Article by: ETO Markets

Gold prices (XAU/USD) extended their uptrend on Tuesday, attracting some buyers for the second day in a row. It was the fifth positive day in the past six. Gold climbed above $2,430, benefiting from expectations that the Federal Reserve will begin a rate-cutting cycle in September. This expectation was further reinforced by comments from Federal Reserve Chairman Jerome Powell, who noted increased confidence that inflation would return to target. However, the modest strength of the US dollar and the rebound in risk appetite in global equity markets limited the upside for gold prices. In addition, market participants are awaiting the upcoming release of monthly US retail sales data for fresh market momentum.

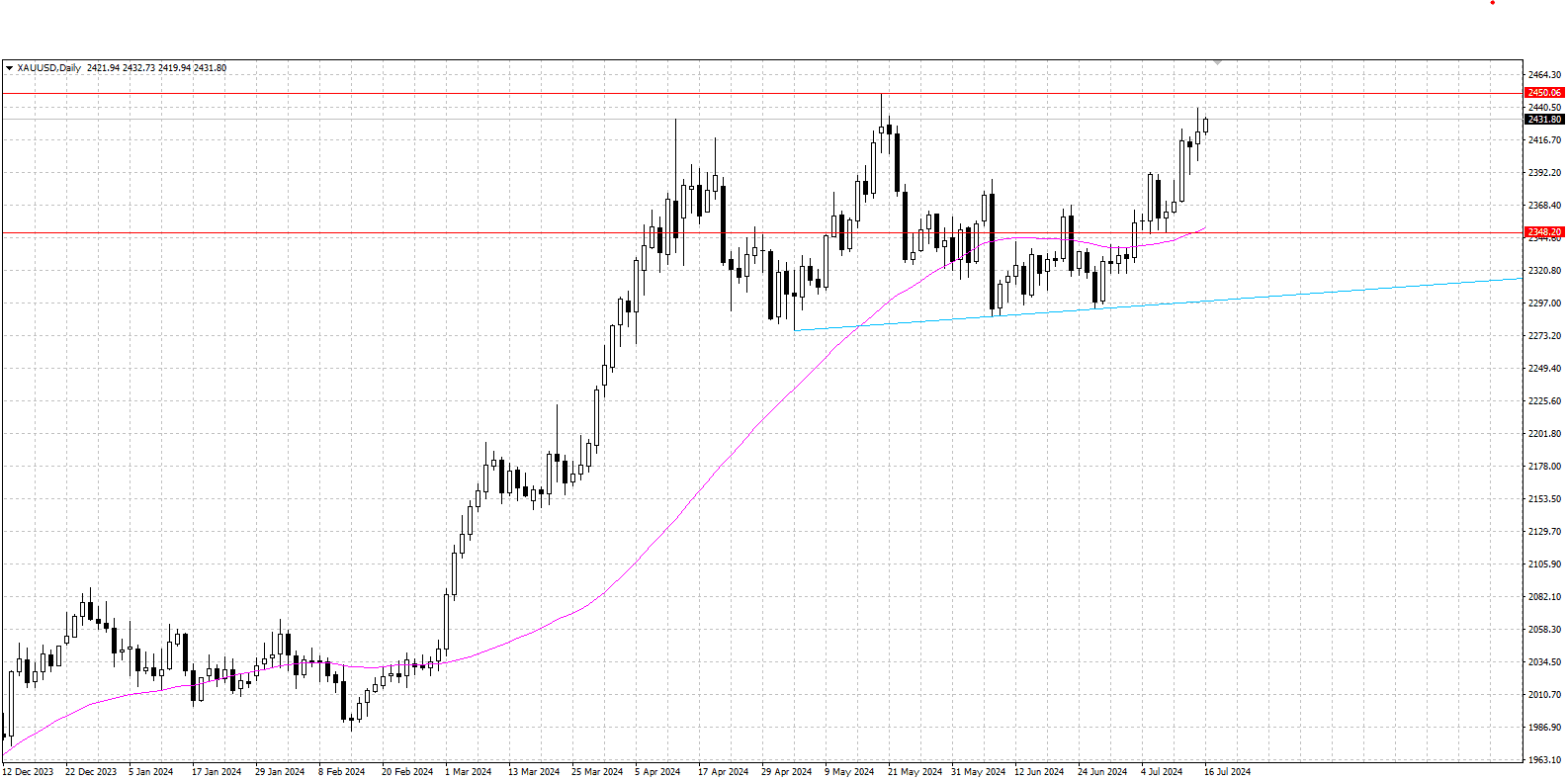

From a technical perspective, gold broke out of the $…- $… supply zone last week and continued to strengthen above $…, which is favorable for bullish traders. And it is currently in a head-and-shoulders situation, and if the gold price falls below the neckline, it will peak. If the gold price breaks through the middle of the top of the $…, it means that it is a flag-shaped adjustment of the upward trend, but also continue to rise. The current first support level will be in the 50-day Simple Moving Average (SMA) $… area. Resistance is in the $… area, the all-time high hit in May.