Article by: ETO Markets

Gold prices fell for the second straight session, weighed down by a stronger dollar and market optimism. Expectations of Trump's expansionary policies after his victory in the presidential election boosted the dollar and weighed on demand for non-yielding assets like gold. Trump's promise to cut corporate taxes further supported risk appetite and weakened gold's appeal as a safe haven asset. In addition, Trump's economic policies are expected to boost growth and inflation, thereby limiting the Fed's ability to cut interest rates more aggressively, causing U.S. Treasury yields to remain high, which puts additional downward pressure on gold prices.

Nevertheless, the Fed cut its benchmark overnight lending rate by 25 basis points last week and hinted at further monetary easing in the future. The market still expects another rate cut in December, which may support gold prices to some extent. Investors will focus on the release of U.S. consumer inflation data, producer price index and retail sales data this week, as well as a speech by Fed Chairman Powell, for more clues on the path of interest rates, which will affect the trend of the dollar and gold.

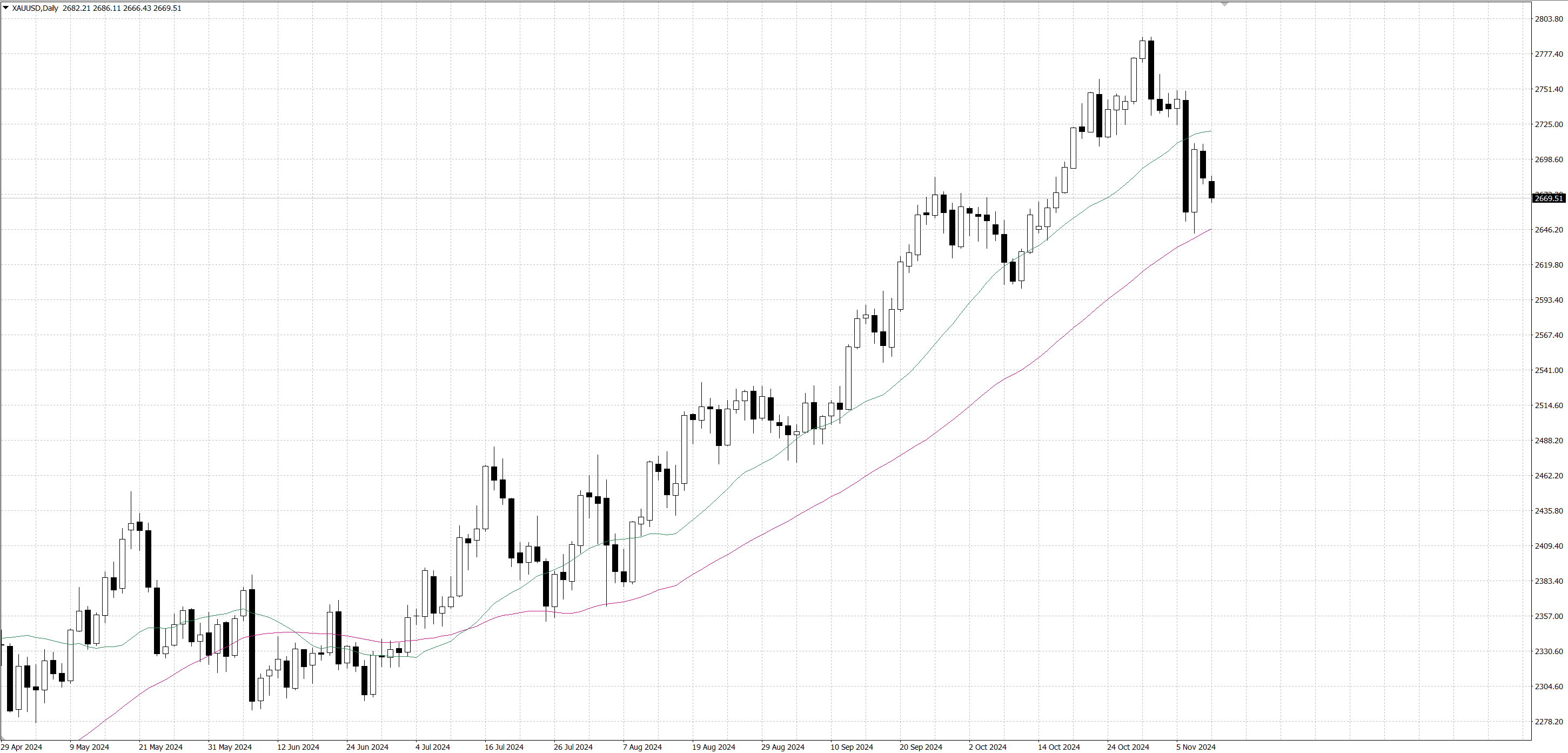

From a technical perspective, if the price of gold continues to move downward, it may find support in the $… area, which is located near the 50-day simple moving average (SMA), which is currently in the $…-$… area. If the price of gold falls below last week's low of $…, it may trigger new bearish momentum, and the target may be further down to the monthly low of October in the $…-$… area.

On the upside, if the price of gold returns above $…, it will face strong resistance in the $… area, followed by the supply zone of $…-$…. A break above this area will indicate that the correction has ended, which may push the price of gold further up to challenge the static resistance level of $… and move towards the $…-$… area (the historical high on October 31).