Article by: ETO Markets

The US dollar and US Treasury bond yields saw a significant decline on Tuesday, but the safe-haven attractiveness of gold was undermined as concerns over a broader regional conflict in the Middle East subsided. As a result, gold price continued to fall. The US Preliminary Composite PMI for Tuesday was negative, all eyes are on the US Durable Goods data, which is expected late on Wednesday, for new trade incentives. This week's major event risk is still the advance first-quarter US GDP announcement.

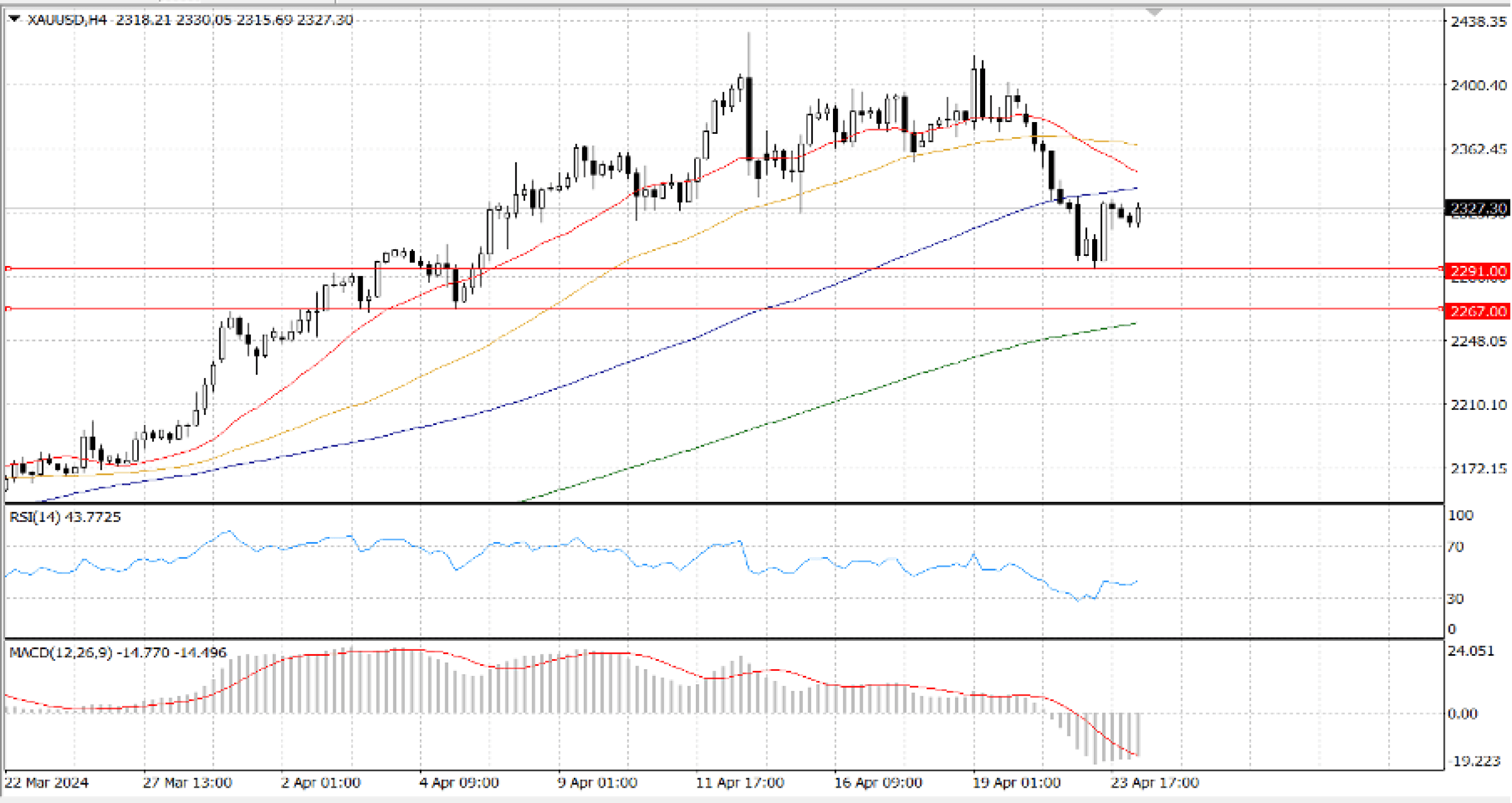

The price of gold is currently circling the important 20-SMA around $… after closing higher on Tuesday. The psychological level of $ … will be put to the test above the high of the previous day, which is $…, which is the first point of resistance. Buyers of gold will next aim for the static resistance around $...

If gold sellers gather their composure, a sustained fall below the 20-DMA support would target the previous day's low of $…, which is the next significant demand region. The early April low, which is close to $… now, may represent the last line of defence for buyers of gold.