Market Review

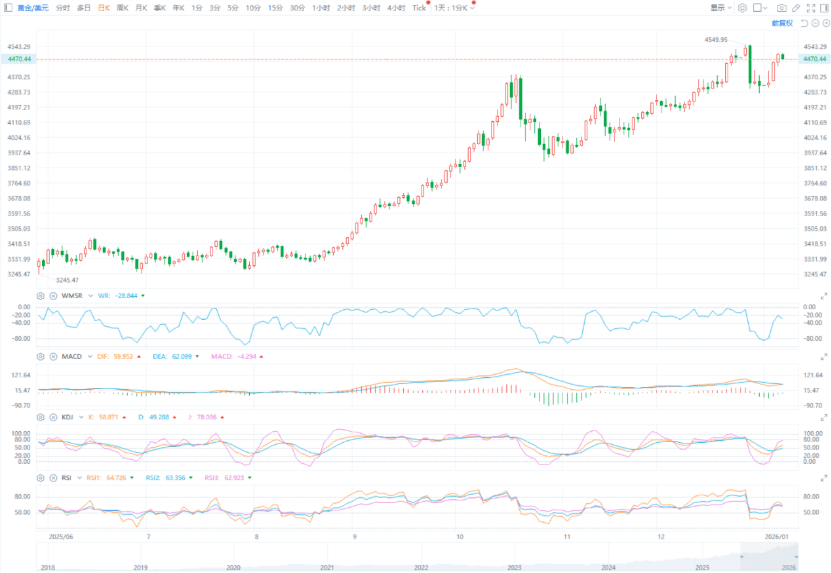

According to ETO Markets monitoring, on January 6 (Tuesday), spot gold extended the previous session gains and closed up about 1% at USD 4,494 per ounce. Prices moved closer to recent highs during the session, but upside momentum faded near key resistance.

On January 7 (Wednesday), during the Asian session, spot gold opened higher before pulling back. Prices are now trading near the USD 4,470 level, retreating from overnight highs. Gold remains below the record peak of USD 4,549 per ounce and has entered a phase of high-level consolidation.

Global Headlines

1) NFP in Focus This Week

Markets are closely watching the U.S. Non-Farm Payrolls report due on Friday. Consensus expects around 60,000 new jobs in December, a sharp slowdown from the previous reading. The data will be a key gauge of U.S. economic momentum and the FED’s next policy steps, and could amplify short-term volatility in gold.

2) FED Officials Signal Policy Split

Recent comments from FED officials highlighted ongoing differences. Richmond FED President Barkin said policy is in a “delicate balance” between inflation and employment, with rates near neutral. FED Governor Milan argued data supports further easing, suggesting total rate cuts this year could exceed 100 basis points.

3) CME Pricing Limits Near-Term Cuts

According to CME FedWatch, the probability of a 25-basis-point rate cut in January stands at 18.3%, while the chance of no change is 81.7%. By March, the probability of cumulative easing reaches 40.7%, showing markets remain cautious on aggressive near-term cuts.

4) Venezuela Tensions Lift Risk Premium

On Monday, Maduro pleaded not guilty to drug-related charges, drawing renewed attention to Venezuela’s political outlook. Meanwhile, U.S. President Trump is expected to meet oil executives later this week to discuss plans related to Venezuela’s energy sector, adding to geopolitical and energy-market uncertainty.

5) NATO Strains Over Greenland

On Tuesday, leaders from France, the UK, Germany, Italy, Poland, Spain, and Denmark issued a joint statement stressing Greenland’s status must be decided by Denmark and local residents. They warned that threats among NATO members could undermine alliance cohesion and Arctic security.

6) PBOC Reaffirms Easing Stance

China’s central bank stated at its January 5–6 policy meeting that it will maintain a moderately accommodative monetary stance. The PBOC pledged stronger counter-cyclical adjustments to support stable growth and financial market conditions.

ETO Markets Analyst View (Spot Gold)

From a technical perspective, gold has entered a consolidation phase after its recent rally, with intraday volatility narrowing. Prices remain above the USD 4,454 level, which helps preserve a constructive structure, though upside pressure is becoming more visible near the top.

If gold holds above USD 4,454, the rebound could extend, with resistance seen around USD 4,513 and USD 4,544. A break below this zone may trigger a range pullback, with support at USD 4,426 and USD 4,396. RSI remains biased to the upside, but momentum has slowed, leaving near-term direction more dependent on macro data and event risk.

Ahead of the NFP release, directional signals remain limited. Gold is likely to trade sideways at elevated levels while markets wait for confirmation, and investors should continue to monitor macro developments closely.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.