The fundamentals of the foreign exchange market this week were mainly affected by US economic data, a stronger dollar, the outlook for the Fed's policy, and geopolitical factors. First, the US labor market data performed strongly. The ADP report showed that the number of new private sector jobs in October reached 233,000, higher than the market expectation of 159,000, showing the resilience of the job market, and other recent economic data have been positive, suggesting that the fundamentals of the US economy remain solid. These data have weakened the market's expectations for further sharp interest rate cuts by the Federal Reserve, driving up the US dollar and US Treasury yields. The 10-year Treasury yield remained at a high level of around 4.3%, which not only increased the attractiveness of the US dollar, but also put pressure on non-yielding assets including gold.

In addition, the core PCE price index on Thursday will be the focus of market attention, because this data is an important indicator of the Federal Reserve to measure inflation, which may affect the market's expectations of the Fed's interest rate path and drive demand for the US dollar. At the same time, with the US presidential election on November 5 approaching, market concerns about US political uncertainty have intensified. In particular, the escalation of the situation in the Middle East, these safe-haven factors still support the US dollar, and geopolitical tensions may also have an impact on gold and other safe-haven assets.

Overall, the U.S. dollar is supported by strong fundamentals and higher yields, but the market's cautious sentiment on future Fed policies and global geopolitical events has made the foreign exchange market more volatile. The U.S. dollar may continue to operate at a higher level this week, while the trend of other currencies will mainly depend on the economic data of their respective countries and the demand for safe havens.

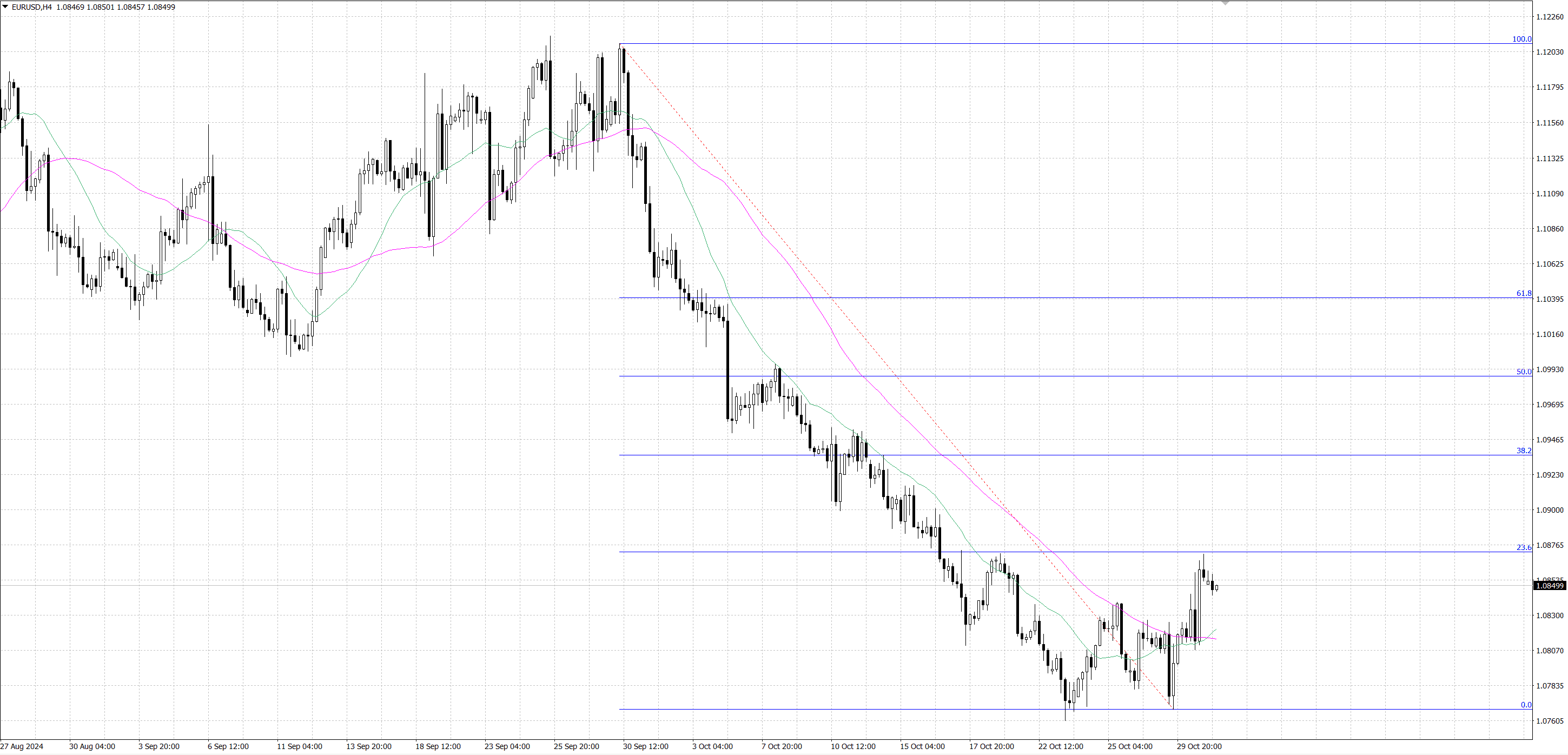

Currently, EUR/USD is under pressure from the impact of data from China and the United States. The strength of the US dollar comes from the solid performance of the US economy and the market's expectations of a small interest rate cut by the Federal Reserve, which supports the attractiveness of US Treasury yields and the US dollar. The ADP report showed that the US private sector added 233,000 jobs in October, highlighting the resilience of the US job market, which is expected to continue to support consumer spending and increase overall economic growth. At the same time, concerns about the widening US fiscal deficit have further pushed up US Treasury yields, supporting the US dollar.

On the other hand, inflation data from the eurozone has become the focus this week. Germany's third-quarter GDP data was better than expected, with a month-on-month increase of 0.2%, showing the resilience of major economies in the eurozone. In addition, inflation pressure in Germany remains stubborn, which reduces market expectations for a sharp interest rate cut by the European Central Bank and supports the euro. The release of Eurozone CPI data on Thursday will further affect the market's judgment on the ECB's future monetary policy. If inflation data is strong, it may help to curb the euro's downside.

From a technical perspective, EUR/USD is currently oscillating around the upper support level of …, showing selling pressure, and the market is waiting for the next Eurozone and US data. If the price moves further down and falls below the … support, it may trigger a deeper correction, and the next key support level is in the … area. On the contrary, if the euro finds support and rises again, it may retest the … resistance level, and further resistance is in the … area. The relative strength index (RSI) on the daily chart is currently in the neutral zone, suggesting that the short-term range shock may continue, waiting for clearer directional signals.

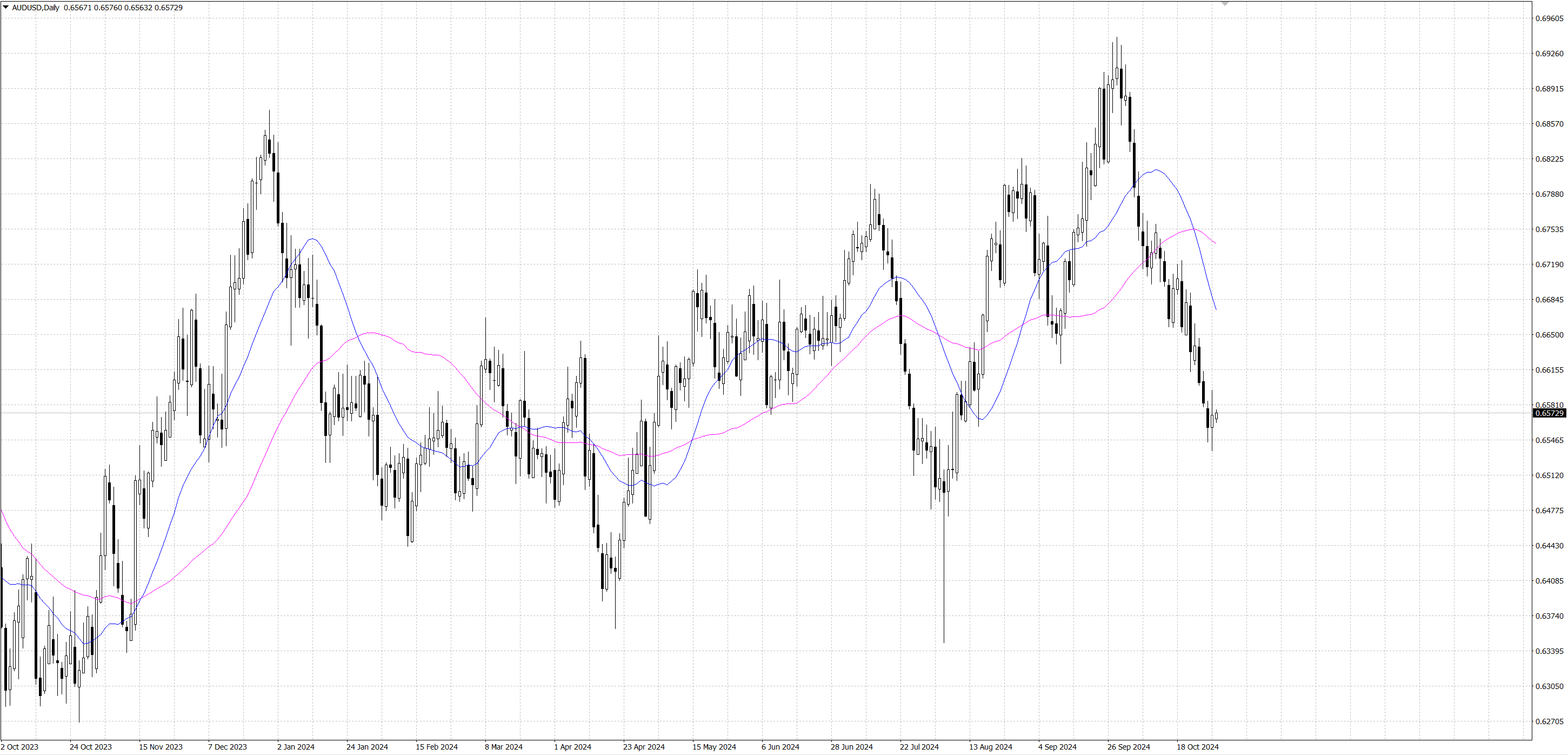

The Australian dollar against the US dollar (AUD/USD) has fluctuated this week under the influence of key economic data and market expectations for the policies of the Federal Reserve and the Reserve Bank of Australia. Australia's retail sales data were slightly lower than expected, with a month-on-month growth of only 0.1% in September, missing expectations of 0.3%. In addition, Australia's consumer price index (CPI) increased by 0.2% in the third quarter, indicating lower than expected inflationary pressures. These data indicate that Australia's economic growth is slowing down, keeping the market concerned about the future policy of the Reserve Bank of Australia. However, given that the Reserve Bank of Australia maintained the cash rate at 4.35% and suggested that this level is sufficient to curb inflation, the market currently does not expect an interest rate cut in November.

Chinese economic data also has an impact on the Australian dollar. China's manufacturing PMI rose slightly to 50.1 in October, indicating a slight improvement in economic activity, but it failed to significantly exceed market expectations and was still hovering near the expansion range. At the same time, U.S. economic data was strong. ADP employment data showed that 233,000 new jobs were created in October, which was better than market expectations, which enhanced the appeal of the dollar. At the same time, the Federal Reserve may make a smaller interest rate cut, with the 10-year U.S. Treasury yield approaching a high of 4.3%, which puts pressure on the Australian dollar.

On the technical side, AUD/USD is currently trading around …, within a short-term descending channel, showing a weaker trend. The 14-day relative strength index (RSI) on the daily chart hovers above 30, reinforcing bearish sentiment. In terms of support, … is the lower boundary of the descending channel. If it falls below this support level, it may further test the psychological level of …. If the Australian dollar rebounds, the upper boundary of the channel at … is a short-term resistance level. If it breaks through, it may rise to … and the 9-day exponential moving average (EMA) near ….