Article by: ETO Markets

This week, influenced by the hawkish comments from Federal Reserve Governor Michelle Bowman, the US Dollar Index (a measure of the dollar's value against a basket of major currencies) continued its upward trend from the previous three weeks, reaching a high of 105.75. Despite the continuous hawkish remarks from Federal Reserve officials, the market still generally expects about two rate cuts this year, with a higher likelihood of a cut in September.

Economic data in the United States remains mixed. On Tuesday, the CB Consumer Confidence Index exceeded the expected 100, reaching 104.4. However, the government's report on new home sales recorded the largest decline since September 2022, plummeting 11.3% in May to 619K. Currently, dollar bulls seem unaffected by these data points. The final Q1 GDP figure, weekly initial jobless claims, and the Personal Consumption Expenditures (PCE) Price Index, which will be released on Thursday and Friday respectively, are expected to provide new momentum.

Additionally, the Australian dollar continued to strengthen following the release of robust CPI data. Despite signs of economic weakness, the higher-than-expected inflation data has limited the likelihood of rate cuts by the Reserve Bank of Australia (RBA). Consequently, the Australian dollar has been able to maintain its upward momentum even as the US dollar strengthens.

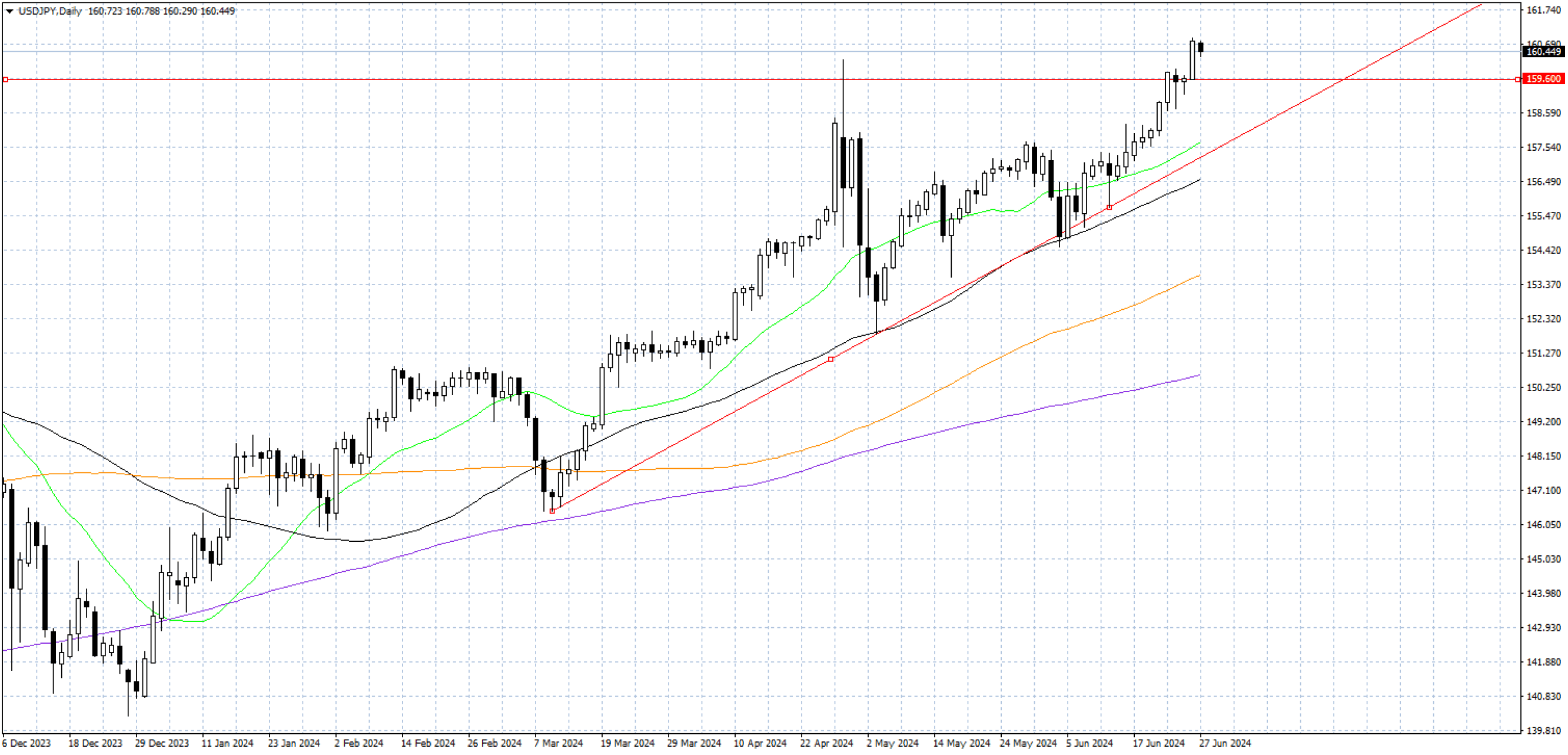

In contrast, the Bank of Japan (BoJ) has been reluctant to provide detailed plans for reducing bond purchases. Coupled with the Federal Reserve's hawkish comments, this has led to the US dollar strengthening and USD/JPY reaching a 38-year high. Although Japanese officials, such as Vice Finance Minister Masato Kanda, have reiterated the possibility of market intervention to support the currency, their efforts appear to have little effect so far. The Federal Reserve's reluctance to cut rates and the potential bullish tone in global equity markets may further weaken the safe-haven Japanese yen (JPY).

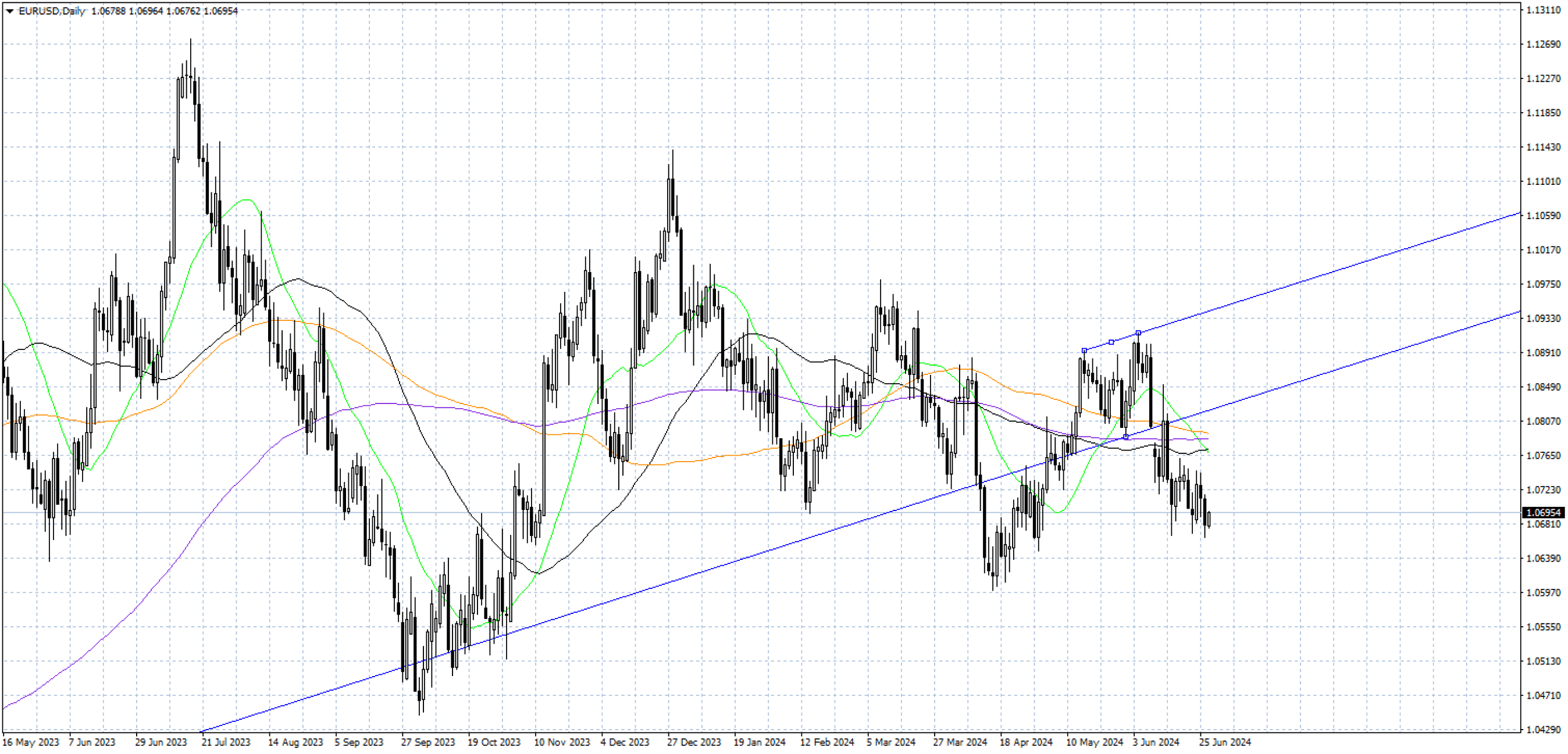

During Thursday's Asian trading session, EUR/USD slightly retraced the losses from the previous day. On Wednesday, the euro continued to struggle after Germany's GfK Consumer Confidence Index unexpectedly declined. Pan-European data on business climate, consumer confidence, and the Economic Surprise Index are set to be released during the European trading session. Additionally, the US Q1 GDP and core PCE Price Index could impact the future trajectory of EUR/USD.

EUR/USD has almost completed a head and shoulders pattern, nearly reaching the target range near $… The next support level is around $…, the lowest since April. If euro buyers fail to break the pattern of consecutive lower highs, the downward trend in the euro may not be easily reversed. Resistance at $… has limited the euro's upward movement.

Despite statements from Japan's Hayashi and Japan's Suzuki indicating readiness to take necessary measures in the forex market, USD/JPY still rose to near 161 yen. Aggressive yen bearish traders need to proceed with caution, as excessive currency volatility could have negative effects on the national economy, prompting likely intervention from the Bank of Japan (BoJ). Additionally, optimistic retail data for May in Japan provided some support for the yen.

Subsequent declines in USD/JPY could attract buying interest around the psychological level of … yen, followed by a breakout point at resistance of …, which has now turned into support. If breached, USD/JPY may further extend its decline, correcting towards the integer level of … yen. The Relative Strength Index (RSI) is still below …, indicating it has not reached severely overbought conditions yet. Bullish alignments in moving averages also suggest potential for further upside, supporting continued upward movement in USD/JPY.