Article by: ETO Markets

Although a number of factors continue to support the bid tone going into the European session, a positive tone around the US market futures helps to limit the upside for the gold price. Investors are still concerned about the possibility of a military conflict in the Middle East escalating further. Apart from this, the safe-haven XAU/USD pair may continue to receive some support due to mounting fears over China's economy growing more slowly.

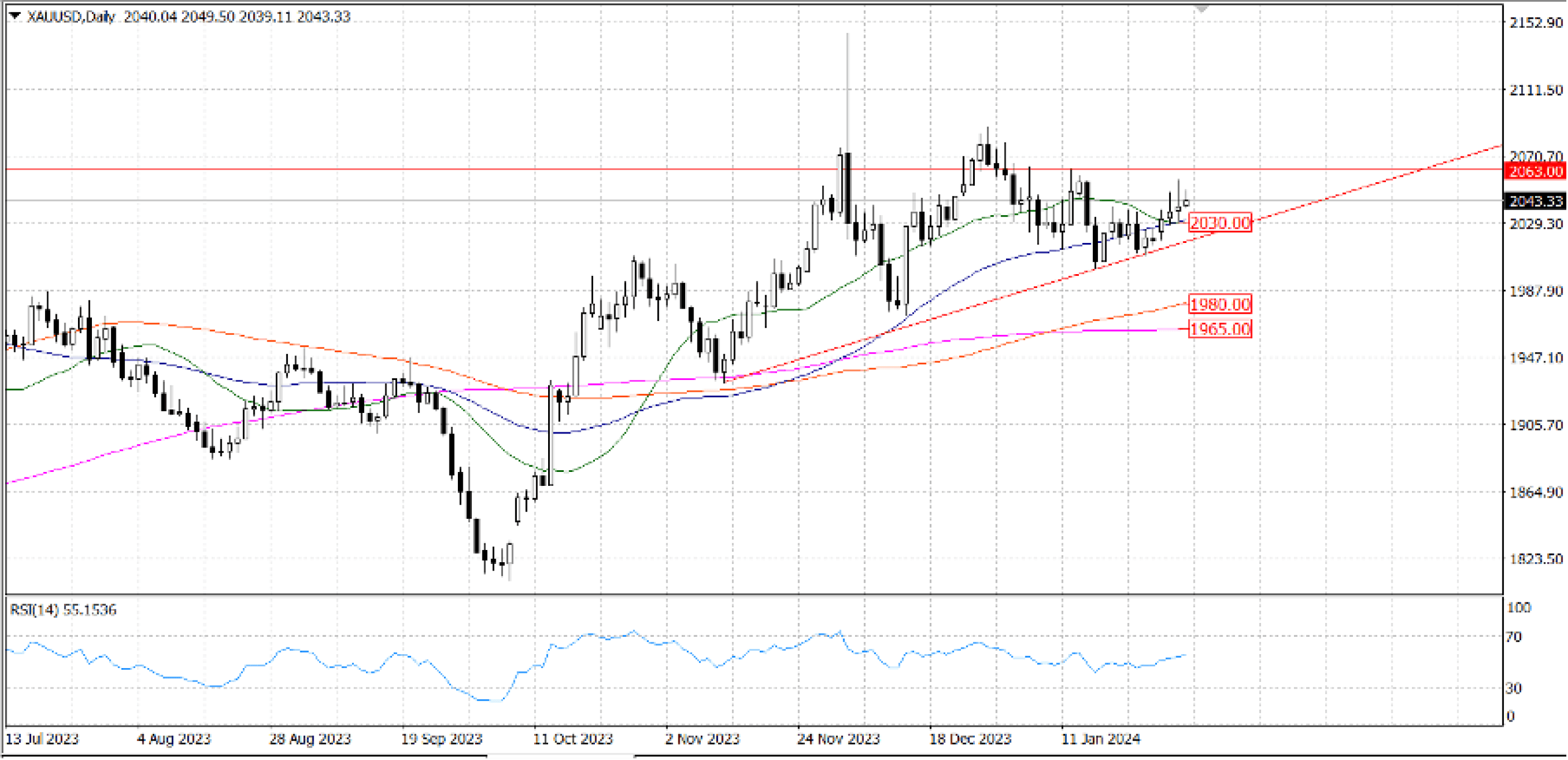

The price of gold is still probably biased bullishly, and the immediate significant resistance is seen at the high of the previous day, $… , beyond which the high of Mid-December, $... , will be tried. The $… round number could put bearish pledges to the test further up.

Strong support is still present in the $… area, which is where the 20- and 50-DMAs are hanging out, on the downside. If the latter is accepted, selling interest may increase in anticipation of a challenge of the triangle support at $... There may be a test of the crucial $… barrier if the negative momentum continues.