Article by: ETO Markets

After setting a new record high earlier on Thursday, the price of gold declines but remains positive for the second day in a row, trading just over the $2,200 round-figure mark in the first part of the European session. Profit-taking in the safe-haven precious metal is prompted by the broad risk-on climate, which is reflected in the generally bullish tone surrounding the equity markets. In addition, the commodity is being undermined by a tiny increase in the yields on US Treasury bonds, which is occurring in the context of somewhat overbought conditions on short-term charts.

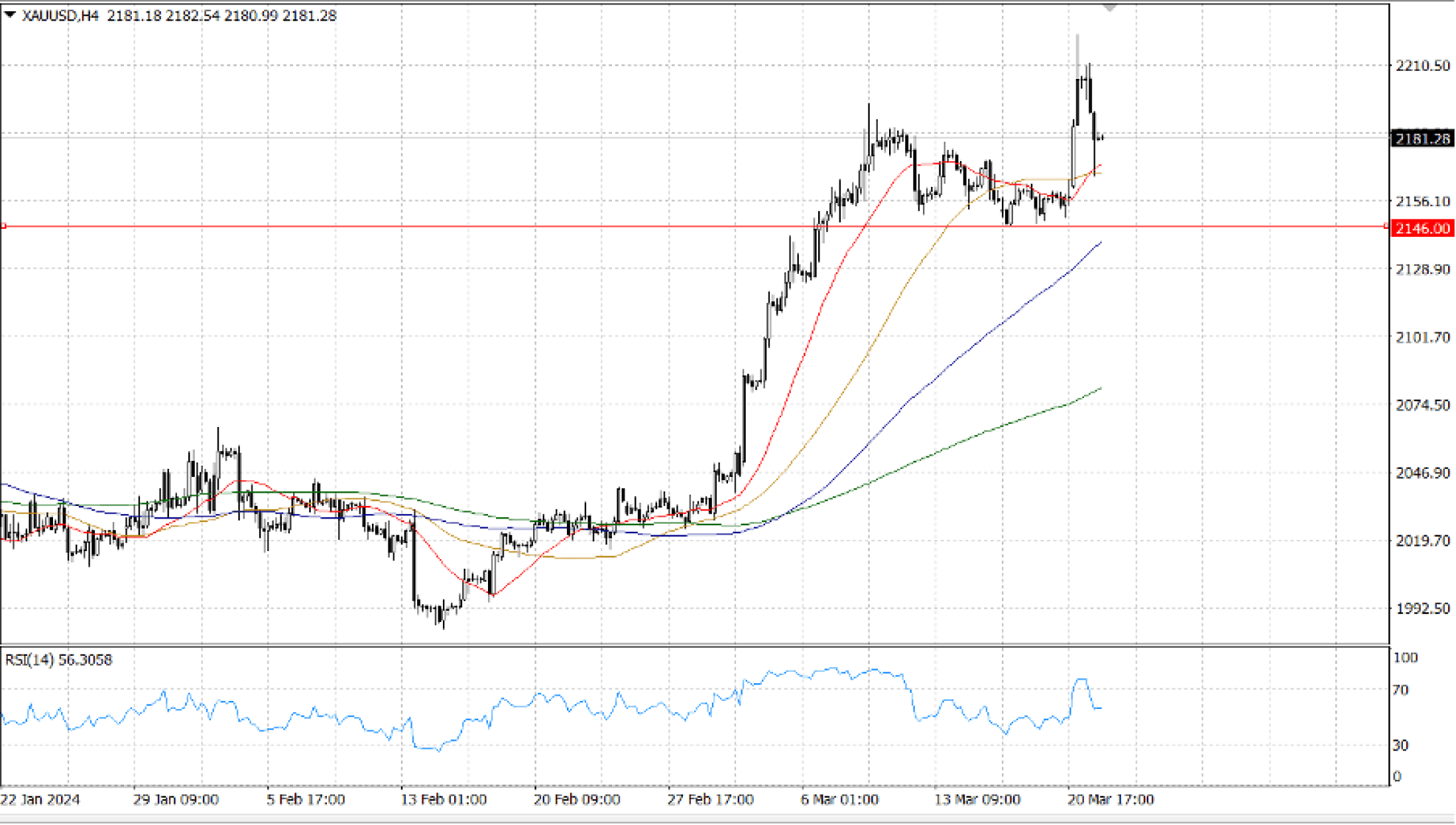

As sellers entered the market, the price of XAU/USD dropped below $… and is now below the previous all-time high of $... But before they can test the $… mark, they need to push prices back near the high on December 4, which turned into support at $... Conversely, if buyers drive prices up to $…, they will be forced to confront the all-time high of $… before attempting to reach $...