Article by: ETO Markets

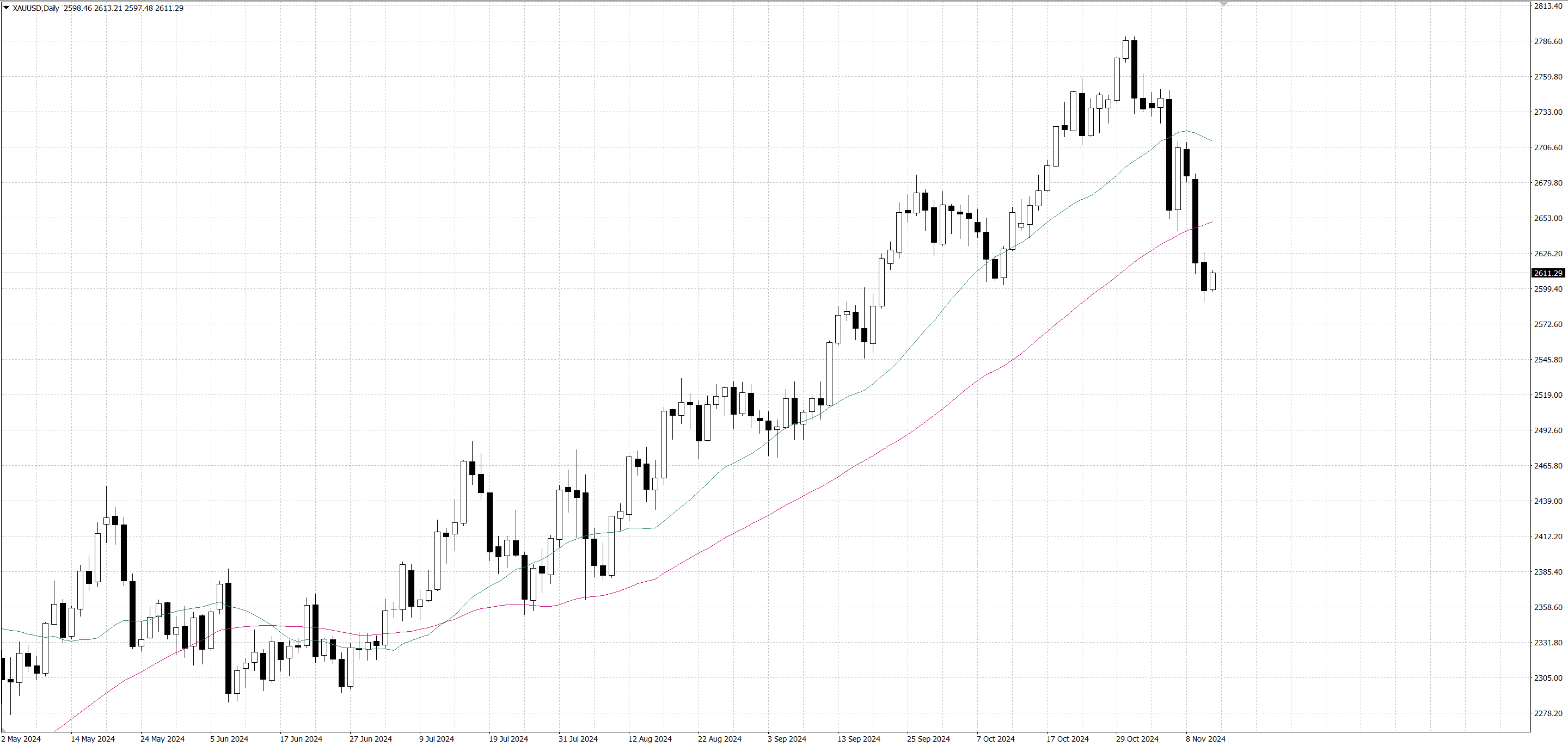

Gold prices fell below $2,600 on Tuesday, mainly affected by the strengthening of the US dollar and rising US Treasury yields. After Trump's victory, market expectations of his expansionary policies boosted the US dollar, causing gold denominated in US dollars to face pressure. US Treasury yields continued to climb, exacerbating the downside risk of gold as high yields weakened the attractiveness of gold. In addition, the Fed's policy expectations are hawkish, and the market's expectations for a rate cut in December have been reduced, further supporting the US dollar and unfavorable to gold.

From a technical perspective, the price of gold has broken below the low of $… on October 10, showing a strengthening of bearish momentum. A daily close below $… could lead to further declines to the psychological support of $…, followed by the 100-day simple moving average (SMA) of $…. If the price continues to fall below the 100-day SMA, it will further decline to the psychological level of $….

On the other hand, if the price of gold finds support at the $2,600 level, it may test the resistance of the 50-day SMA at $… and then $…. If it can break through this level, the further upside target is the November 7 high of $….