Article by: ETO Markets

The yield on US government bonds is pushing the market to multi-week highs; the 10-year Treasury note is currently trading at 4.31%, down from an early peak of 4.35%. Following the release of the minutes from the Federal Open Market Committee meeting on Wednesday, yields increased. According to the memo, policymakers are not in a rush to lower rates; instead, they would like to see more proof of inflationary pressure building before doing so. Policymakers acknowledged that the policy rate is probably near its peak for this tightening cycle, but they also emphasized the dangers of "moving too quickly."

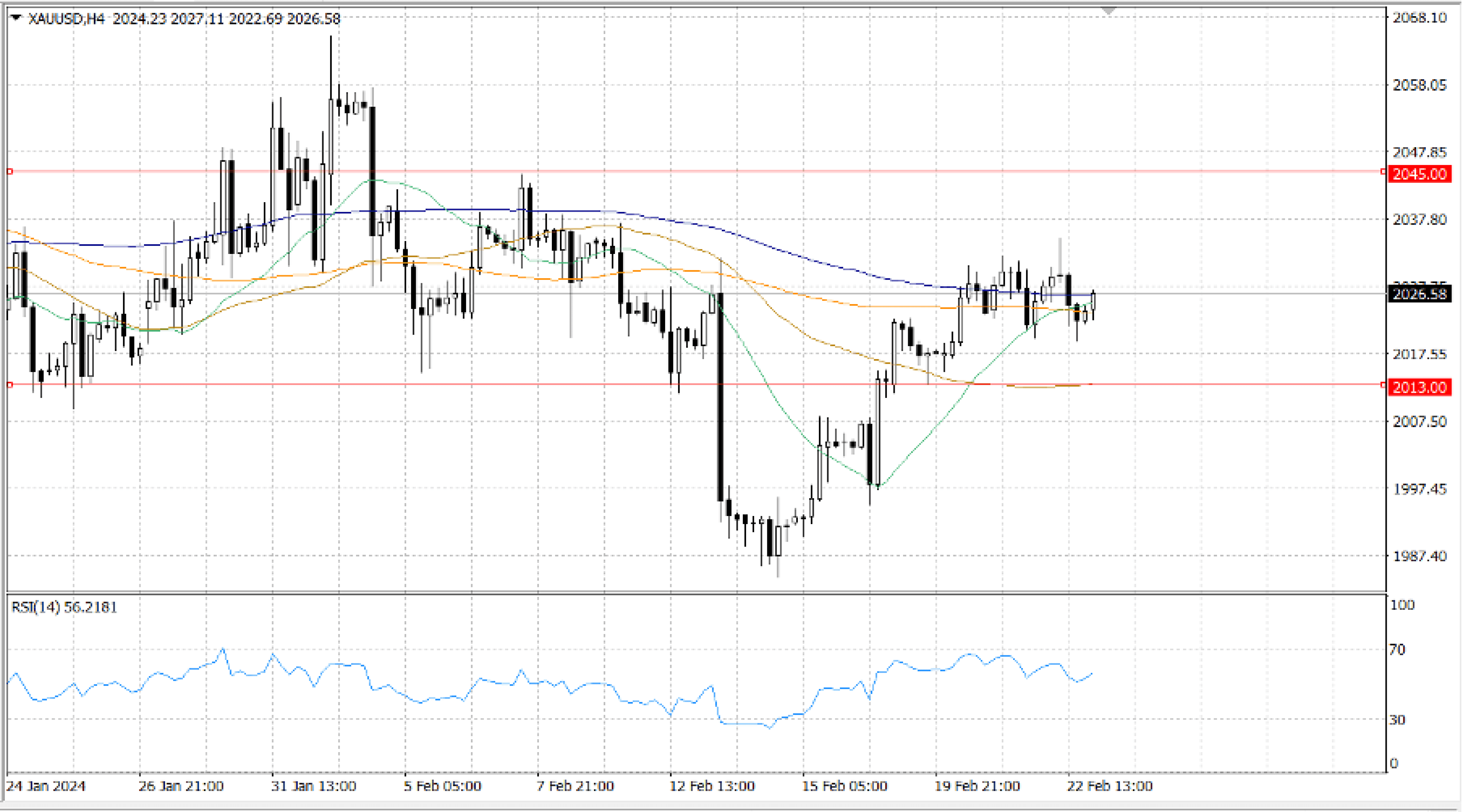

The yellow metal has been under selling pressure for the past two days, according to the 4-hour chart, but it appears that the bleeding has stopped. XAU/USD is slowly making up ground after hitting an intraday low of $... The Relative Strength Index has stabilized just above 50, indicating that technical indicators have ceased their downward trend. Simultaneously, XAU/USD is circling a little positive 100-SMA, while the 20-SMA turned slightly lower, nevertheless remaining well above the present level. The immediate resistance awaits around $...