Article by: ETO Markets

The gold price gains some of the ground it lost, below the mid-$2,000s. The US Federal Reserve may decide to maintain its tight policy longer, which might lead to some selling pressure on yellow metal in the near future. On Thursday, the US Consumer Price Index will provide additional guidance to gold dealers.

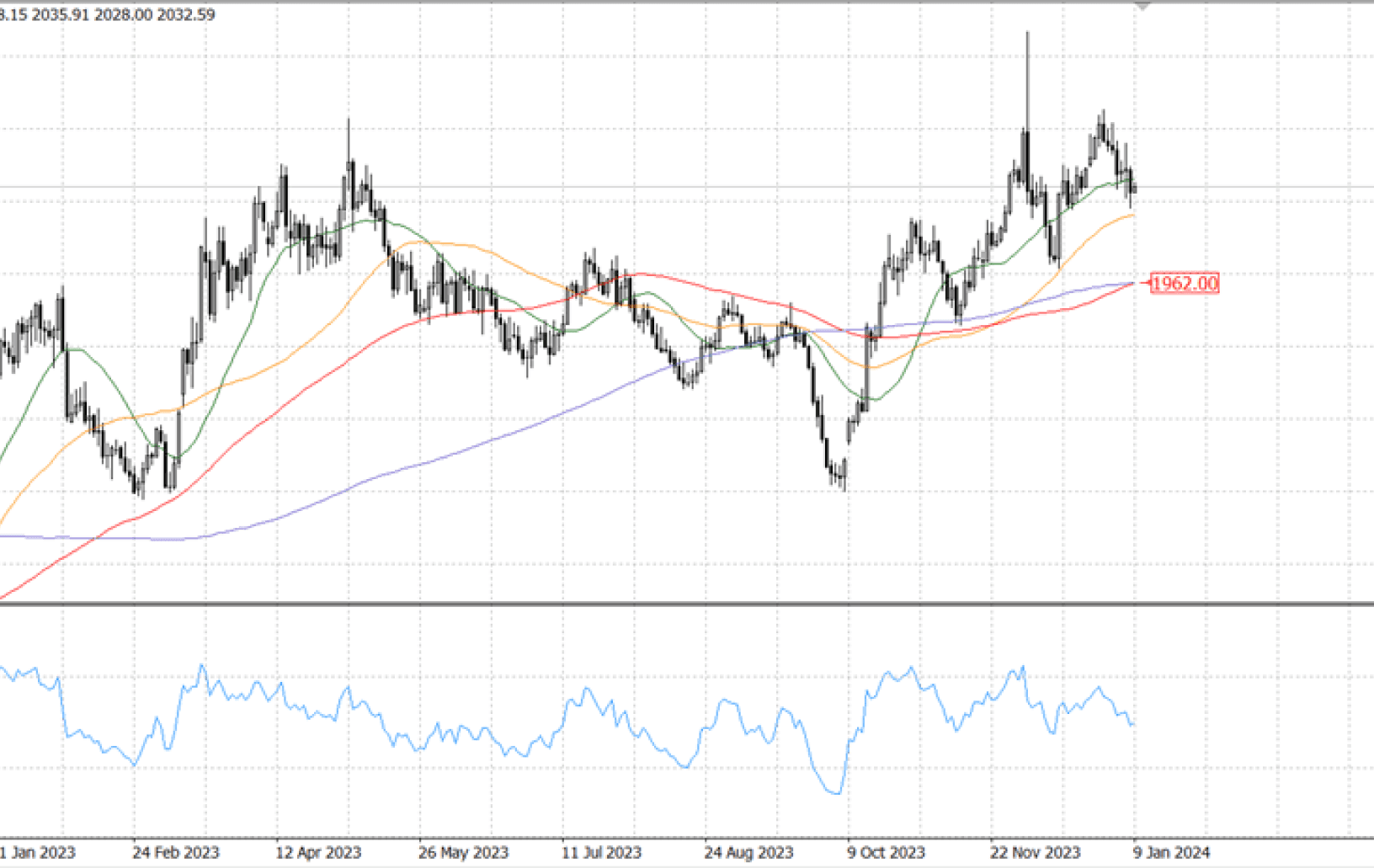

The risk is tilted to the downside, as can be seen in the XAU/USD daily chart. The 100- and 200-SMAs converge at $… with a moderate upward strength, but the shiny metal trades below a flat 20-SMA. The Relative Strength Index presents a negative slope around 49, predicting another leg lower without providing confirmation.

Technical indicators on the 4-hour chart have recovered from their recent lows, but they are still in negative territory, which reduces the likelihood of a stronger rebound. While the 20- SMA moves southward above the current level and provides dynamic resistance near the $… level, XAU/USD is battling a directionless 200-SMA at the same time.