Market Review

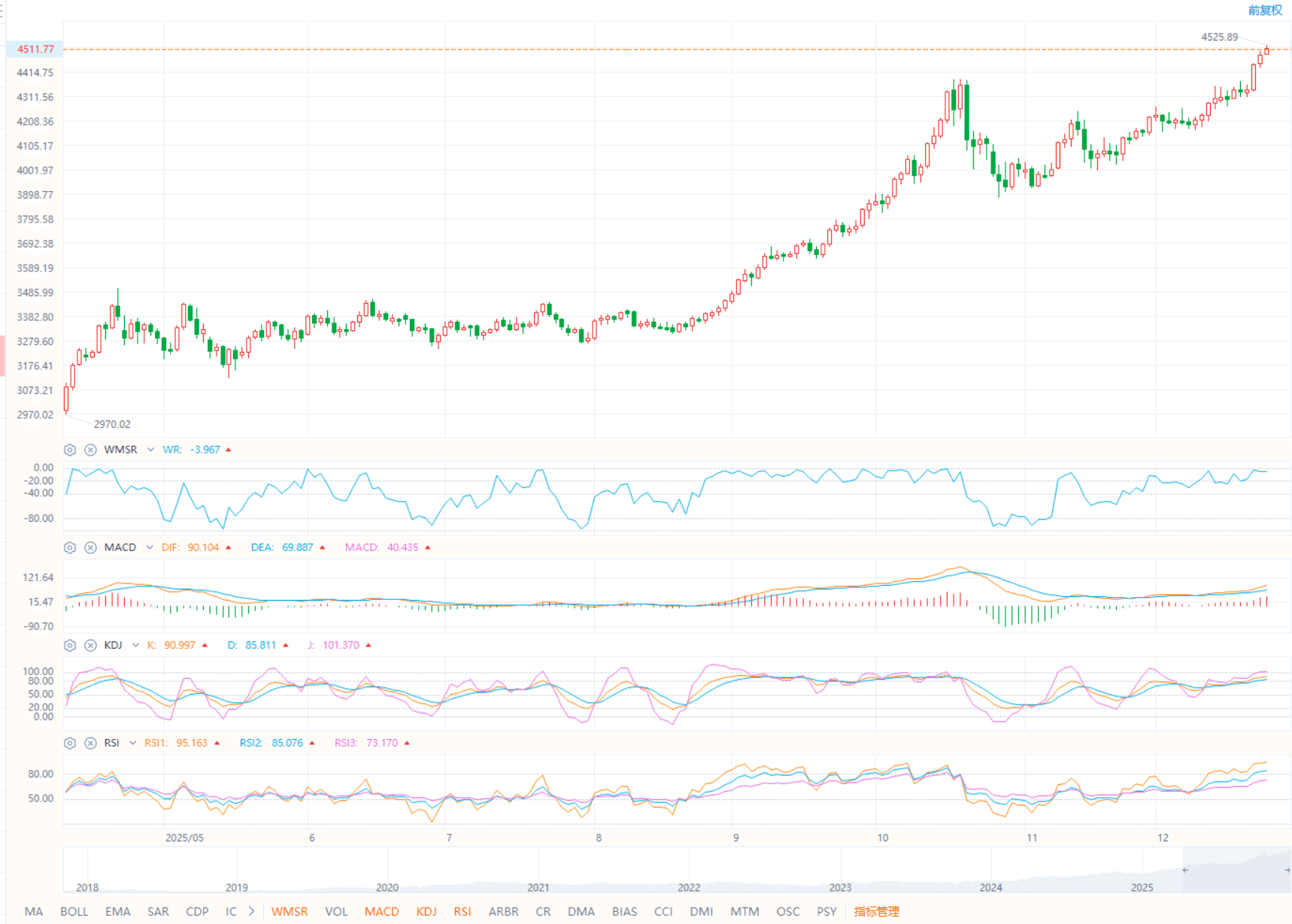

According to ETO Markets monitoring, on Tuesday, December 23, precious metals extended their powerful rally. Spot gold rose around 0.8% and briefly touched USD 4,497.55 per ounce, setting a new record high.

On Wednesday, December 24, momentum accelerated further. Spot gold broke above the USD 4,500 per ounce level for the first time in history. Year-to-date gains have now exceeded 70%, signaling a clear acceleration phase across the precious metals complex.

Global Headlines

Precious Metals Enter Acceleration Phase

Precious metals posted broad-based gains. Silver’s year-to-date advance expanded to around 145%, while both gold and silver set fresh all-time highs. Capital allocation into the sector continues to rise, pointing to rapid repricing of long-term valuation levels.

US Growth Strong Inflation Stable

U.S. data showed third-quarter GDP grew at an annualized 4.3%, the fastest pace in two years. Core PCE inflation stood at 2.9%. ETO Markets notes that while data release procedures were adjusted due to the government shutdown, the figures still indicate economic resilience without runaway inflation.

Hassett Says FED Lagging Cuts

FED Chair candidate Hassett said the U.S. is clearly lagging other major central banks in its rate-cut cycle. He cited tariffs, AI investment, and improved trade structures as growth drivers, while also helping ease inflation pressure.

Bessent Urges Inflation Target Review

U.S. Treasury Secretary Bessent said that once inflation stabilizes near 2%, the FED could reassess its inflation target. He suggested a target range such as 1.5%–2.5% or 1%–3% to better balance growth and price stability.

Russia Ukraine Risks Escalate

Despite ongoing talks, Russia launched large-scale missile and drone strikes across Ukraine, hitting energy infrastructure and civilian areas. Ukraine said the attacks occurred during negotiations, reigniting geopolitical uncertainty.

Ukraine Election Preparations Resume

Ukraine’s Central Election Commission announced the restoration of the national voter registry. This marks the first such move since the conflict began in 2022, laying groundwork for potential future elections.

US Tightens Venezuela Energy Pressure

Former President Trump warned Venezuela’s President Maduro against provoking the U.S. and said seized oil would be detained. U.S. enforcement against Venezuelan oil tankers has intensified, raising both geopolitical and energy market risks.

ETO Markets Analyst View (Spot Gold)

From an intraday technical perspective, spot gold remains firmly supported above USD 4,455 per ounce, with the price base continuing to shift higher. As long as prices hold above this pivot, upside targets are seen at USD 4,520 and USD 4,550.

If a technical pullback emerges, attention should turn to the USD 4,428–4,405 support zone.

RSI remains elevated, confirming that bullish momentum is still dominant. With precious metals accelerating and macro and geopolitical drivers overlapping, volatility is likely to increase, warranting close monitoring of market structure and sentiment.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.