Article by: ETO Markets

Gold prices (XAU/USD) rebounded above $… at the start of the week, recovering from Friday’s retracement, as a broadly weaker US Dollar and rising geopolitical tensions supported demand. The USD weakened further after disappointing US Retail Sales data, which fell 0.9% in January, prompting markets to price in a potential Federal Reserve rate cut in September. Additionally, a 40-basis-point drop in the 10-year US Treasury yield signalled expectations of lower inflation, adding to gold’s appeal. Trade war fears escalated after US President Donald Trump ordered officials to draft plans for reciprocal tariffs and hinted at new automobile levies by April 2, raising concerns about global economic stability. Meanwhile, despite diplomatic talks between the US and Russia, intensified Russian attacks in eastern Ukraine sustained demand for gold as a safe-haven asset. With economic uncertainty and geopolitical risks mounting, the outlook for gold remains bullish, with the path of least resistance pointing upward.

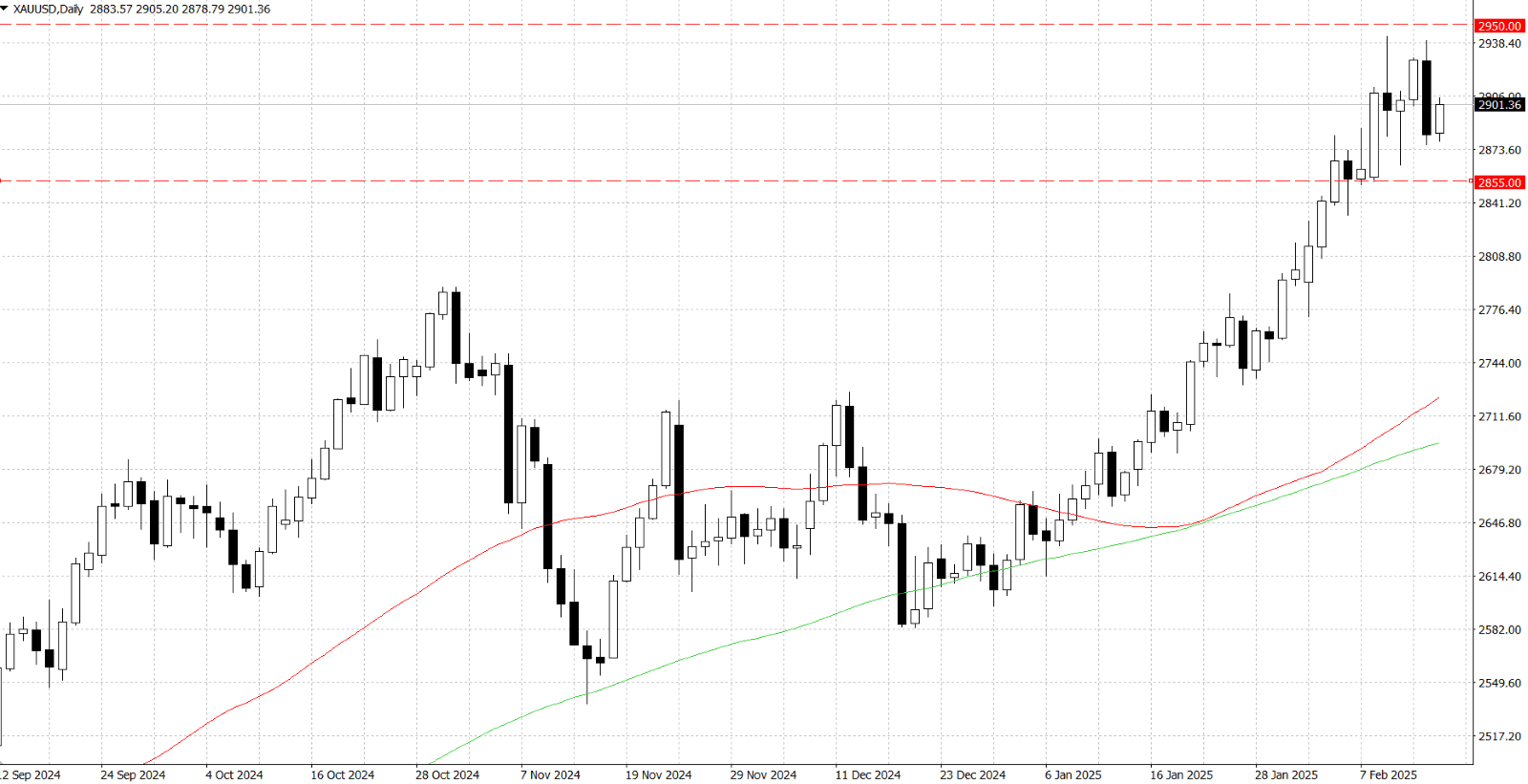

From a technical perspective, the RSI on the daily chart has retreated from overbought levels, but other indicators remain positive, reinforcing the near-term bullish outlook for gold. Immediate resistance is seen at $…, followed by the all-time high near $…, with a breakout above this level potentially extending the two-month uptrend. On the downside, support lies at $…, with additional buying interest expected near $… and $…, while a decisive break below $…-… could trigger a deeper correction.