Article by: ETO Markets

Gold prices are currently under downward pressure, trading below the $... mark, as markets anticipate that the Federal Reserve may maintain higher interest rates for an extended period. This expectation is driven by concerns that US President Donald Trump's trade tariffs could reignite inflation, thereby prompting the Fed to adopt a more hawkish stance. The emergence of some USD buying has further contributed to the bearish sentiment surrounding gold, as a stronger dollar typically weighs on the precious metal. However, the market is not without its supportive factors. Worries about the potential economic fallout from Trump's protectionist policies, which could escalate into a global trade war, are tempering investors' appetite for riskier assets. This uncertainty, coupled with ongoing geopolitical risks, is providing a degree of support to gold as a safe-haven asset. Market sentiment remains cautious, with traders likely to hold back from aggressive positioning ahead of the pivotal US Non-farm Payrolls report on Friday, which could significantly influence the USD and, by extension, gold prices.

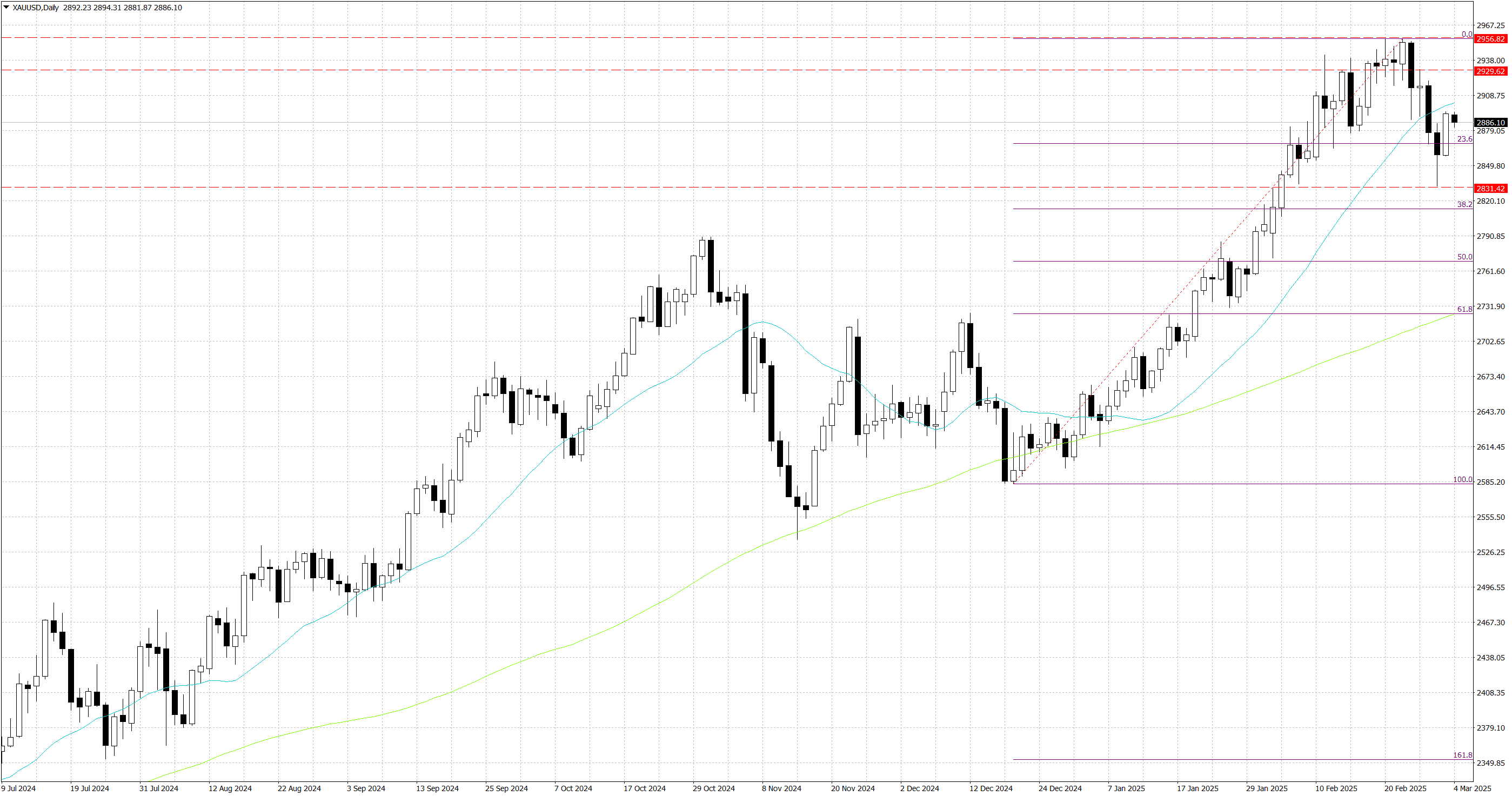

From a technical perspective, gold is consolidating below the $... level after failing to sustain its recent positive momentum. The price action indicates a bearish bias, with the failure to hold above $... serving as a cautionary signal for bullish traders. Oscillators on the daily chart, while still in positive territory, have begun to lose traction, suggesting that the upward momentum is waning. Immediate support is seen near $..., and a break below this level could lead to a test of the multi-week low around $... If this key support is breached, gold could accelerate its decline towards the $... round figure. On the upside, bulls may need to see a sustained break and acceptance above $... (where 20-day Simple Moving Average is $...) to regain control, with potential targets at $... and the record high of $... The market's reaction to the upcoming NFP data will be crucial in determining the next directional move for gold.