Article by: ETO Markets

Gold prices (XAU/USD) paused their two-day rally on Wednesday as rising US Treasury yields pressured non-yielding assets, but they may still find support from safe-haven demand amid escalating trade tensions. This comes as President Trump's 25% tariffs on Mexican and Canadian imports and a hike in Chinese duties to 20% took effect on Tuesday, sparking retaliatory measures from Canada and China and heightening fears of a global trade war. In a Fox News interview, US Commerce Secretary Howard Lutnick hinted that Trump might reconsider his tariff policy within 48 hours if USMCA rules are followed, although reports indicate that Trump privately plans to maintain the tariffs. Meanwhile, the safe-haven appeal of gold was further bolstered by a pause in US military aid to Ukraine—leading to the grounding of US military equipment not yet deployed—as tensions flared during peace deal negotiations between President Trump and Ukrainian leader Volodymyr Zelenskyy. At the same time, despite the US Dollar Index trading around 105.70 amid rising yields, concerns over slowing economic growth, tariff impacts on consumer spending, and mixed economic indicators like a dip in the ISM Manufacturing PMI alongside a surge in the Prices Paid Index continue to fuel market uncertainty that could ultimately support gold prices further.

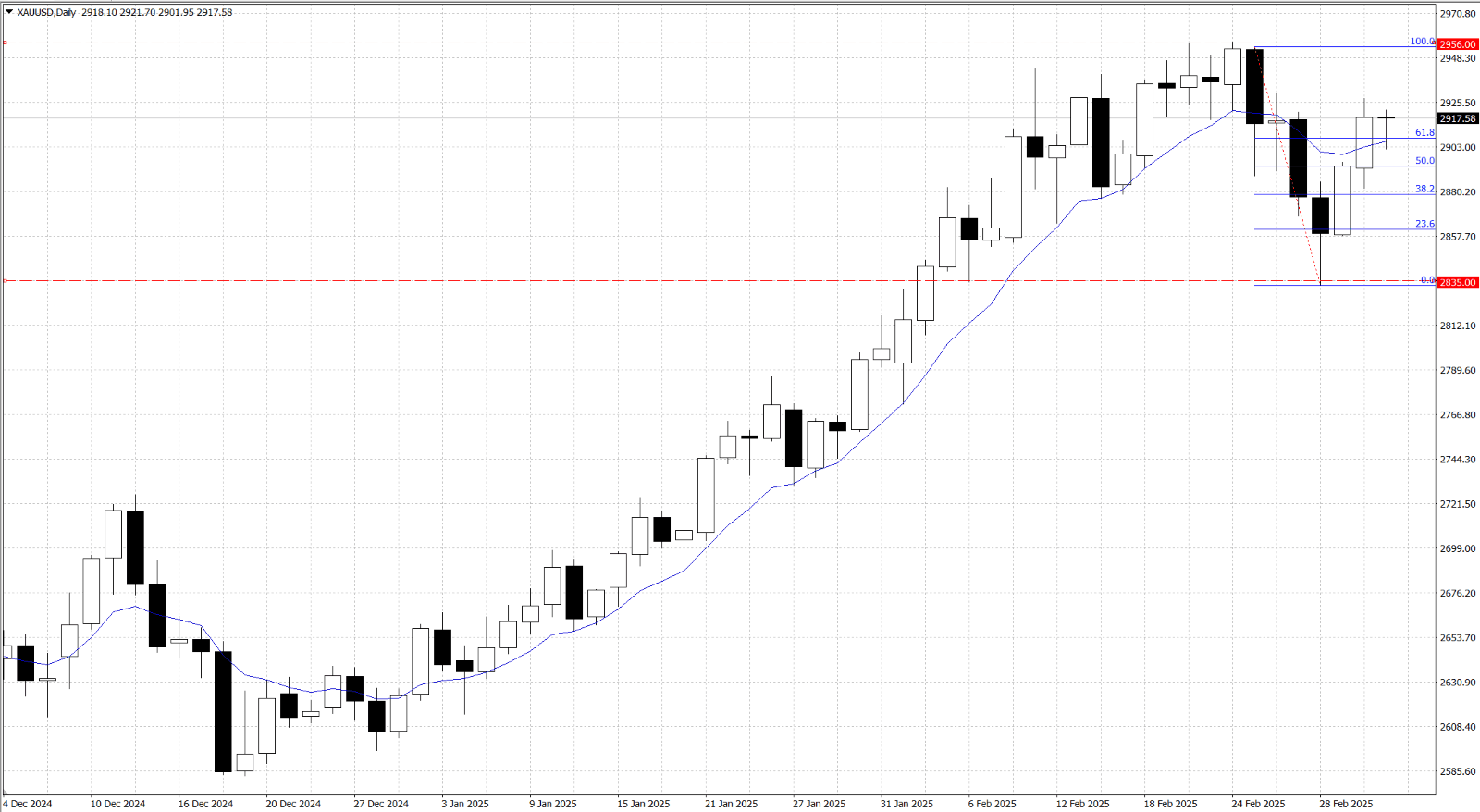

From a technical perspective, gold is trading around $… per troy ounce on Wednesday, with technical analysis indicating that the price is consolidating within an ascending channel pattern, which suggests that the bullish bias remains intact. At the same time, the 14-day Relative Strength Index (RSI) is positioned above 50, reinforcing a bearish outlook among market participants. The metal could potentially target primary resistance at the all-time high of $… recorded on February 24, while immediate support is found at the nine-day Exponential Moving Average (EMA) of $…. A break below this support level might weaken short-term momentum and lead to a test of the lower boundary of the ascending channel at around $….