Article by: ETO Markets

The negative US Retail Sales report was mostly ignored by markets, which were more influenced by the strong PPI inflation data than by the US Dollar. The PPI data release coincided with the US Treasury bond yields' continuing rebound rally, which caused the Greenback to spike higher. The preliminary University of Michigan Consumer Sentiment and Inflation Expectations data is still important information on the price of gold. But, the markets might use profit-taking in front of the Fed policy meeting on March 19–20 as a justification to rekindle interest in purchasing gold. Weekly close flows may potentially influence the movement of the gold price in the upcoming sessions.

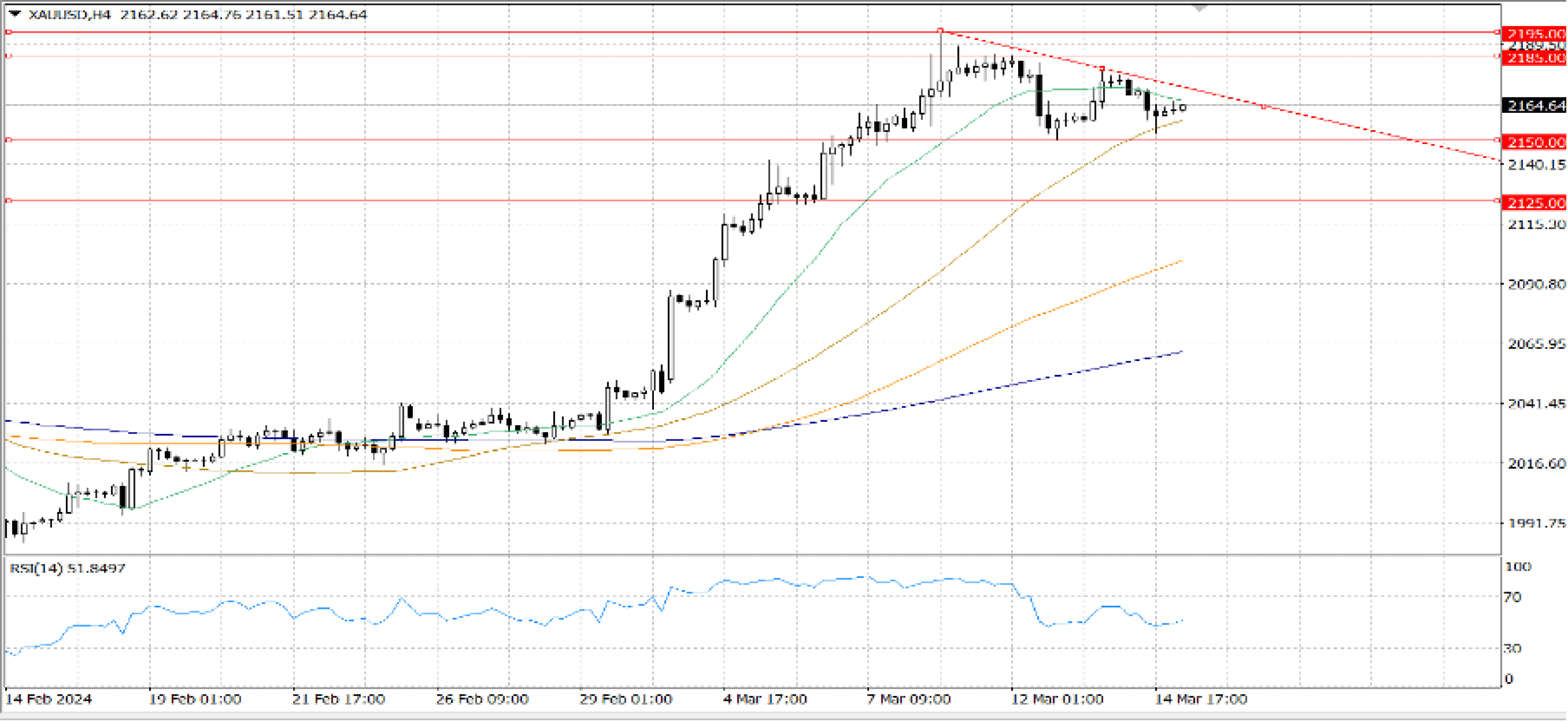

Gold price has potentially formed a Bull Pennant formation, as seen on the daily timescale. To validate the bullish continuing pattern, the price must close each day above the falling trendline resistance at $... After acceptance over Tuesday's high of $…, the doors would reopen for a try of the record high at $... The psychological level of $… and the $…barrier represent the next important upside targets.

It is not impossible for gold sellers to take back control and break the rising trendline support around $… on a consistent basis, which would lead to a further drop toward $... The static support at $… will save the buyers further down.