Market Review

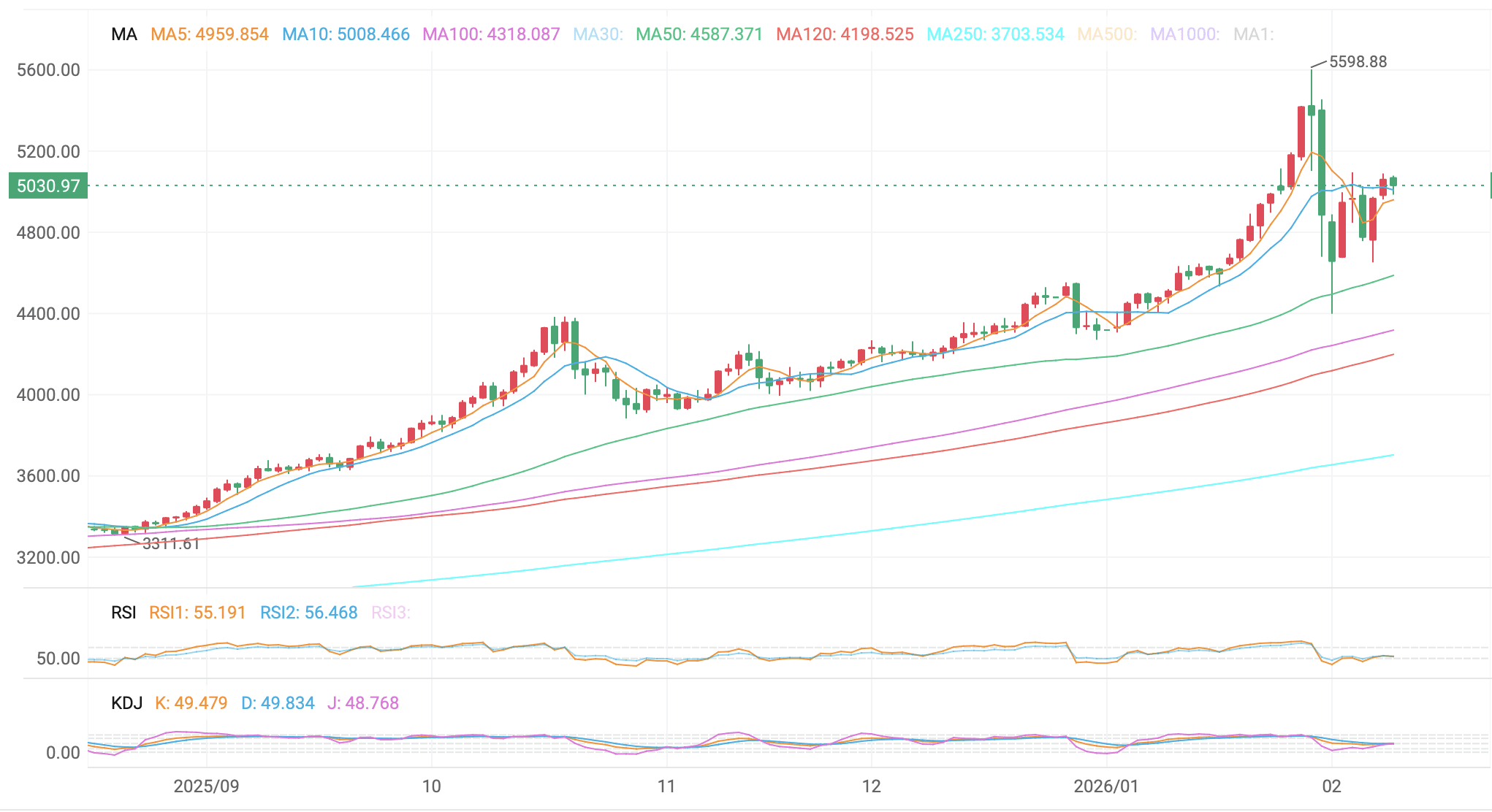

According to ETO Markets monitoring, on Feb 9 (Monday), gold extended its rebound as the U.S. dollar weakened. Spot gold rose about 1.9% to USD 5,056.21/oz. The dollar index fell roughly 0.8% to a one-week low, improving gold’s appeal for non-dollar investors.

During Asian trading on Feb 10 (Tuesday), price action turned volatile. Gold briefly plunged more than USD 70, dipping toward USD 4,987/oz, before quickly retracing losses. Spot prices later stabilized near USD 5,030/oz, highlighting elevated intraday swings ahead of key data.

Global Headlines

NFP Revisions in Focus

Markets are bracing for the upcoming NFP report. Consensus expects January payrolls to rise by around 69,000, with the unemployment rate seen holding at 4.4%. Attention is also on annual benchmark revisions, which could cut reported employment levels by roughly 911,000, potentially reshaping perceptions of U.S. labor-market resilience.

Rate Cut Expectations Pushed Back

Rate pricing shows an 82.3% probability that the FED will keep rates unchanged in March, with only a 17.7% chance of a 25bp cut. For April, the probability of a cumulative 25bp cut stands at 32.4%. By June, odds of at least one cut rise to about 50.4%. Overall, expectations for the first rate cut have shifted toward mid-year.

Iran Signals Conditional Nuclear Flexibility

Iran’s Atomic Energy Organization said Tehran could dilute highly enriched uranium if all sanctions are lifted. The remarks suggest limited flexibility within nuclear talks, though uncertainty around negotiations remains high.

Middle East Shipping Risks Highlighted

The U.S. issued updated maritime guidance, advising U.S.-flagged vessels to avoid Iranian territorial waters. The warning again underscores how tensions around the Strait of Hormuz could influence risk sentiment and safe-haven pricing.

ETO Markets Analyst View (Spot Gold)

From a short-term perspective, gold has entered a high-level consolidation phase after a sharp rally. The USD 4,980 zone has emerged as a key near-term pivot. Holding above this area keeps the structure biased toward consolidation and repair, with scope for gradual upside extension. A sustained break below support would shift focus to downside acceptance and the depth of follow-through selling.

RSI suggests room for further consolidation, but the duration of corrective moves may be limited. With NFP and inflation data approaching, directional conviction remains low. Gold is likely to trade in a wide range as the market digests data risk, warranting disciplined position sizing and careful risk management.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.