Article by: ETO Markets

Gold prices (XAU/USD) resumed their upward trend during Friday's Asian session, reaching the highest level since October 31, as lower US Treasury yields, and a weakening US Dollar bolstered the safe-haven metal. The Dollar's slide followed US President Donald Trump's remarks suggesting he would rather avoid tariffs on China and his calls for the Federal Reserve to cut interest rates, fuelling expectations of further policy easing. Investors' concerns about the economic fallout from Trump's protectionist policies also supported gold demand, though overbought conditions and a bullish equity market limited fresh buying. The metal remains poised for a fourth consecutive weekly gain as traders await global PMI data for additional market cues.

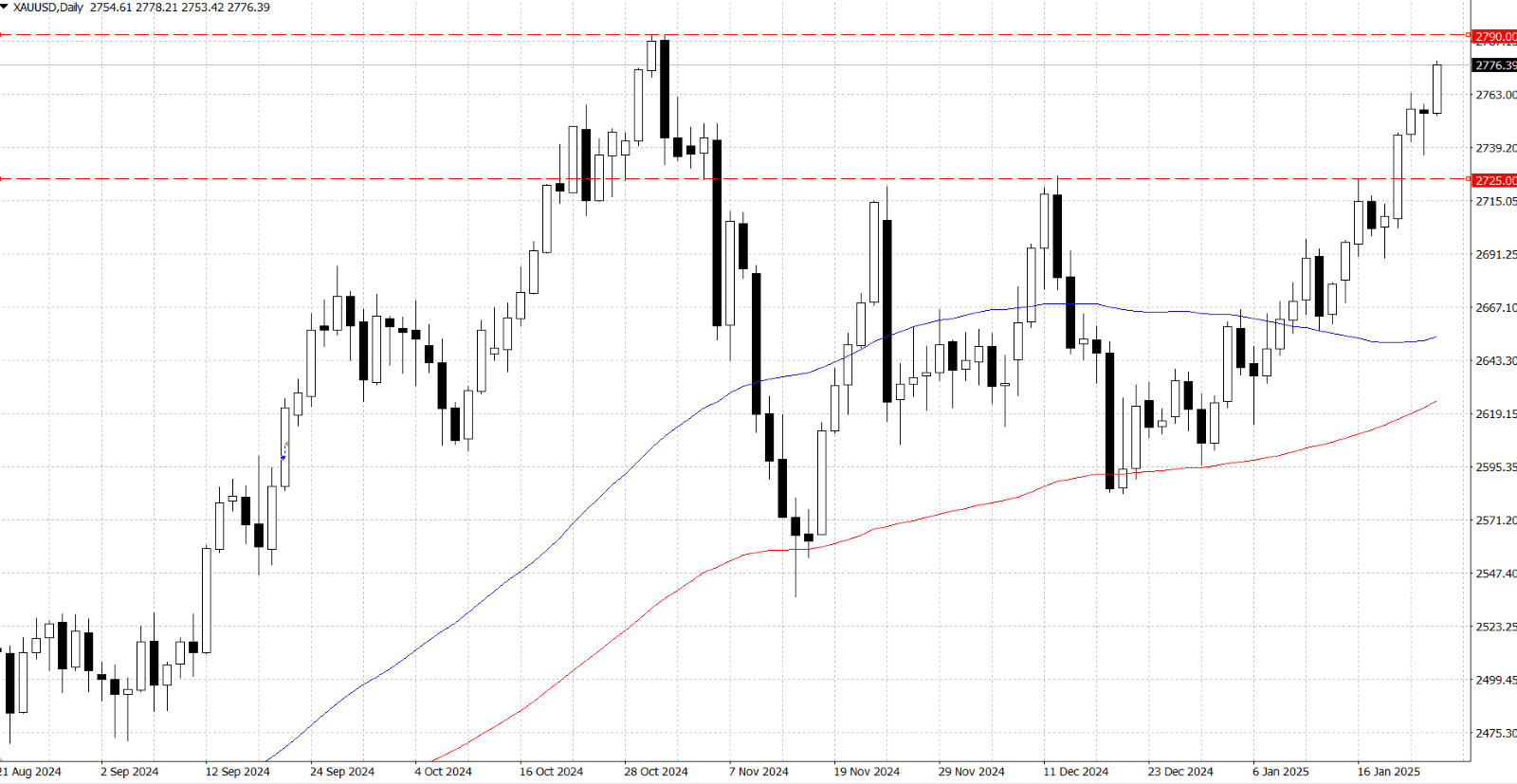

From a technical perspective, Gold's dip-buying on Thursday and subsequent rise confirm a bullish breakout above the $…-… supply zone. However, with the daily RSI nearing overbought levels, a period of consolidation or a minor pullback may be prudent before further gains. Upside momentum is expected to face strong resistance near the all-time high of $…. On the downside, immediate support lies at $…-…, with further support at $…-…. A drop below the $…-… resistance-turned-support zone could signal a bearish shift and open the door to deeper declines.