Article by: ETO Markets

Gold prices (XAU/USD) are experiencing mild gains, trading around $… during the early Asian session on Monday. The rise is driven by heightened geopolitical tensions in the Middle East and growing expectations of a rate cut by the Federal Reserve. The US Consumer Price Index (CPI) for November, set to be released on Wednesday, is expected to draw significant market attention. China's central bank, the People's Bank of China (PBOC), resumed gold purchases for its reserves in November after a six-month hiatus, increasing its holdings to 72.96 million troy ounces. This move could support gold prices, given China's role as a major gold consumer. Global uncertainties, particularly the geopolitical tensions in Ukraine following another Russian attack, and the political upheaval in Syria after the collapse of President Bashar al-Assad's regime, are further boosting gold's appeal as a safe-haven asset. Additionally, the US November employment report indicated a gradual easing of the labour market, raising expectations of an 87% likelihood of a 25-basis-point rate cut by the Fed on December 18. However, the potential for higher tariffs under US President-elect Donald Trump could stoke inflation, possibly limiting further rate cuts and weakening the US dollar. This dynamic presents a mixed outlook for USD-denominated commodities like gold.

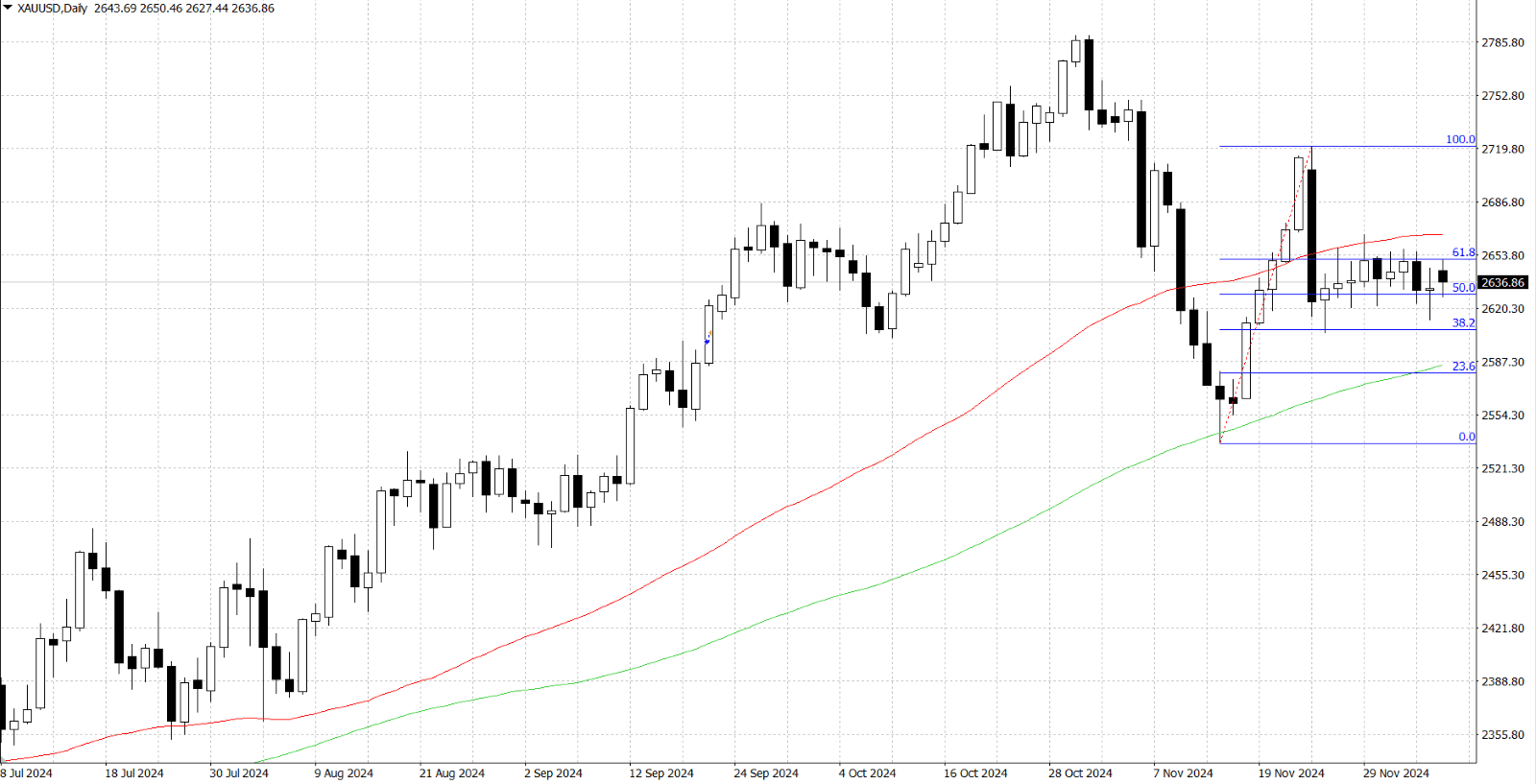

From a technical perspective, gold's price movement reflects a struggle between bullish and bearish dynamics as it tests key support and resistance levels. On the upside, resistance is evident around $… supported by both psychological level and the 61.8% Fibonacci level. Furthermore, there is a sustained move above 55-day Simple Moving Average of $…. Conversely, immediate support lies near 50% Fibonacci level of $…, with stronger psychological support level at $…. A decisive drop below the 100-day SMA at $… could open the door to a retest of the November swing low at $….