Article by: ETO Markets

Gold (XAU/USD) experienced a partial recovery from its dip below $… during the Asian session but remains below its one-month high reached earlier on Thursday. Market expectations for the Federal Reserve's third consecutive interest rate cut next week, fuelled by Wednesday's US consumer inflation data, are bolstering gold's safe-haven appeal. Geopolitical risks, including the Russia-Ukraine war, Middle East conflicts, and concerns about President-elect Trump's proposed trade tariffs, further underpin the metal's demand. However, the Fed's struggle to achieve its 2% inflation target has led to rising US Treasury yields and a stronger US Dollar, capping gold's gains and prompting profit-taking. Despite these headwinds, any price dips are seen as potential buying opportunities, as traders monitor the US Producer Price Index and upcoming FOMC meeting for further market direction. Inflationary pressures linked to Trump's policies are expected to influence Treasury yields and Fed actions, keeping gold's trajectory uncertain in the near term.

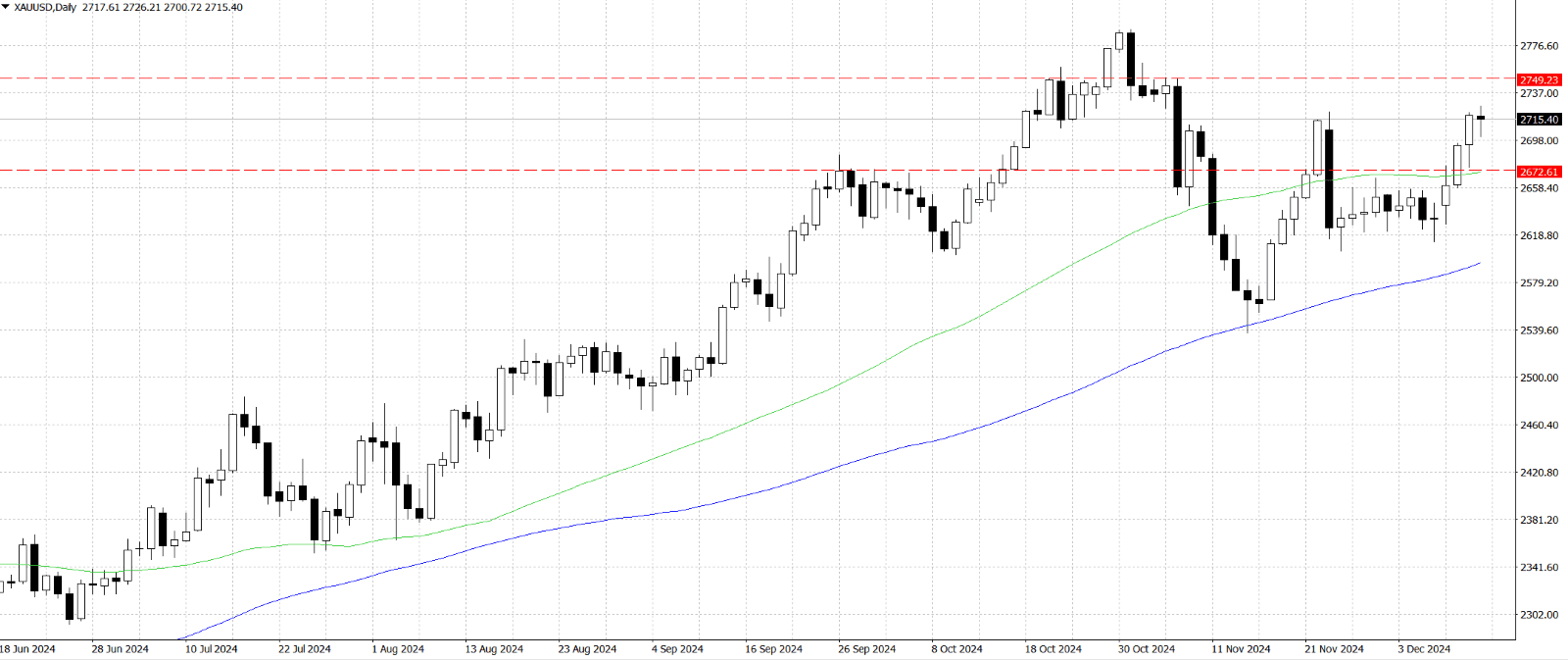

From a technical standpoint, the Relative Strength Index (RSI) on the hourly charts has eased from overbought levels, and oscillators on the daily chart are beginning to gain positive momentum, suggesting potential dip-buying opportunities for gold. Any further weakness below the $… mark may find support near the overnight swing low around $… supported by 50-days SMA. However, a continuation of selling pressure could drive gold lower towards the $… area as the starting point of bullish outlook. On the upside, $… could act as immediate resistance, with a breakout above this level likely targeting the all-time high near $….