Article by: ETO Markets

there is some dip-buying in the gold market during Tuesday's session, and most of the overnight little losses are recovered. Middle East geopolitical unrest and worries about China's sluggish economic recovery help to strengthen the safe-haven precious metal. The upside is still limited, though, as investors are continuing to reduce their expectations for a more aggressive relaxation of Federal Reserve policies, which might put the non-yielding yellow metal at risk.

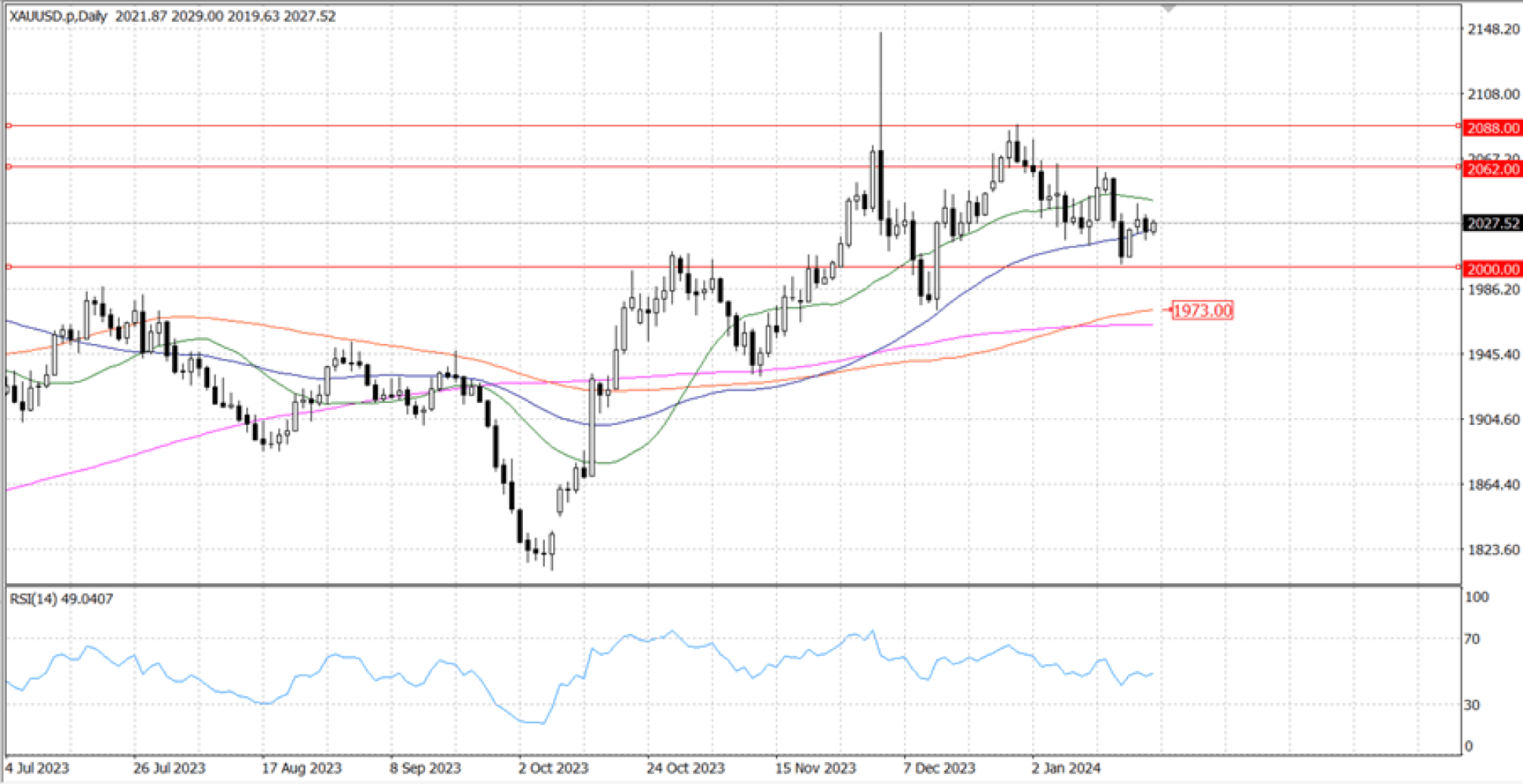

Any further advance above $… is probably going to run into strong resistance in the vicinity of the $… supply zone. The latter ought to serve as a crucial turning point that, should it be cleared with conviction, might lead to a rally in short covering. After that, the price of gold may rise to around $… before attempting to retake the $…, the highest in late December.

Conversely, the overnight swing low, which was reached last week and is currently located near $…, appears to be guarding against further declines before the $… psychological level or a one-month low. If the latter is broken consistently, the price of gold may be more susceptible to a quick decline towards the intermediate support level of $….