Market Review

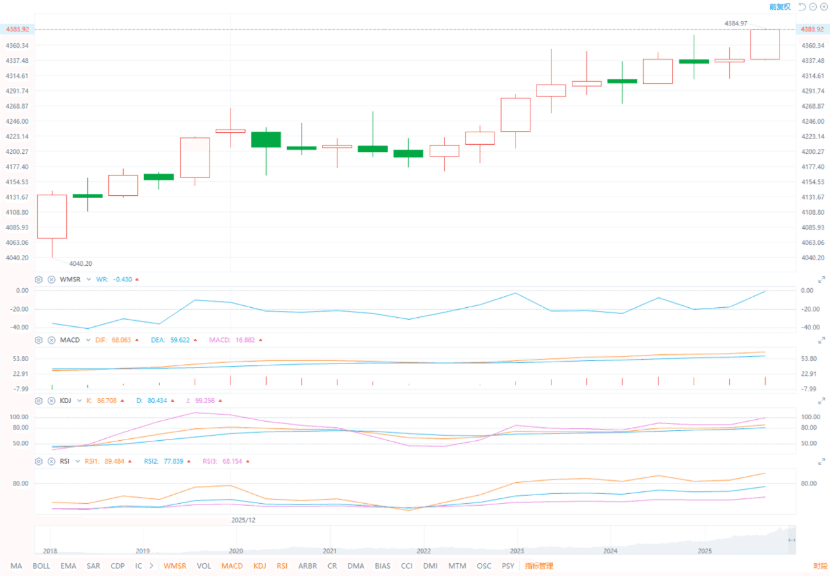

According to ETO Markets monitoring, on Friday, December 19, spot gold edged up by around 0.14% to USD 4,338.22 per ounce, posting a weekly gain of approximately 0.89%.

During early Asian trading on Monday, December 22, gold extended its upside momentum. Prices broke above the previous high set on October 20 at USD 4,381.48 per ounce, marking a fresh all-time high. As of publication, spot gold is trading near USD 4,380.29 per ounce, with intraday gains close to 1%, reflecting strengthening bullish momentum.

Global Headlines

Cooling Inflation Fuels Rate-Cut Bets

U.S. November CPI rose 2.7% year-on-year, well below the 3.1% market forecast. At the same time, the unemployment rate climbed to 4.6%, the highest since September 2021. The combination reinforced expectations of further Fed easing, directly supporting gold.Housing And Confidence Stay Weak

U.S. existing home sales rose just 0.5% month-on-month in November, annualized at 4.13 million units. High rates and economic uncertainty continue to weigh on demand. Meanwhile, the University of Michigan’s December consumer sentiment index fell to 52.9, underscoring fragile household confidence.Russia-Ukraine Talks Send Mixed Signals

U.S. officials said Ukrainian representatives held constructive discussions with U.S. and European partners on a peace timeline. Ukraine cited progress on ceasefire, security guarantees, and post-war reconstruction. However, Russia reiterated its conditions, keeping the outlook uncertain.Middle East Tensions Escalate Again

Israeli airstrikes targeted southern Lebanon on December 21, raising concerns over regional spillover risks. Heightened geopolitical uncertainty continued to support safe-haven demand.Venezuela Risks Return To Focus

The U.S. Coast Guard pursued a sanctioned oil tanker in international waters near Venezuela. If confirmed, this would mark the third such incident recently, reviving regional geopolitical concerns.Fed Officials Signal Wait-And-See

Cleveland Fed President Hammack said current policy remains appropriate while assessing the impact of cumulative 75 basis points of rate cuts. Clearer signals from inflation or employment data are needed before further moves.CFTC Data Shows Bullish Positioning

CFTC data show that, as of the week ending December 9, speculative net long positions in gold rose to 124,637 contracts. Silver net longs increased to 27,978 contracts, pointing to continued inflows into precious metals.Analysts Flag $5,000 Gold Zone

Chuan Cai Securities’ Chief Economist Chen Li said the bullish case for gold remains intact, though volatility may rise. He expects the price center to shift toward the USD 4,500–5,000 range next year, with upside risks toward USD 5,200 under extreme scenarios.

ETO Markets Analyst View (Spot Gold)

From an intraday technical perspective, spot gold remains in a strong consolidation-uptrend structure. The key pivot sits near USD 4,328 per ounce. If prices hold above this level, gold retains room to test USD 4,374 and potentially USD 4,400.

A pullback below the pivot would shift focus to support in the USD 4,307–4,290 zone. RSI readings remain broadly constructive, suggesting bullish momentum has not yet faded. With macro drivers overlapping and precious metals rotation accelerating, price action may stay volatile, warranting close monitoring of structure and risk signals.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.