Article by: ETO Markets

The US Federal Reserve is expected to cut interest rates in June if the monthly headline and core CPI inflation surprise to the downside. This would cause the US dollar to continue to decline and push the price of gold to all-time highs. If the US CPI surprises negatively, there will be significant adverse pressure on US Treasury bond yields, which will start a new rally in the price of non-interest bearing gold.

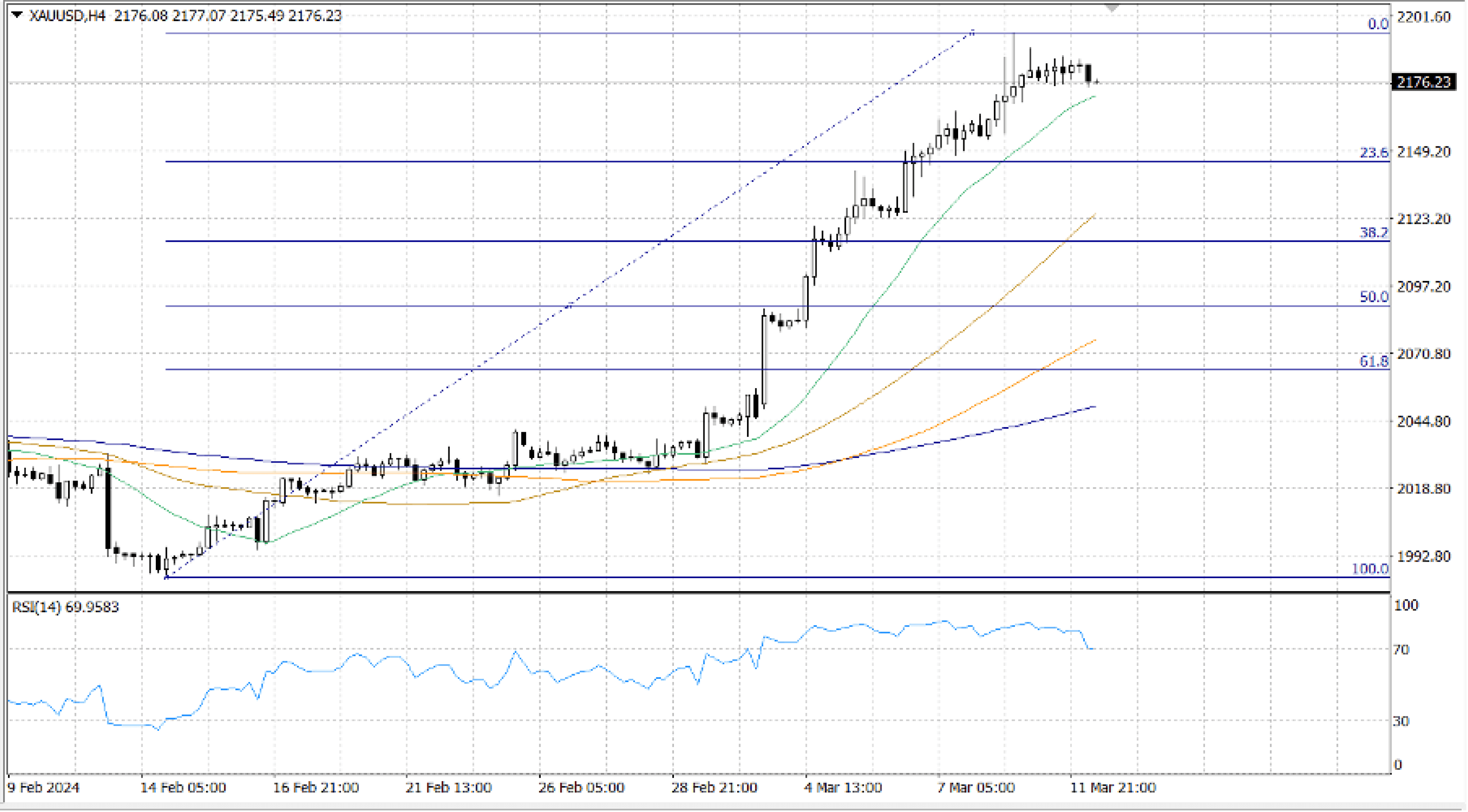

The price of gold might increase to an all-time high of $… in the event of a bearish surprise in the US CPI figures. over that point, a sustained break over the $… barrier is required in order to target the psychological level of $...

Conversely, strong US inflation numbers suggest that the gold price drop will probably continue, possibly reaching the $… low of March 8. The next level of support is located at $…, which also happens to be the location of the March 7 low and the 23.6% Fibonacci Retracement level.