Article by: ETO Markets

Gold prices are struggling to build on modest gains seen during the Asian session while staying above a three‐week low, as market participants weigh a mix of factors. Expectations that the Federal Reserve will implement two quarter-point rate cuts this year have not strengthened the US Dollar, which recently rebounded from a two-month low, thereby sustaining some demand for the safe-haven metal. Meanwhile, rising concerns over the potential economic impact of President Donald Trump’s imminent tariff measures on Canada, Mexico, and China—coupled with ongoing geopolitical risks—further support gold prices, even as a lack of sustained buying cautions investors against declaring the corrective pullback from previous all-time highs complete. Additionally, US economic data, including a slight slowdown in the Personal Consumption Expenditures Price Index and an unexpected 0.2% decline in consumer spending, have raised questions about the growth outlook, while traders now await key US macro releases such as the ISM Manufacturing PMI and Nonfarm Payrolls report to determine the near-term direction of the USD.

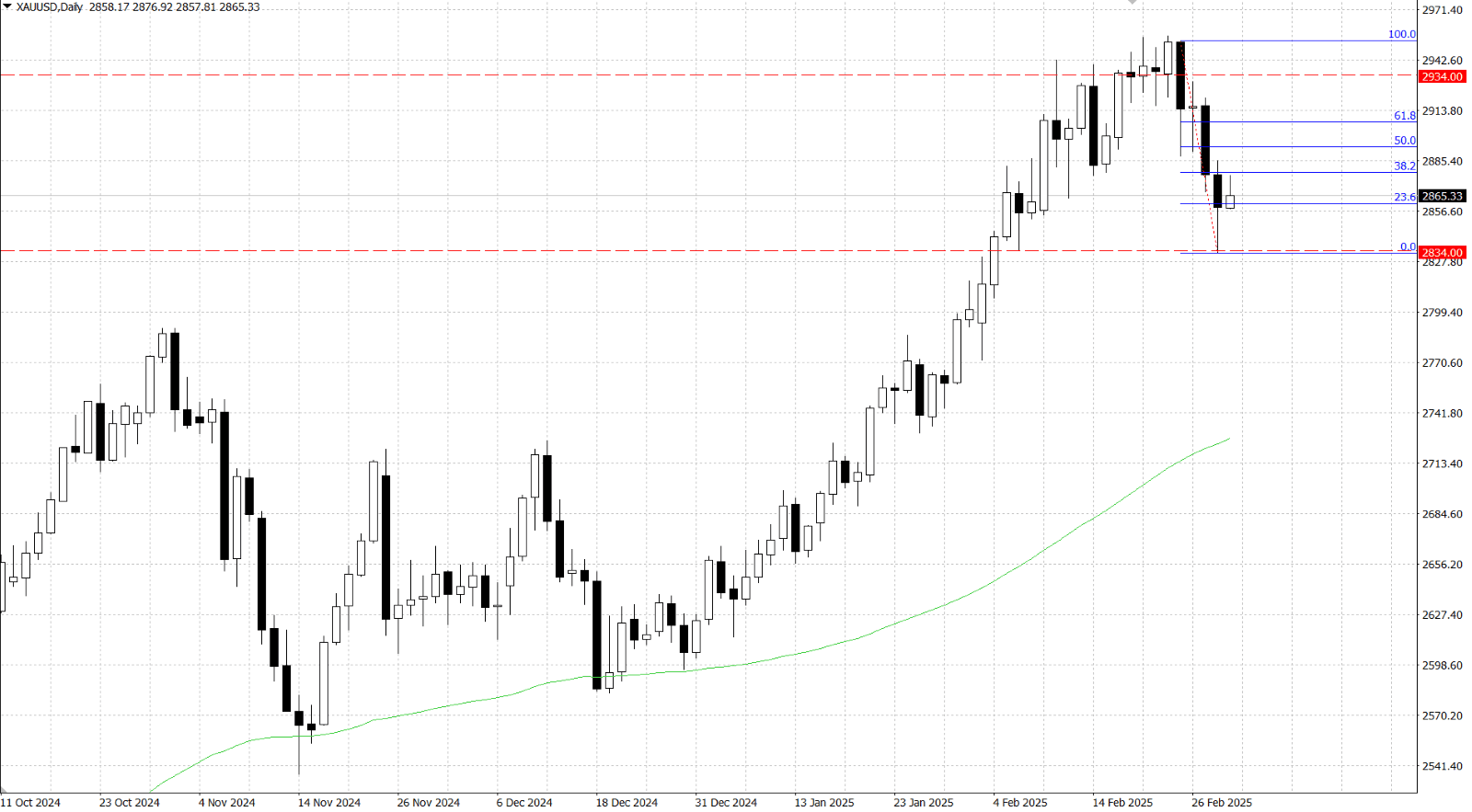

From a technical perspective, last week's breakdown below the 23.6% Fibonacci retracement level of the December-February rally signaled a critical trigger for sellers, with daily oscillators beginning to show negative momentum that supports an extended corrective pullback from previous highs. Consequently, any upward movement might be interpreted as a selling opportunity, likely capped near the $… region, with additional resistance around the $… level potentially limiting gains until a break toward the $… intermediate hurdle and ultimately a record high near $… is achieved. Conversely, Friday's swing low—around the $… zone—acts as a crucial support level; a fall below this could drive prices to the support below $… may indicate that gold has peaked and could experience further declines.