Market Review

According to ETO Markets monitoring, on December 15 (Monday), spot gold surged early before retreating, briefly approaching a seven-week high of USD 4,350 per ounce. Selling pressure intensified at elevated levels, quickly capping gains. Gold eventually closed marginally higher by around 0.1% at USD 4,304.91 per ounce.

As of publication on December 16 (Tuesday), gold continues to trade in a consolidation range with a mild upward bias, hovering near USD 4,308 per ounce. Overall market sentiment remains cautious, with investors awaiting clearer macroeconomic signals before committing to directional trades.

Global Headlines

Russia-Ukraine Talks Show Progress

President Volodymyr Zelensky of Ukraine met with a U.S. envoy in Berlin, signaling flexibility on NATO membership. U.S. officials described the negotiations as making significant progress.

These developments have slightly reduced safe-haven demand, putting moderate pressure on gold prices.

European Leaders Support Peace Process

Germany, France, and other European nations welcomed the diplomatic progress, emphasizing commitments to Ukraine’s security guarantees and post-war economic reconstruction under a ceasefire framework. French President Macron stated that achieving a just and lasting peace ultimately depends on Russia, while Europe continues to coordinate its military and security stance.Ukraine Maintains Cautious Negotiation Stance

Zelensky emphasized that territorial issues remain highly sensitive and that current proposals represent only a “working version.” While advancing peace efforts, Ukraine remains focused on agreement quality and long-term security assurances, noting progress toward key security arrangements with partner countries.Markets Await Key US Data

Traders are closely watching U.S. non-farm payrolls and retail sales data scheduled for release later today. CME data indicate markets are pricing in approximately a 76% probability of a rate cut in January 2026. Analysts caution that potential government shutdowns and layoffs may distort data quality, increasing the risk of short-term market noise.Payroll Uncertainty May Boost Volatility

October payroll growth is expected to soften, while November employment may see a technical rebound, though forecast ranges remain unusually wide. The unemployment rate could temporarily rise to 4.6%–4.7%. Given disruptions to the statistical base, the data may trigger exaggerated market reactions, directly affecting both the U.S. dollar and gold.Nasdaq Plans Extended Trading Hours

Nasdaq plans to apply to the SEC to extend trading hours to 23 hours per day, five days a week, adding overnight trading sessions. This move would further advance round-the-clock U.S. equity trading and could have lasting implications for liquidity structure and cross-market trading dynamics.Fed Chair Succession Debate Intensifies

Prediction markets show declining odds for Hassett as the next Federal Reserve Chair, amid concerns that his close ties to Donald Trump could unsettle bond markets. Meanwhile, support for Kevin Warsh has risen notably, bringing Federal Reserve independence back into market focus.Fed Officials Signal Dovish Bias

New York Fed President Williams stated that slowing labor market momentum and easing inflation risks supported recent rate-cut decisions, and he expects inflation to continue trending lower. Governor Milan hinted at a possible extension of his term until a successor is confirmed, adding uncertainty to the future policy path.

ETO Markets Outlook

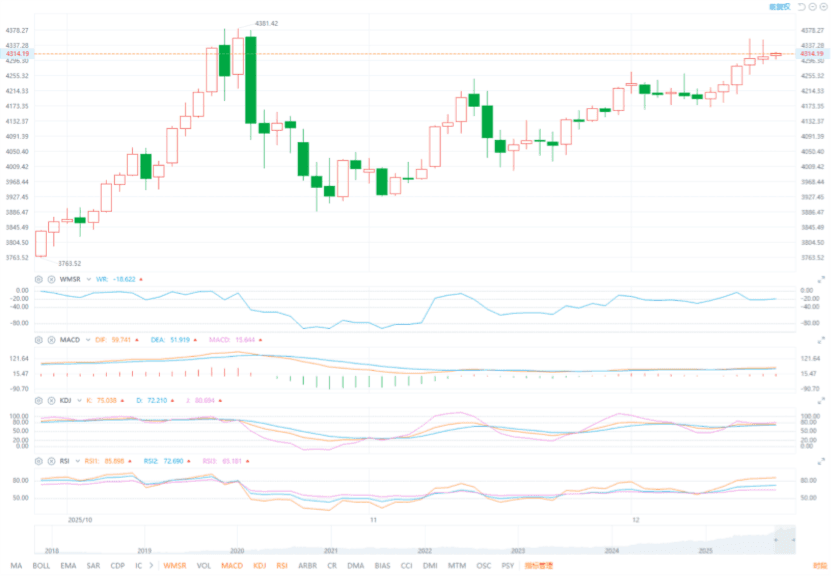

From an intraday technical perspective, spot gold has established a clear short-term support zone near USD 4,285 per ounce, which also serves as the key pivot between bullish and bearish momentum. As long as prices hold above this level, the broader bias remains range-bound with a slight upside tilt. Initial resistance is seen at USD 4,333, followed by USD 4,353 near previous highs.

A decisive break below USD 4,285 would signal weakening short-term sentiment and open room for deeper pullbacks, with downside levels to watch at USD 4,257 and USD 4,240. Current technical indicators suggest the support base around USD 4,285 remains structurally intact. However, ahead of major macroeconomic data releases, gold is more likely to remain in consolidation rather than attempt a sustained directional breakout.