Market Review

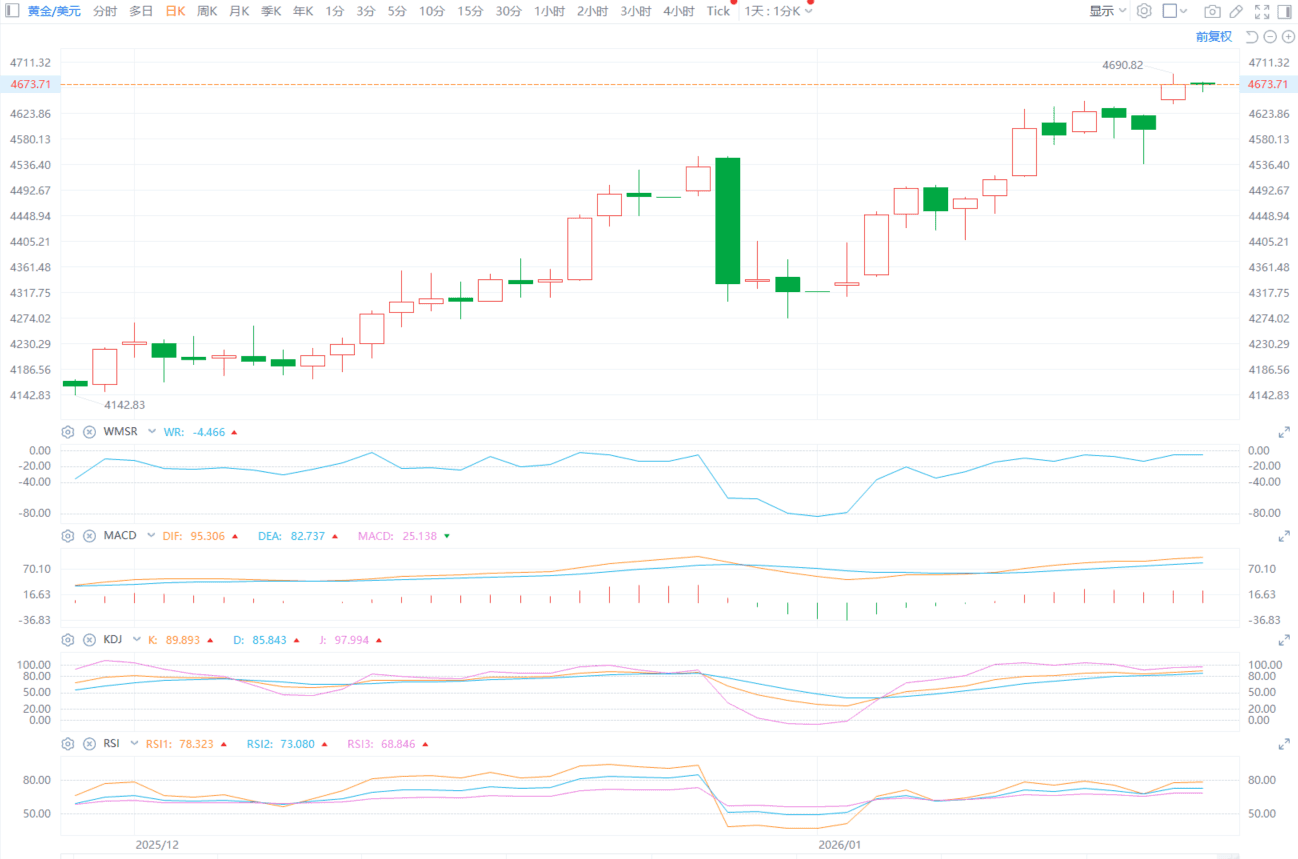

According to ETO Markets monitoring, on January 19 (Monday), spot gold rallied sharply as risk-off flows accelerated on renewed tariff and geopolitical uncertainty. Prices set a fresh record intraday at USD 4,690.46 per ounce. Gold closed up about 1.7% at USD 4,672.49 per ounce, marking a strong one-day move.

In early Asian trade on January 20 (Tuesday), spot gold held firm and traded around USD 4,670.60 per ounce. With tariff uncertainty and geopolitical risks still in play, gold remains supported at elevated levels.

Global Headlines

Trump Escalates Greenland Tariffs

Trump refused to rule out the use of force over Greenland in an interview. He also said the U.S. will “100%” impose tariffs on European countries if talks do not deliver an outcome. He criticized European leaders opposing the U.S. stance and argued Europe should focus on the Russia-Ukraine conflict rather than Greenland.

UK Warns Against Trade War

UK Prime Minister Keir Starmer said a trade war benefits no one and called using tariffs against allies “completely wrong.” He said Greenland’s future should be decided by its people and the Kingdom of Denmark. He also stressed preventing a broader trade conflict remains a priority, while urging Europe to take more responsibility on defense and security.

U.S. Boosts Middle East Presence

As tensions with Iran rise, the U.S. is deploying additional military assets to the Middle East, including an aircraft carrier, and strengthening missile defense coverage. U.S. officials said the moves are intended to expand the president’s military options if needed.

Trump Targets Powell, Stops Short

Trump said the administration is investigating FED Chair Jerome Powell but has no immediate plan to remove him. He reiterated the president should have a stronger voice in the direction of monetary policy. The process to select Powell’s successor is also accelerating, keeping FED independence in focus.

IMF Backs Central Bank Independence

IMF Managing Director Kristalina Georgieva publicly emphasized the importance of central bank independence and voiced support for Powell. She said decisions anchored in facts and data help stabilize expectations for households and businesses, and noted Powell’s strong professional standing within the global central banking community.

ETO Markets Analyst View (Spot Gold)

Technically, spot gold remains in a strong consolidation phase after a fast rally. Prices are holding above USD 4,652, keeping the broader bias constructive. Markets have not fully priced the latest combination of trade friction and geopolitical risk, so sideways action at high levels looks more like digestion than reversal.

If gold continues to hold above USD 4,652, the market may extend toward USD 4,690 and USD 4,710. A break below USD 4,652 would raise the risk of a pullback toward USD 4,620.

RSI remains elevated without a clear downside turn, suggesting limited near-term corrective pressure. With macro uncertainty still high and the risk-off narrative intact, gold may keep grinding in a high-range consolidation. Stay focused on policy headlines and geopolitics, and manage positioning carefully.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.