Article by: ETO Markets

Last Friday, the U.S. released the core PCE index at 0.2%, lower than the expected 0.3%. The lower-than-expected data briefly stimulated an increase in gold prices. However, the current U.S. PCE inflation report is not enough to prompt the Federal Reserve to cut interest rates, and the central bank needs more time to achieve its goals. As a result, precious metals prices started to pull back and closed in the negative.

On Sunday, the Israeli government reluctantly accepted the Biden administration's proposal for a ceasefire in Gaza. However, attacks in the Rafah area have not ceased. Investors are closely monitoring the developments in the geopolitical situation, as any further conflict and signs of escalating risks are likely to drive gold prices higher.

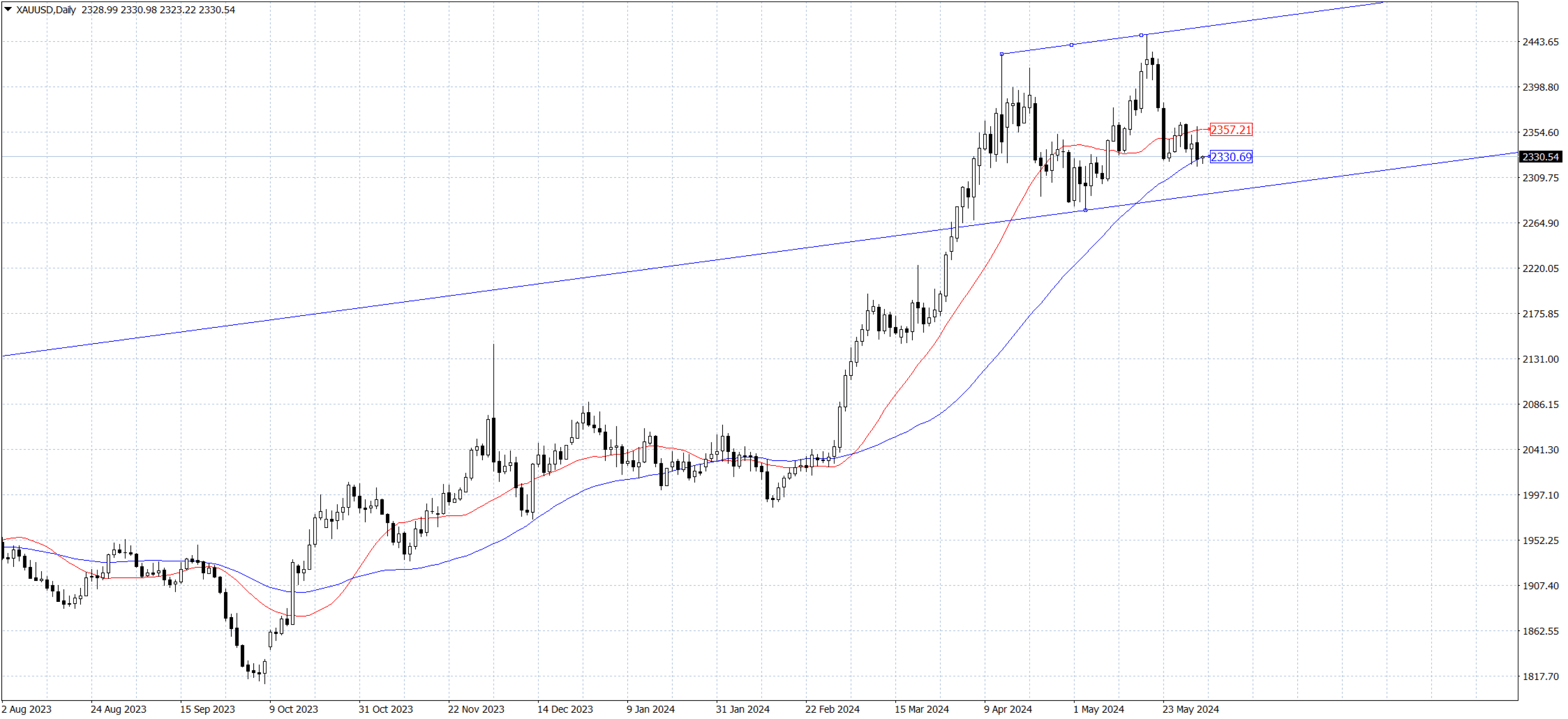

From the daily chart, upside-down flags are appearing, with the SMA-20 at $… and the SMA-50 at $… both acting as resistance levels for gold prices. If gold prices remain weak and fall below the May low of $…, a significant correction could occur, potentially starting a downward trend. Currently, gold is expected to find support at the $… level, followed by the May low.