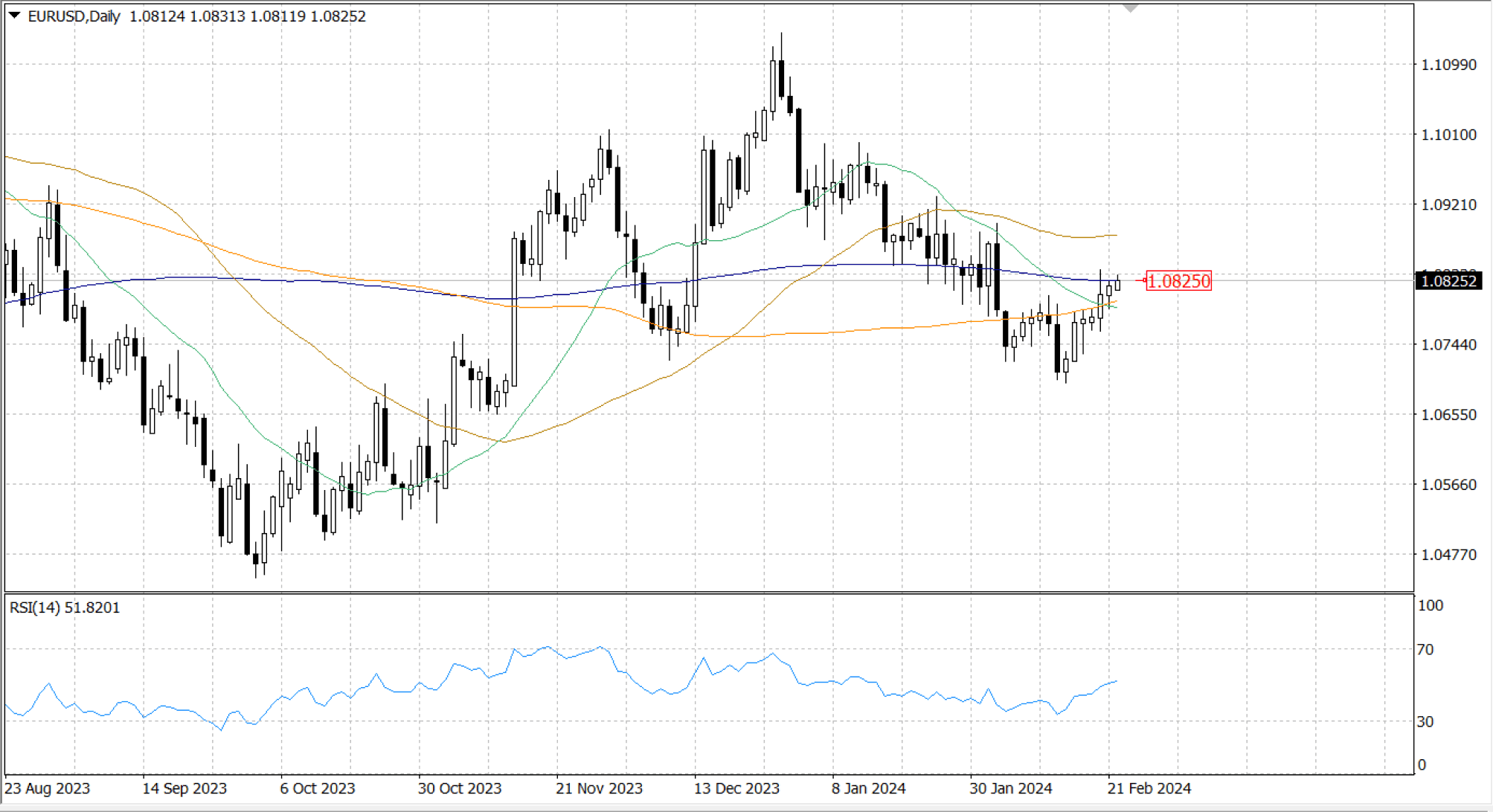

The US Federal Reserve released its most recent Minutes on Wednesday, and it indicated that policymakers are still worried on downside risks. As a result, EUR/USD moved into the middle before making a late surge into the high side. The US economy's uneven inflationary pressures are preventing the Fed from reducing interest rates, and officials are still waiting for more evidence that inflation is approaching the Fed's targeted range. The markets are anticipating a little increase in the euro area and a lower print in the US activity statistics when the European and US Purchasing Managers Indices are released on Thursday.

As EUR/USD pair moves closer to the high end in the near future, EUR/USD continues to trade on the bullish side of the 200-HMA at …. Although the price has been steadily rising after the drop into the … handle last week, the positive attitude is starting to wane at the intraday level due to the stalling pace.

The pair is approaching …, the 200-DMA, according to daily candlesticks, and topside momentum is confronting a big technical ceiling. The EUR/USD pair is still down about 3% from December's top bids near … and is continuing to follow a pattern of declining highs.

The Reserve Bank of Australia decided not to rule out additional tightening in the coming months, with support from the Wage Price Index in Australia, which increased 4.2% YoY in Q4 and more than anticipated. The central bank released on Tuesday its minutes from the February meeting. The perception of a reduction in the likelihood of inflation failing to attain the Board's target within a reasonable timeframe led to the decision to maintain the cash rate at 4.35%.

The AUD/USD pair fluctuated near the key level of …, which is situated above the level of immediate support at …. If there is a break below this key level, the weekly low at … and the psychological support level at … could be retested. A significant resistance zone could be encountered by the AUD/USD pair on the upside, located between the three-week high at … and the 50-EMA at …. The AUD/USD pair may approach the resistance zone around the psychological level of … and the 38.2% Fibonacci retracement level of … if this area is broken above.