Article by: ETO Markets

RBA Governor Michele Bullock revealed that the CPI had slightly increased, slightly above estimates but comfortably within the range that was expected. Bullock stressed the central bank's balancing act, which aims to slow down the economy's growth without inviting the recession into its embrace.

Because of the positive US Treasury yields and the stronger-than-expected preliminary S&P Global PMI data from the US that were issued on Tuesday, the US Dollar Index is still rising.

In October, the US S&P Global Composite PMI increased from 50.2 to 51.0. While the Manufacturing PMI increased to 50.0, the Services PMI saw growth, coming in at 50.9.

The US Q3 GDP is expected to be the main focus for investors on Thursday. On Friday, attention will be focused on Australia's Producer Price Index and the US Core Personal Consumption Expenditures.

Furthermore, the influx of safe-haven assets is expected to be sustained by geopolitical uncertainty. Benjamin Netanyahu, the prime minister of Israel, declared that his country was prepared to launch a ground invasion of Gaza, with a consensus being reached on the attack's timeframe.

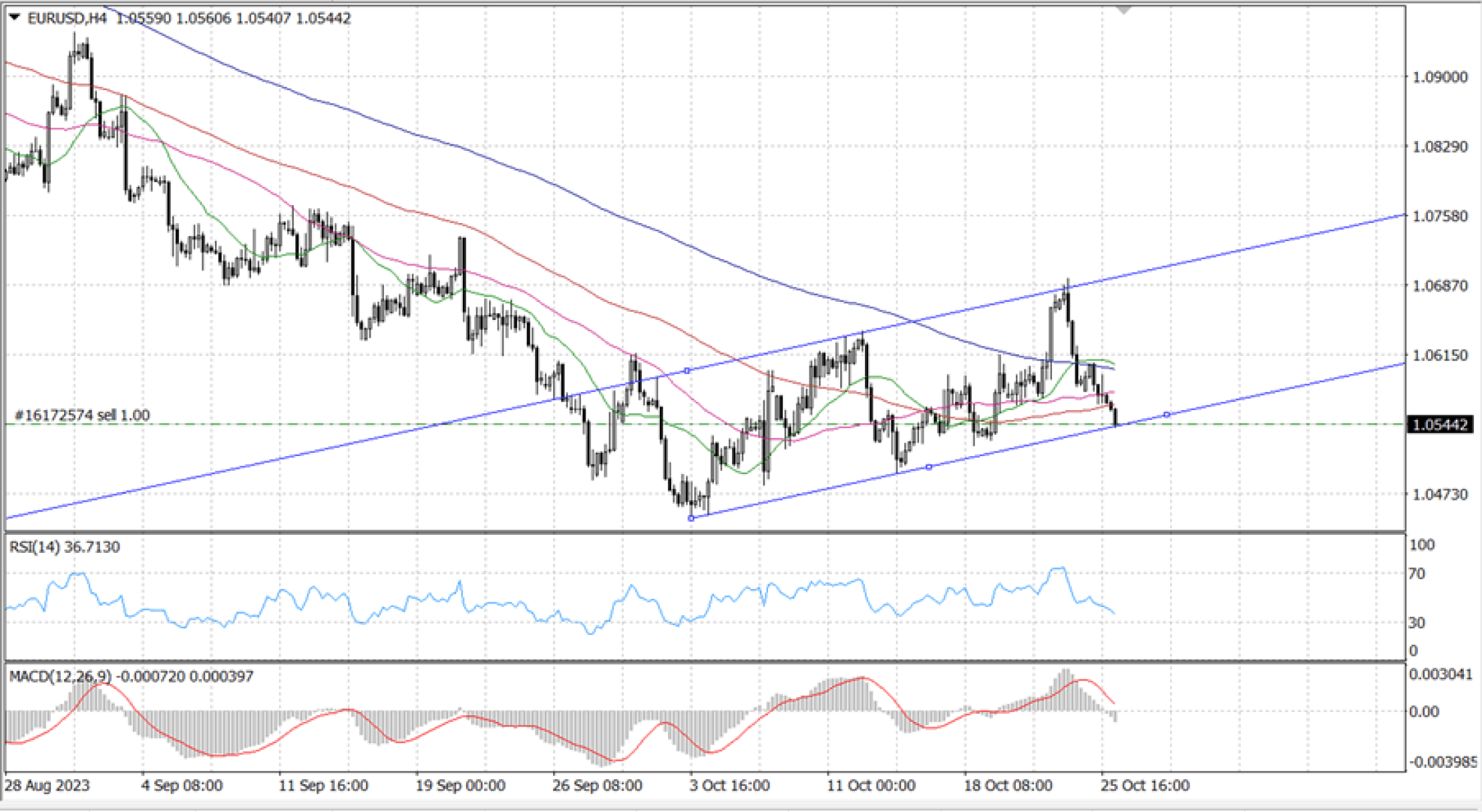

Thursday's rate decision by the ECB is anticipated to remain unchanged given the slowing rate of inflation and the muted level of economic activity. It is anticipated that the balance sheet and changes to reserve requirements will be the main topics of discussion. Given that inflation is still high and in an effort to please the hawks at the Bank, ECB President Christine Lagarde is expected to stick to her hawkish stance.

For the second day in a row, the EUR/USD fell, prolonging its withdrawal from monthly highs. At …, the decline found support above the 20-DMA. Right now, the two are testing the … support region. Technical indicators on the 4-hour chart are pointing downward. An upward trend line at …serves as the primary support level. Resuming the pair’s climb is feasible as long as the price stays above that level. But a breach below would mean more losses, with … and … being the initial targets. In order for the technical picture to become more optimistic, the EUR/USD pair would have to rise over ….

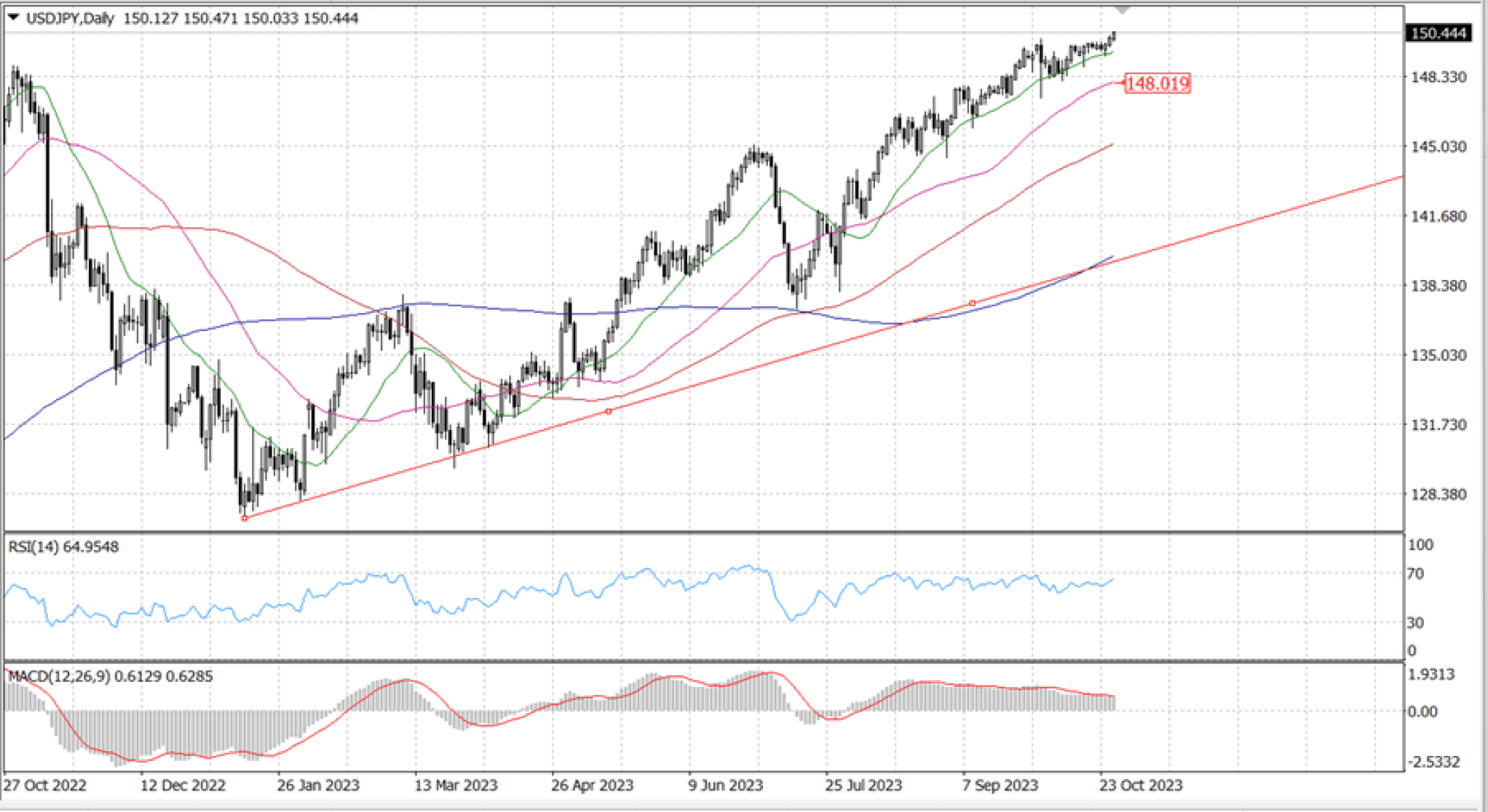

In an effort to fuel more long-term inflation in Japan, the Bank of Japan is still one of the few major central banks that hasn't raised interest rates significantly over the past two years. Nevertheless, the Japanese central bank continues to worry that internal inflation pressures may fall short of their 2% target. Investors are counting for the Bank of Japan to reverse course as soon as its next meeting, potentially giving up on its negative-rate short-term rate regime and yield curve control mechanism.

The USD/JPY pair is trading above …, despite the Dollar-fuelled pump. With little technical resistance above to draw meaningful boundaries, the USD/JPY is currently trading in a no-man's-land. However, given the pair's long-term bullish outlook for the majority of 2023, there isn't much technical support outside of the 50-DMA, which is currently rising into …, while the 200-DMA is stuck around …, well below the current price action.