Article by: ETO Markets

This week, the main drivers for the foreign exchange market have come from dovish expectations from the Federal Reserve and heightened global geopolitical risks. Expectations that the Fed will cut interest rates by another 50 basis points in November have put the dollar under renewed pressure after a brief recovery. This uncertainty has provided continued support for non-yielding gold, especially as the global economic outlook darkens and fears of a recession grow.

While some Fed officials have tried to counter more aggressive easing, market sentiment remains in favor of continued Fed rate cuts, and a speech by Fed Chairman Jerome Powell on Thursday is expected to give the market more clues on the path of future rate cuts. As the dollar weakens, other major currencies such as the euro and the British pound continue to benefit. At the same time, the second quarter US GDP final reading, durable goods orders and other data will also have a short-term impact on the trend of the dollar.

On the geopolitical front, tensions in the Middle East have further escalated, the conflict between Israel and Lebanon has intensified, and global investors' demand for safe-haven assets has increased significantly. In addition, despite the announcement of a new round of economic stimulus measures in China, uncertainty about its effects and the risk of a global economic downturn remain, which also weighs on risk assets.

Overall, the foreign exchange market this week has been affected by expectations of a Fed rate cut, the US dollar is under pressure, while safe haven currencies such as the Swiss franc and the Japanese yen are likely to continue to benefit, and safe haven assets such as gold are also supported.

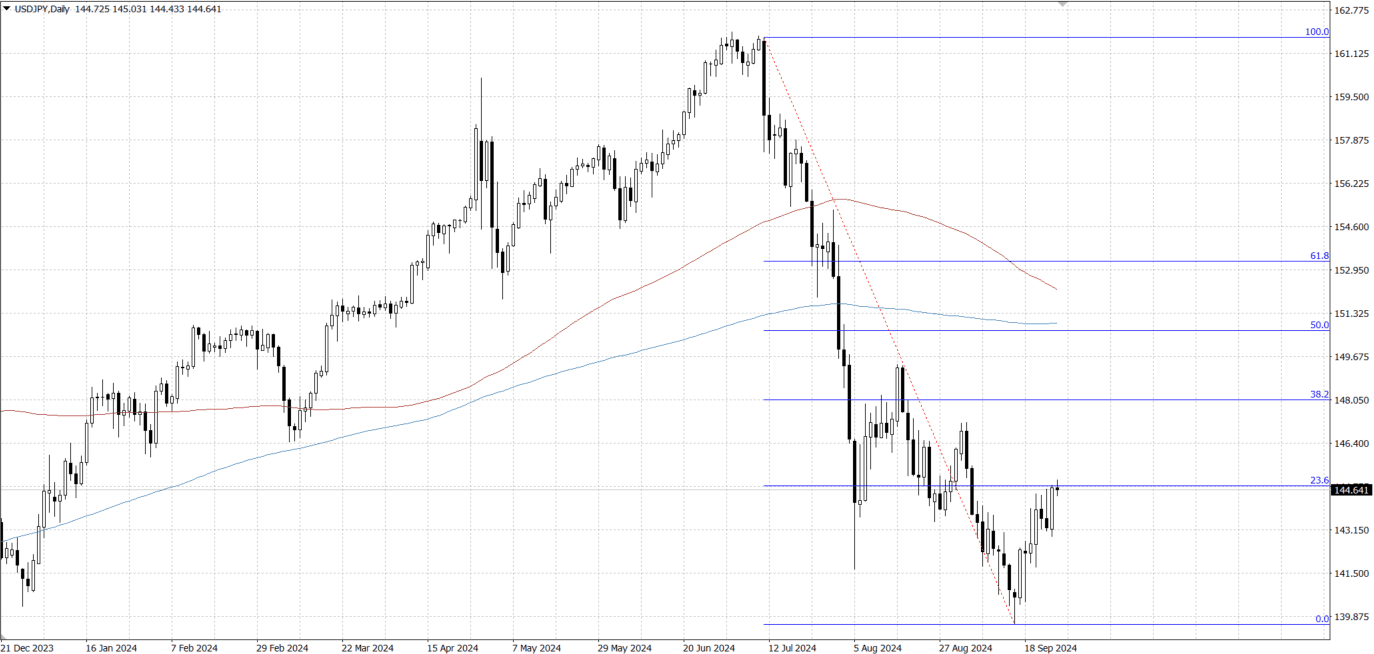

The direction of USD/JPY this week is mainly influenced by two factors: the Fed's monetary policy expectations and the Bank of Japan's policy direction. The dollar has recently been affected by dovish expectations that the Federal Reserve may cut interest rates further, especially after weaker-than-expected consumer confidence in the United States, the market has been growing expectations for the Fed to ease monetary policy. In addition, the Bank of Japan's policy stance remains accommodative, with Governor Kazuo Ueda making it clear that there is no urgency to raise interest rates in the near term, maintaining accommodative policy to support the economy. These factors leave USD/JPY without significant upside momentum on the back of a shift in risk appetite.

Geopolitical risks in the Middle East and the uncertain outlook for the global economy are also supporting the yen's status as a safe-haven currency to some extent. However, the Bank of Japan's continued negative interest rate policy, coupled with a weak domestic economic recovery, limits the scope for yen appreciation. For the rest of the week, the market will focus on the minutes of the Bank of Japan's monetary policy meeting and inflation data from Tokyo, which are expected to give more clues on the future direction of the yen. In addition, the speech of Federal Reserve Chairman Jerome Powell will also have a key impact on USD/JPY.

From a technical point of view, USD/JPY is trading around …, showing moderate upside momentum in the short term, but remains constrained by the psychological level of …. On the daily chart, USD/JPY remains in a downtrend and the exchange rate continues to trade below the Ichimoku Equilibrium chart (Kumo) and 200-day moving average (DMA), suggesting that the overall trend remains bearish.

The Relative Strength Index (RSI) just broke the neutral line, indicating that USD/JPY could move higher in the near term. If the pair can break through the psychological resistance of …, the next key resistance will be … near the 50-day moving average, and if the strength continues, it may further test …. However, if the pair is unable to break through … and retreat below …, Kijun-Sen support at … May be tested, with further support at Senkou Span A … and Tenkan Sen ….

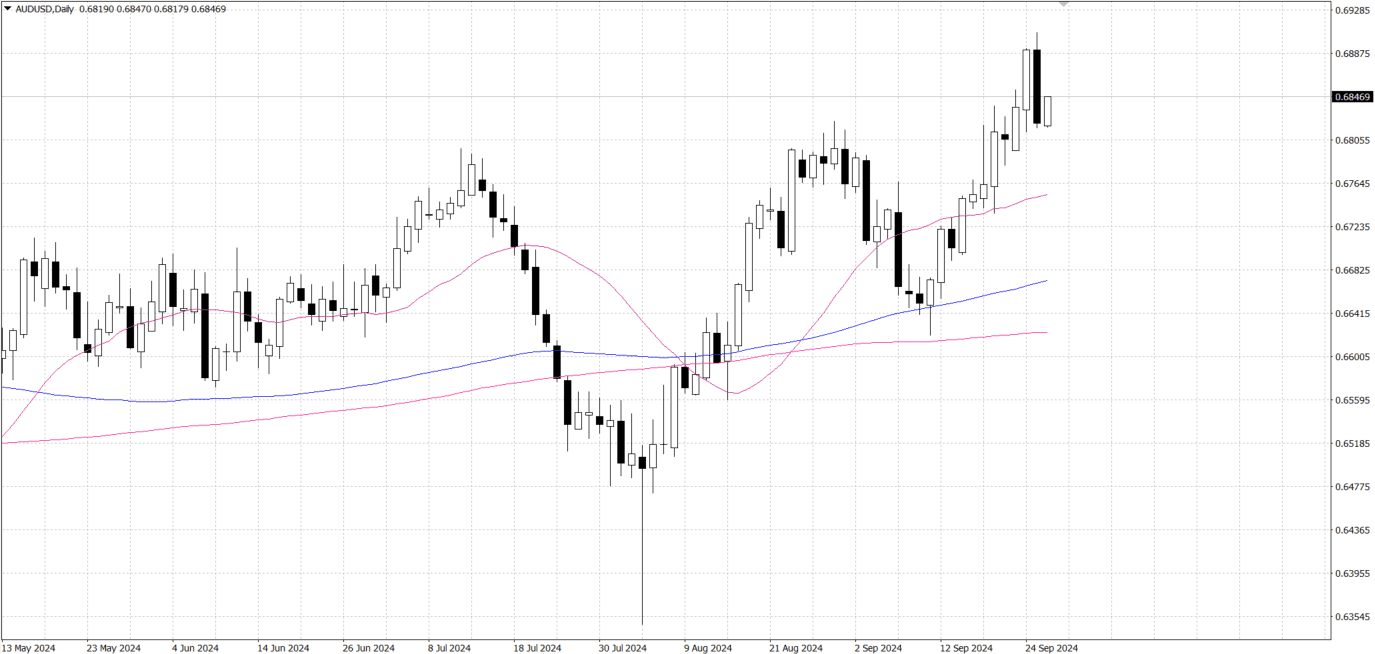

AUD/USD has gained some momentum this week on the back of stimulus measures in China and Australia. China plans to inject Rmb1tn into its top state banks to combat falling profit margins and rising bad loans, a stimulus seen as a boon for the global economy and the commodity-linked Australian dollar in particular. Meanwhile, the Reserve Bank of Australia (RBA) kept interest rates unchanged at 4.35%, indicating a relatively conservative monetary policy in response to domestic inflationary pressures and financial risks. The Australian Treasurer's visit to China has also further strengthened economic ties between the two countries, boosting the Australian dollar.

On the other hand, the Federal Reserve's recent aggressive 50 basis point rate cut, which kicked off a monetary easing cycle, has further diminished the dollar's appeal. According to the FedWatch tool, the market expects the Fed to cut interest rates by another 75 basis points before the end of the year. This divergence in monetary policy has exacerbated the Australian dollar's advantage over the US dollar. In addition, despite uncertainty about the economic outlook in both countries, and persistent concerns about a slowdown in China in particular, China's stimulus measures have provided a new impetus to global growth.

From a technical point of view, the AUD/USD exchange rate is currently hovering around …, and while it has broken through the previous upward channel, the 14-day Relative Strength Index (RSI) remains above the 50 level, indicating that bullish sentiment remains. In the short term, AUDUSD may test the lower boundary of the uptrend channel at …, and if it can successfully break and re-enter the channel, the Aussie will be expected to challenge the upper boundary of the uptrend channel at …, which will further consolidate its bullish bias.

Conversely, if the pair breaks below the nine-day Exponential Moving Average (EMA) support of …, AUDUSD may test further to the psychological support of …. A break below this level could lead to a further pullback to the six-week low of …. Overall, the direction of AUD/USD will depend on further developments in economic policy in China and Australia and changes in global risk sentiment.