Market Review

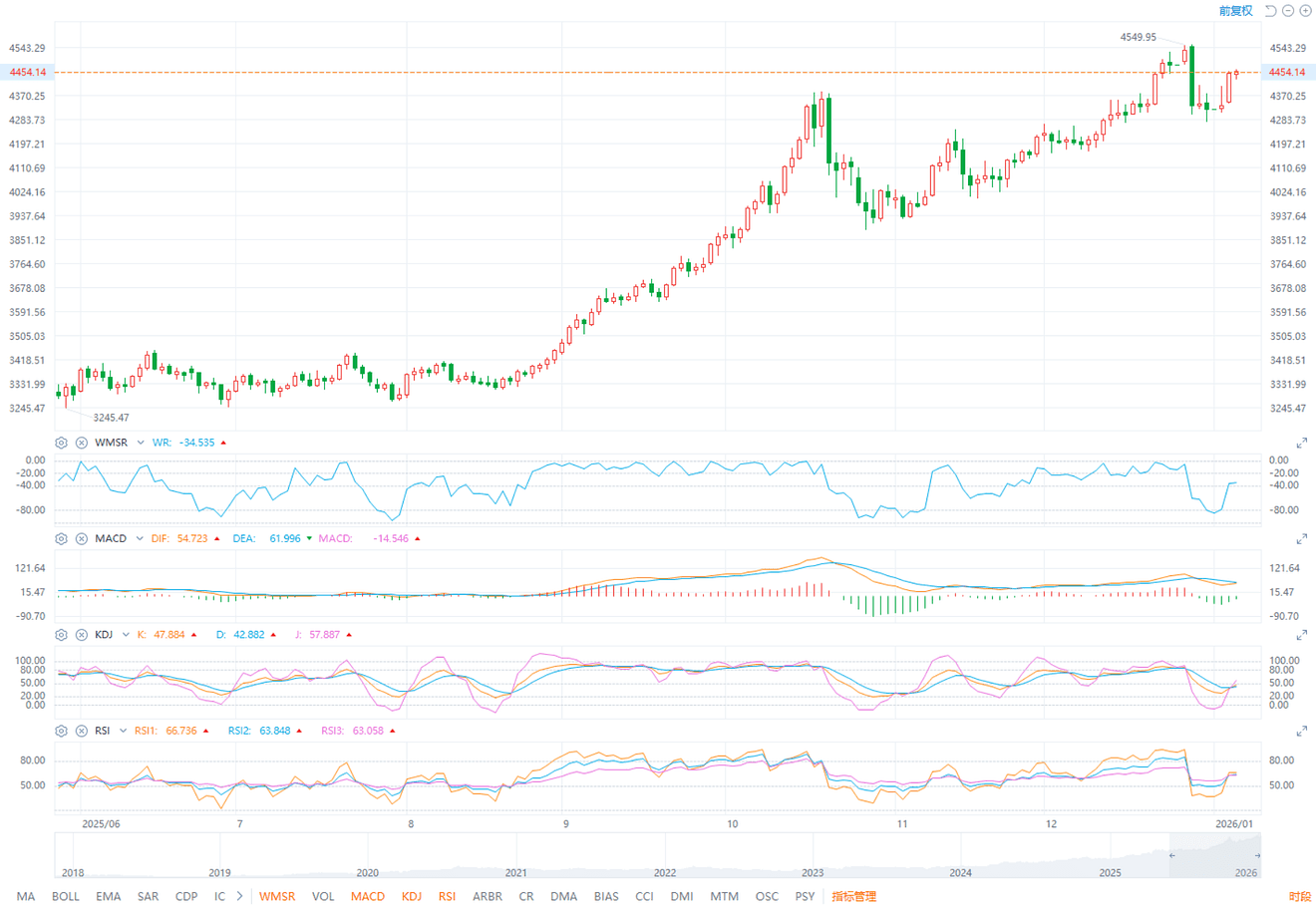

According to ETO Markets monitoring, on January 5 (Monday), spot gold extended its rally and closed at USD 4,448.82 per ounce. Prices briefly climbed to USD 4,455.59 intraday, moving closer to the record high of USD 4,549.71 set on December 26. COMEX gold futures also advanced sharply, rising 2.8% to settle at USD 4,451.50.

On January 6 (Tuesday), as of the Asian session, spot gold traded sideways after the open and hovered near USD 4,450 per ounce. Short-term momentum showed signs of cooling as prices consolidated near recent highs.

Global Headlines

1) FED Signals Rates Near Neutral

On Monday, FED official Kashkari said U.S. policy rates may be approaching a neutral level. He noted future decisions will depend on the balance between inflation and labor market trends. Kashkari warned that tariff policies could create longer-term inflation risks, while a sudden rise in unemployment remains a key downside concern.

2) U.S. Briefs Congress on Venezuela Actions

On Monday, the U.S. Secretary of State and Defense Secretary were set to brief Congress on the Trump administration’s actions toward Venezuela. Republican leaders viewed the post-action briefing as acceptable, while Democrats warned that military involvement could carry lasting regional spillover risks.

3) U.S. Joins Ukraine Security Talks

Over the weekend, reports showed U.S. representatives will attend a “Coalition of the Willing” meeting in Paris on Tuesday. The talks will focus on security guarantees for Ukraine under a potential peace framework. Around 30 European and Western countries are expected to participate.

4) Denmark Warns on Greenland Risk

On Monday, Denmark’s Prime Minister warned that any U.S. military move toward Greenland could undermine NATO and destabilize Europe’s post-World War II security framework. The remarks highlighted growing internal strains within the alliance.

5) U.S. ISM Manufacturing Stays Weak

Data released Monday showed the U.S. December ISM Manufacturing PMI fell to 47.9, marking the tenth straight month below 50. Inventory contraction remained a major drag, though analysts noted lean stockpiles may allow demand to recover later.

6) Chifeng Gold Flags Profit Surge

On Monday, Chifeng Gold announced its 2025 net profit is expected to rise 70%–81% year-on-year. The company cited a roughly 49% increase in average gold prices and improved mine profitability, underscoring strong price transmission to the upstream sector.

ETO Markets Analyst View (Spot Gold)

ETO Markets Global Pulse: Gold Battles $4,450 Near Record Highs

From a technical perspective, spot gold has entered a digestion phase after a strong rally. Prices are holding firmly above the USD 4,396 level, keeping the broader bias constructive. Near USD 4,470, bulls may face short-term profit-taking pressure. If pullbacks remain shallow, gold could still attempt another push toward the USD 4,500 area.

However, a sustained break below USD 4,396 may open the door for a corrective move toward the USD 4,365 and USD 4,340 support zones. RSI remains tilted upward, suggesting the broader bullish trend is intact. With limited near-term data catalysts, gold is likely to consolidate at elevated levels while markets monitor macro and geopolitical developments.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.