Article by: ETO Markets

Gold (XAU/USD) continues rosing on Wednesday, driven by falling US Treasury yields, which boosted demand for non-yielding assets. Traders are anticipating rate cuts from major central banks, with the European Central Bank (ECB) expected to act on October 17, as inflation shows signs of easing. This drop in yields provided a tailwind for gold, despite the recent strength of the US Dollar.

Geopolitical uncertainty, particularly with the upcoming US elections, has further increased demand for gold as a safe-haven asset. Analysts from UBS anticipate heightened volatility until a new US administration is in place, suggesting gold and oil as effective hedges in the current environment. Additionally, traders using the CME FedWatch tool assign a 96% probability to a 25-basis-point rate cut by the Federal Reserve in November, contributing to gold’s bullish momentum.

Market participants are also monitoring upcoming US Retail Sales, Industrial Production, and Initial Jobless Claims data for further market direction. Middle East developments and China’s stimulus program remain key areas of focus in the absence of major economic data releases. With safe-haven demand still strong and expectations for rate cuts growing, the outlook for gold remains bullish, though a lack of momentum could lead to short-term pullbacks.

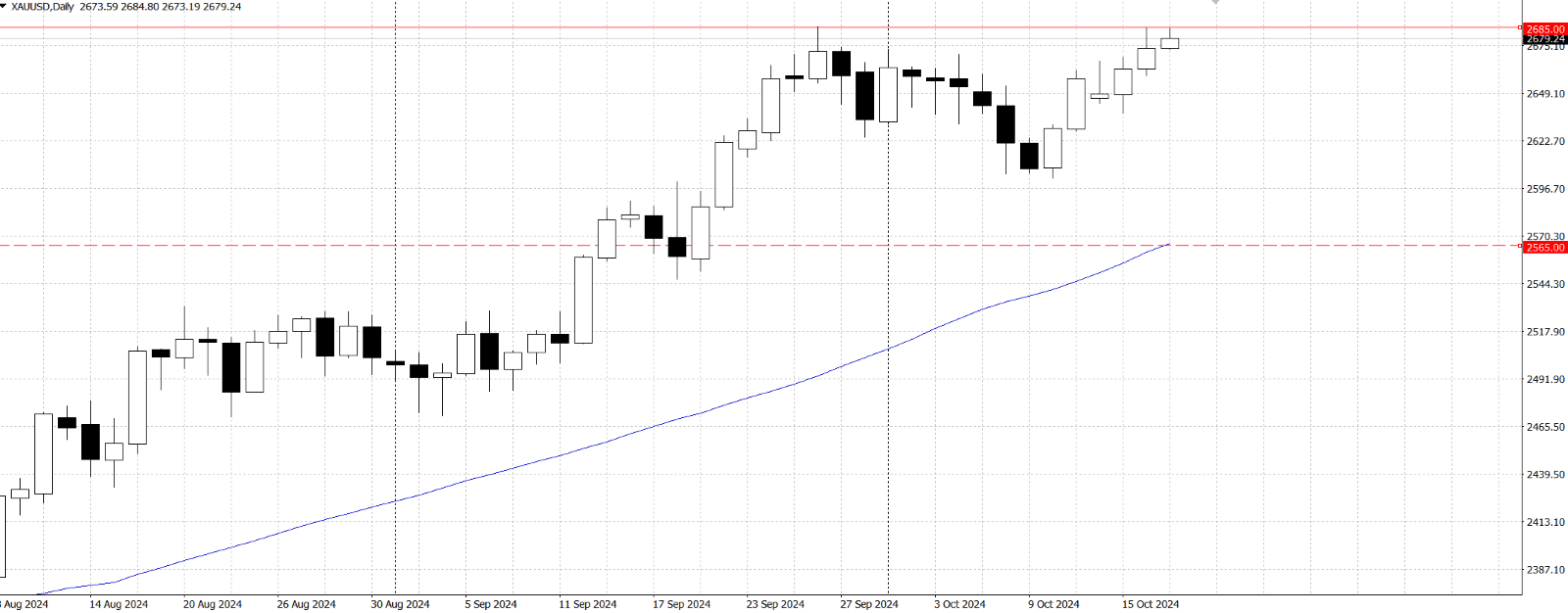

Gold hit its year-to-date (YTD) high of $… but failed to sustain the breakout, leaving $… as the next psychological resistance. Momentum remains positive, with the Relative Strength Index (RSI) at 65, indicating the potential for further gains. If gold clears the $… level, the path could open toward $…, followed by $… and $…. On the downside, if prices fall below $…, a retracement to $… could follow, with additional support at $… and the 50-day Simple Moving Average (SMA) at $….