Article by: ETO Markets

Gold prices (XAU/USD) edged higher during the Asian session on Tuesday, extending their overnight recovery from the ... zone, though bullish momentum remained limited. Support for the precious metal stemmed from expectations that US President-elect Donald Trump's proposed tariffs and protectionist policies could fuel inflation, reinforcing gold's appeal as an inflation hedge. Additionally, ongoing geopolitical risks, including the protracted Russia-Ukraine conflict and tensions in the Middle East, bolstered the safe-haven demand for gold. However, the metal faced headwinds from the potential for slower interest rate cuts by the Federal Reserve in 2025, which continue to support elevated US Treasury yields, along with renewed US Dollar strength. Traders appeared cautious, refraining from making aggressive bets ahead of key economic events this week, including the FOMC minutes release and the US Nonfarm Payrolls (NFP) report, set for Wednesday and Friday, respectively.

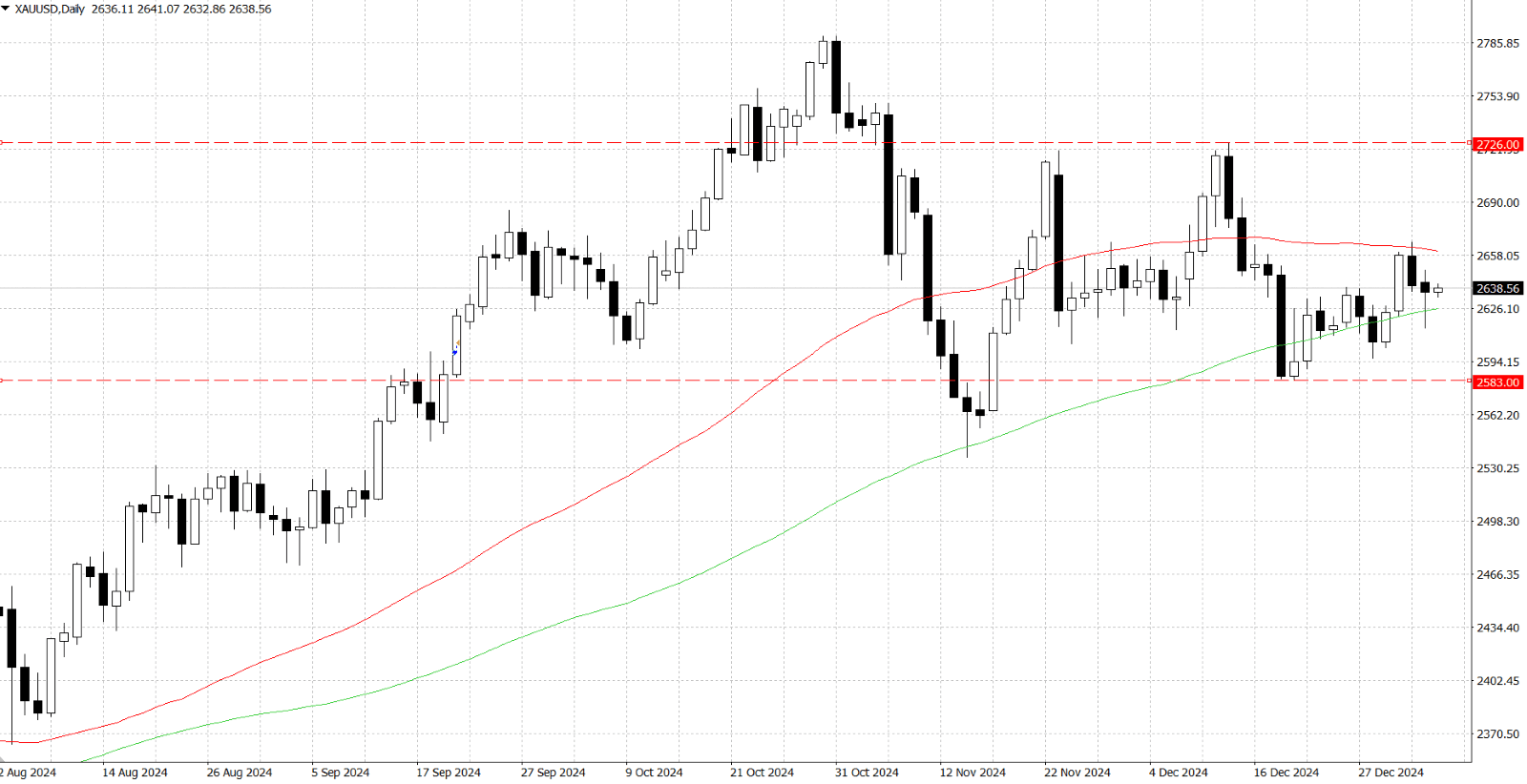

From a technical perspective, Gold's resilience above the 100-day Simple Moving Average (SMA) during the overnight session, along with a rebound, signals caution for bearish traders. Oscillators on the daily chart recovering from negative territory further support the potential for near-term upside. Immediate resistance lies near the ... zone, followed by the ... level, which marks last Friday's multi-week high. A sustained move beyond these levels could drive momentum towards intermediate resistance at ..., eventually challenging the pivotal ... mark supported by the December high. On the downside, the 100-day SMA near ..., the overnight low at ..., and the psychological ... level are expected to provide support. A breach of December's swing low around ... could trigger renewed bearish pressure.