Article by: ETO Markets

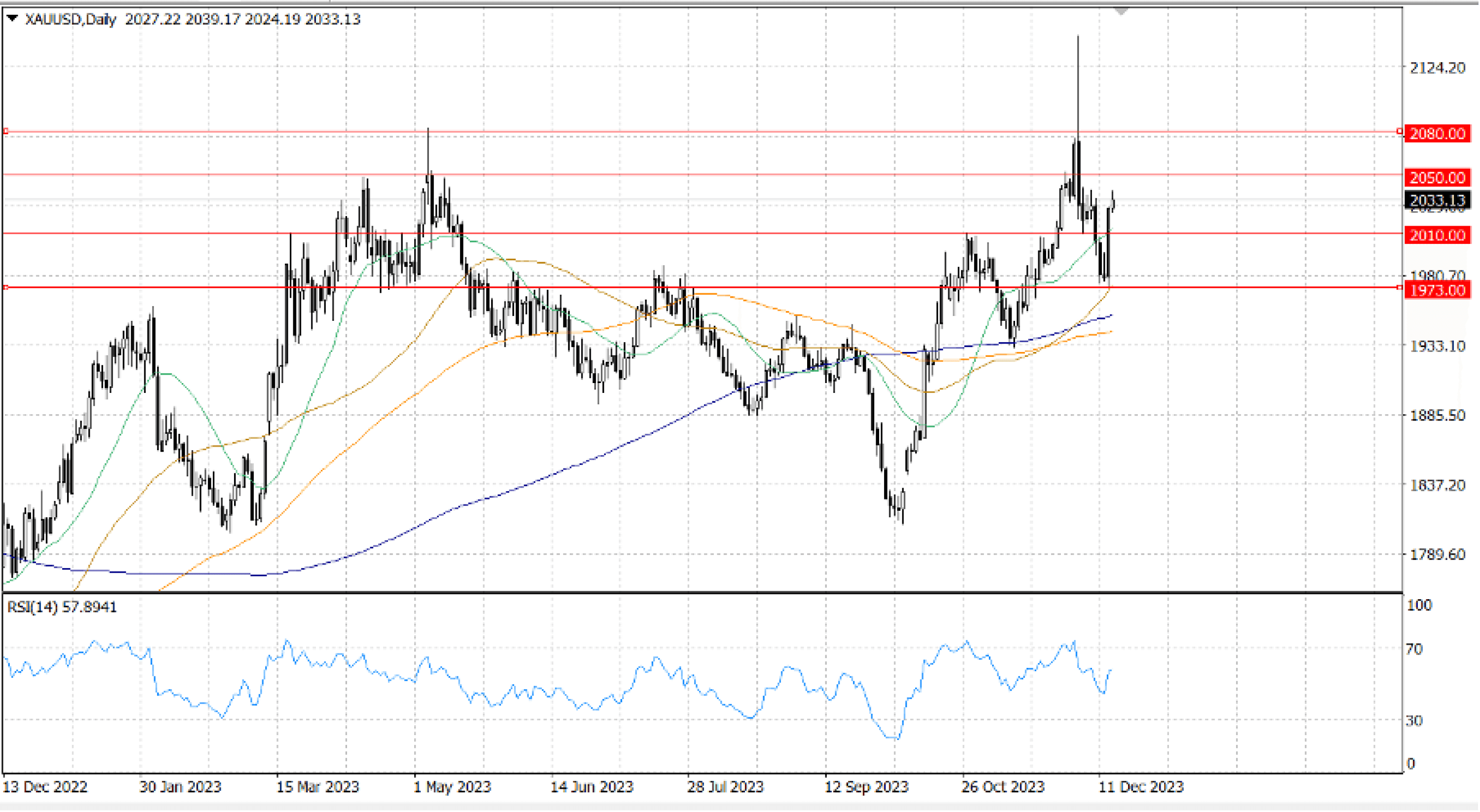

The precious metal gains pace and reaches a one-week high, but it stalls close to the $2,040 supply zone. One important element that is acting as a headwind for the safe-haven gold is the general risk-on climate. Nevertheless, geopolitical risk, worries about a slowdown in China's economy, and the Federal Reserve's dovish trend favour bullish traders and promote the likelihood of a further increase in the commodity's value.

Some follow-through buying above $… will be viewed by optimistic traders as a new trigger. The price of gold may then move up to the next significant barrier, which is probably around $... If the momentum continues, the XAU/USD pair may be able to recover the $… round-figure mark.

Conversely, the horizontal line $… may now shield the short-term decline ahead of the psychological $… barrier. The price of gold will become susceptible and reveal the 50-DMA support, which is now located around the $…, if there is a strong break below the latter.