Market Review

According to ETO Markets monitoring, on Monday, December 22, gold and silver prices surged sharply, with both metals breaking to fresh all-time highs amid a broad risk-off move.

During early Asian trading on Tuesday, December 23, the rally extended. Spot gold is trading near USD 4,457 per ounce, holding firmly in record territory. Silver also strengthened in tandem, confirming a clear shift in market risk appetite toward safe-haven assets.

Global Headlines

Capital Flows Surge Into Precious Metals

The rally in precious metals has been driven by accelerating inflows. Spot silver jumped around 1.9% on Monday to a record high of USD 69.44 per ounce, bringing year-to-date gains above 136%. The iShares Silver Trust added more than 533 tonnes of silver in a single session, the largest increase in nearly two years. Meanwhile, SPDR Gold Trust holdings rose by 12.02 tonnes to 1,064.56 tonnes, the highest level since June 2022, highlighting strong safe-haven and allocation demand.

FED Minutes Reveal Growing Divisions

Minutes from the Federal Reserve’s December meeting showed three dissenting votes against the latest rate cut, the highest since 2019. Policymakers remain split between concerns over labor market cooling and inflation staying above target, complicating the policy outlook.

US Tightens Venezuela Oil Blockade

U.S. officials said Washington has stepped up its oil blockade on Venezuela. Authorities are tracking a third tanker suspected of violating sanctions in international waters. The vessel reportedly used a false flag and is linked to a previously sanctioned Panamanian tanker, raising concerns over geopolitical and energy risks.

Russian General Killed in Bombing

Russian investigators confirmed that a senior military general was killed in a car bomb attack in Moscow. Authorities attributed the incident to Ukraine-linked actors. The attack significantly escalated geopolitical tensions.

Middle East Tensions Intensify Again

Israel warned the U.S. that Iran may be preparing an attack. While U.S. intelligence has not confirmed the threat, Israeli Prime Minister Netanyahu said any strike would face a “very severe response,” keeping regional risks elevated.

Milan Warns Against Rate Pause

Fed Governor Milan said rising unemployment argues for continued rate cuts. He warned that delaying policy action into early next year could increase recession risks. His comments contrasted with officials favoring a wait-and-see approach.

BOJ Hike Expectations Repriced

A Former Bank of Japan policy board member said the BOJ could raise rates three more times under Governor Ueda, potentially lifting policy rates to 1.5%. Fiscal stimulus and inflation risks have prompted markets to reassess implications for the yen and global rates.

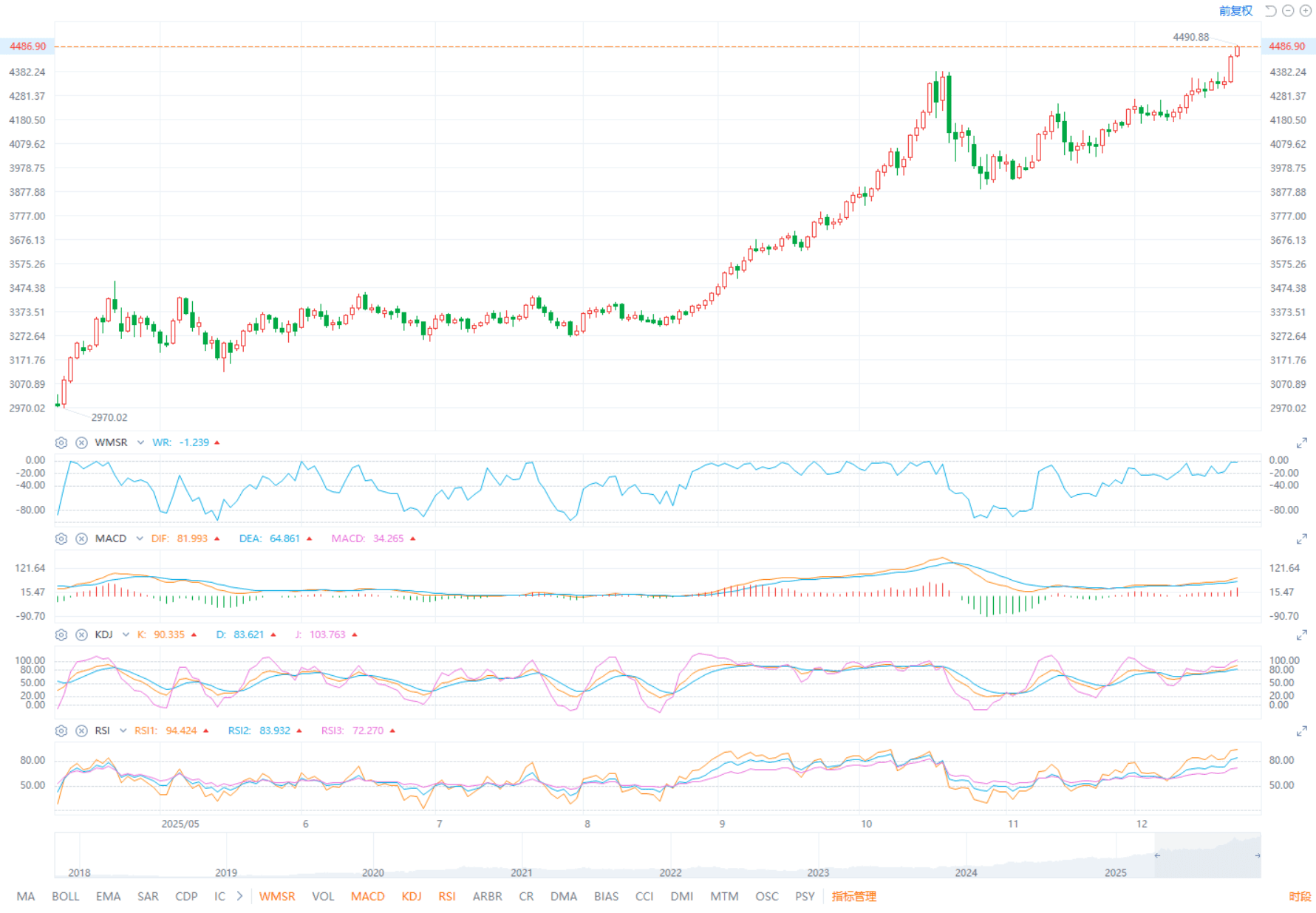

ETO Markets Analyst View (Spot Gold)

From an intraday technical perspective, spot gold remains firmly bid above the USD 4,405 per ounce pivot, with the price base clearly shifting higher. As long as prices hold above this level, upside targets are seen at USD 4,480 and USD 4,500.

If a short-term pullback occurs, support is in the USD 4,375–4,355 zone. RSI indicators continue to trend higher, suggesting bullish momentum remains dominant. With geopolitical risks, policy divergence, and strong capital inflows converging, price volatility may intensify, warranting close monitoring of market structure.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.