Article by: ETO Markets

Gold prices fell slightly in Asian trading on Friday, giving up strong gains of nearly 2% the previous day. Still, a number of factors are expected to limit further declines in gold. The positive tone in global equity markets has dented demand for safe-haven assets, putting gold under pressure. However, expectations that the Fed could cut interest rates by 50 basis points in September, as well as ongoing geopolitical tensions in the Middle East, could provide support for gold prices. In particular, the risk of retaliatory attacks triggered by the assassination of the Hamas leader in Tehran further increased risk aversion in the market. In addition, the moderate strength of US Treasury yields and the US dollar also put some pressure on gold. However, with the Federal Reserve widely expected to cut interest rates in September and recession fears easing, these factors are expected to support gold prices. Investors are now closely watching U.S. consumer inflation data next week, which will provide important guidance on the Fed's next monetary policy move.

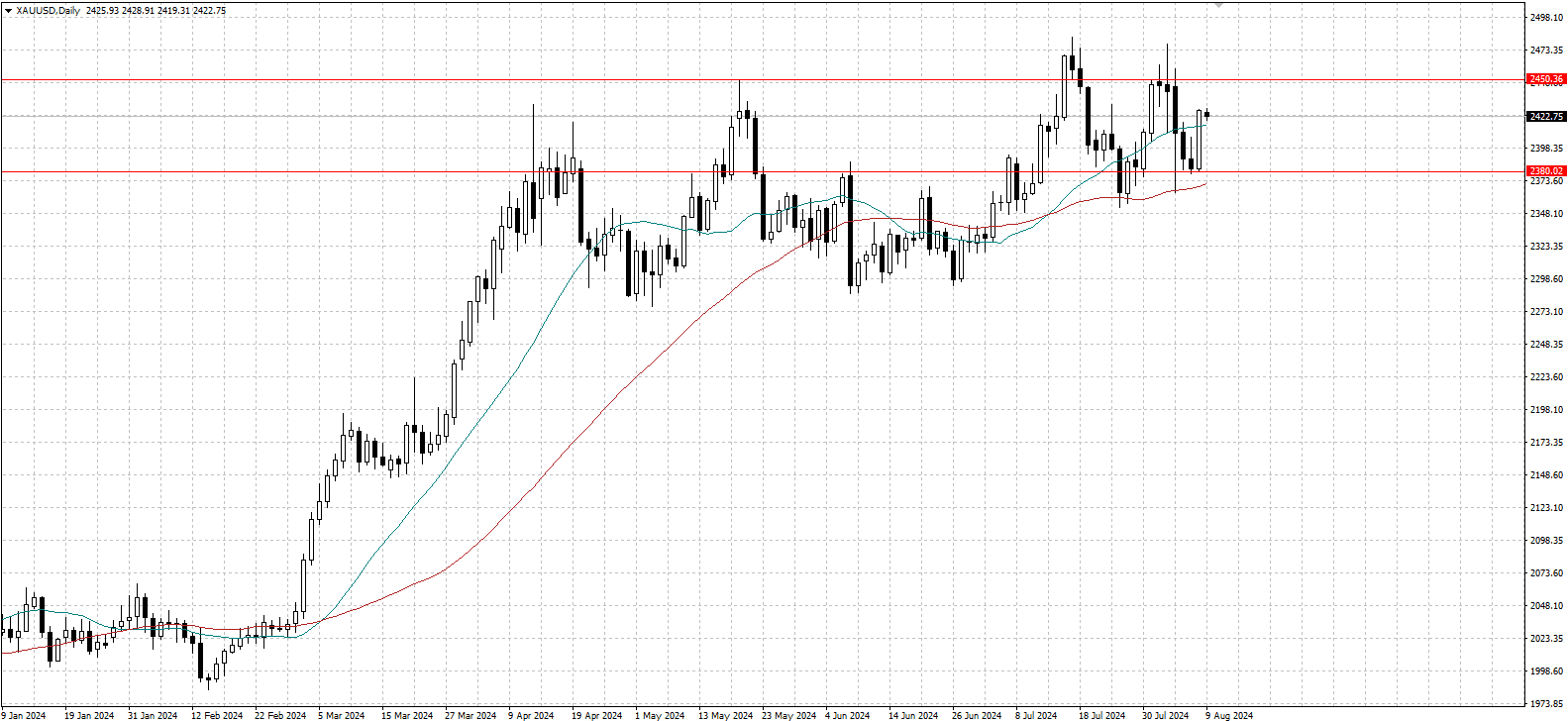

From a technical point of view, gold has found support near the 50-day simple Moving average (SMA) and is showing bullish signs. Oscillators on the daily chart are also starting to regain positive momentum, indicating that the path of least resistance for gold is upward. If gold can break through the $…-… zone, further gains to the all-time high of $…-… hit in July, or even the psychological $… level, are possible. Conversely, if gold breaks below the $…- $… support level, the round $… mark below and the $…-… area near the 50-day SMA will be key support areas. These support levels could attract bargain hunters and limit further declines in gold prices. If these support levels break down, gold could push further down to last week's lows in the $…-… area and possibly even test the 100-day SMA support at the $… area.