Article by: ETO Markets

Investors anticipate the report because they appear certain that the US Federal Reserve will cut interest rates by almost 150 basis points at the end of the year in response to remarks made by Fed Chairman Jerome Powell and colleagues that rates are almost at their high. Softer-than-expected US CPI data could therefore be good for the yellow metal and bad for the US dollar since a decline in US Treasury bond yields is anticipated. Conversely, traders would be unprepared if US inflation increased since they are heavily weighted toward a dovish Fed.

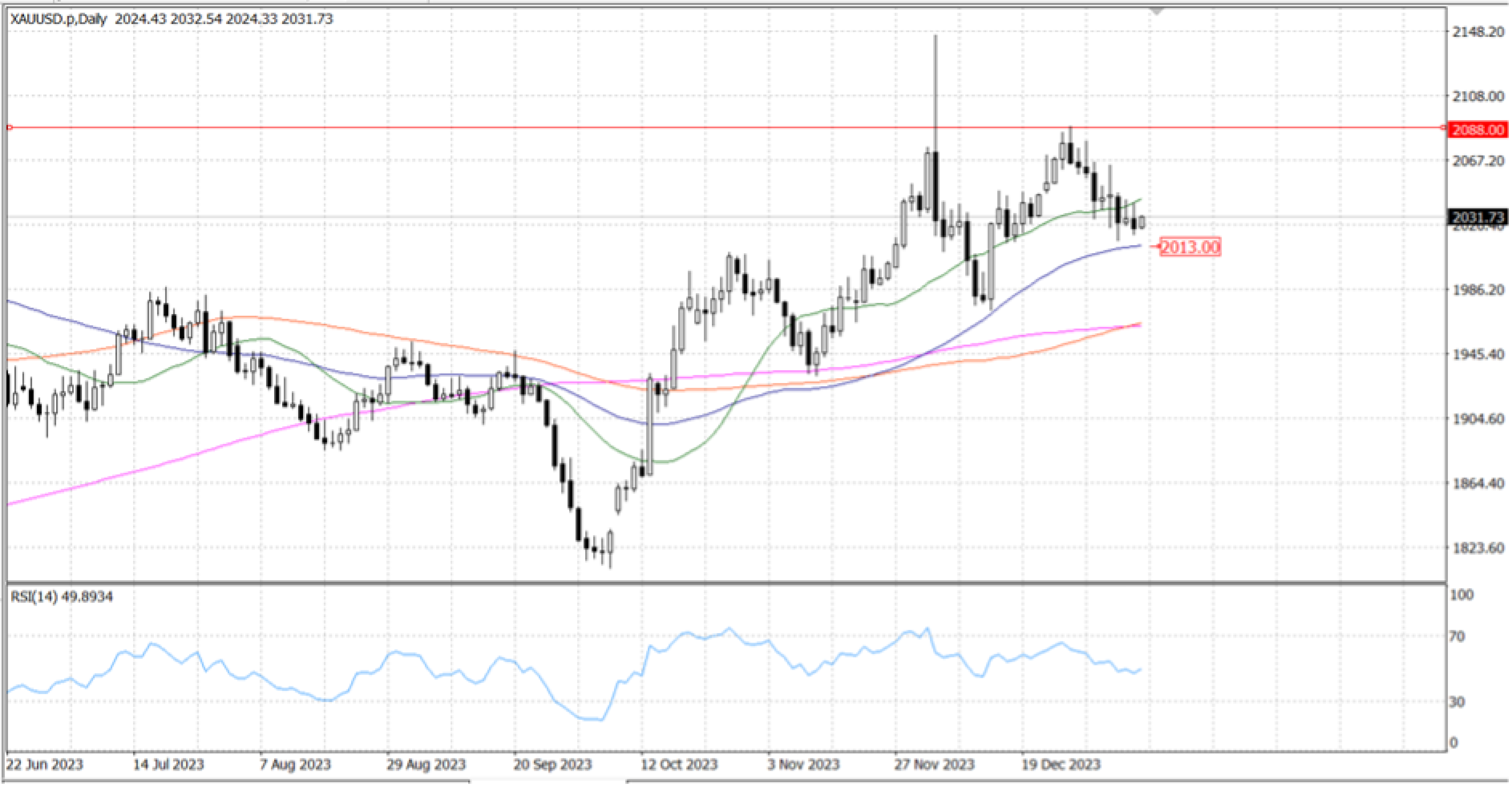

Gold's daily chart indicates a neutral bias in the yellow metal because buyers were unable to break through the most recent cycle high, which was reached on December 28 at $... The short-term trend for XAU/USD is slightly negative, and a decline to test the $… mark may intensify if sellers drive prices below the 50-DMA of $... Alternatively, if buyers enter the market and push prices over $…, that may open the door for a test of the cycle high noted above, which is around $…, before a rebound to $...