Article by: ETO Markets

Gold prices rose slightly in early European trading on Monday, supported by safe-haven demand. Uncertainty over the approaching U.S. presidential election and ongoing geopolitical tensions in the Middle East provided support for gold, a traditional safe-haven asset. In addition, the Federal Reserve is expected to implement a 25 basis point rate cut at its meeting on Thursday, rather than a larger rate cut, which also provided some support for gold. However, the strong performance of the U.S. dollar and rising U.S. Treasury yields may limit the upside for gold prices, as higher yields reduce the appeal of non-yielding assets such as gold. The market will closely watch the results of the U.S. election and the Fed's policy statement for further guidance.

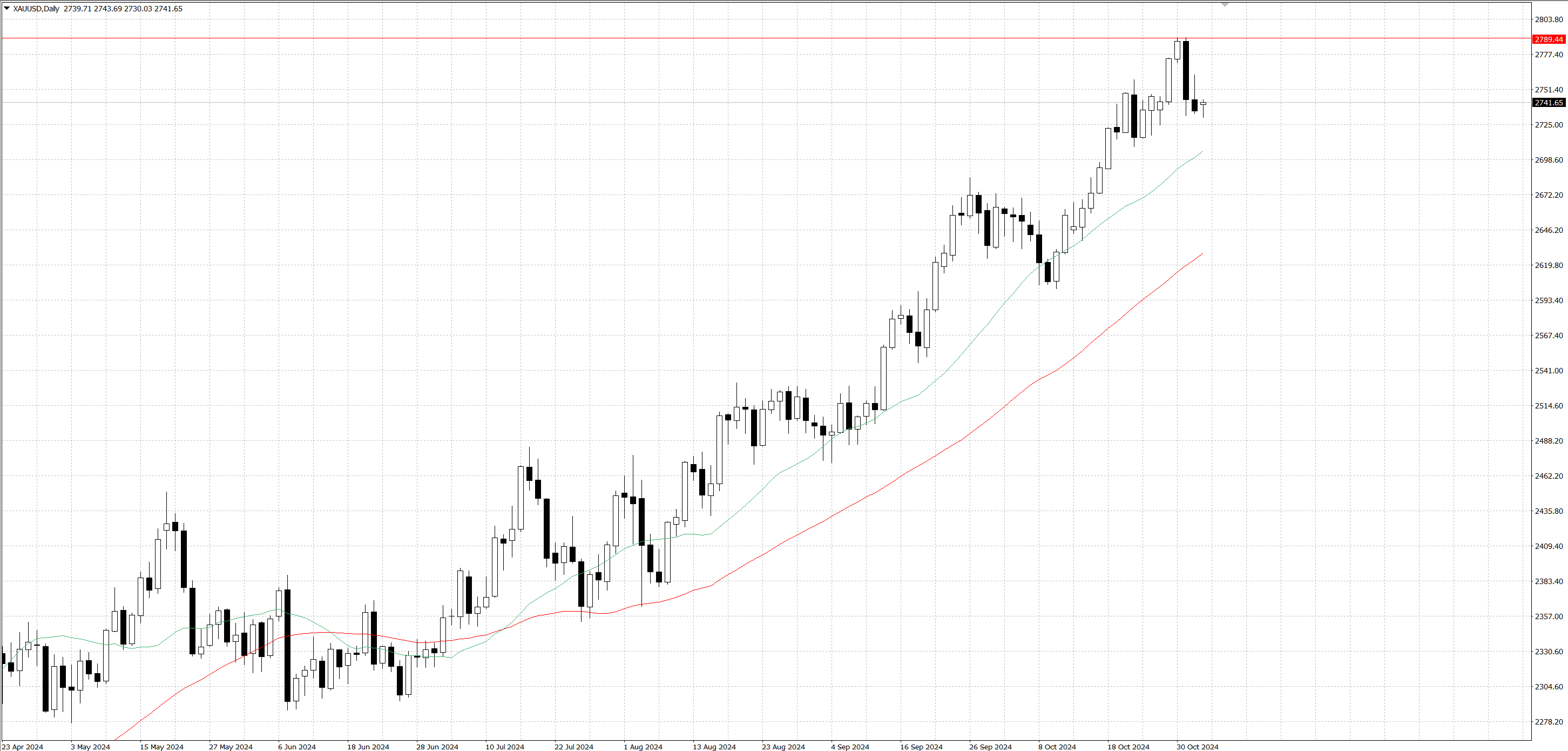

From a technical perspective, gold prices remain above the key 100-day exponential moving average (EMA), indicating a long-term bullish trend. The 14-day relative strength index (RSI) on the daily chart is above the 50 midline and close to 60.20, suggesting that support is expected to hold and remain solid. If gold prices continue to rise and break through the psychological resistance of the $…-$… area, further gains towards $… may be possible.

On the other hand, if gold prices stabilize below $… (October 24 low), it may trigger a larger correction, targeting the September 30 low of $…, or even a test of the $… round mark. Investors should pay close attention to key support and resistance levels to confirm the future direction of the trend.