Article by: ETO Markets

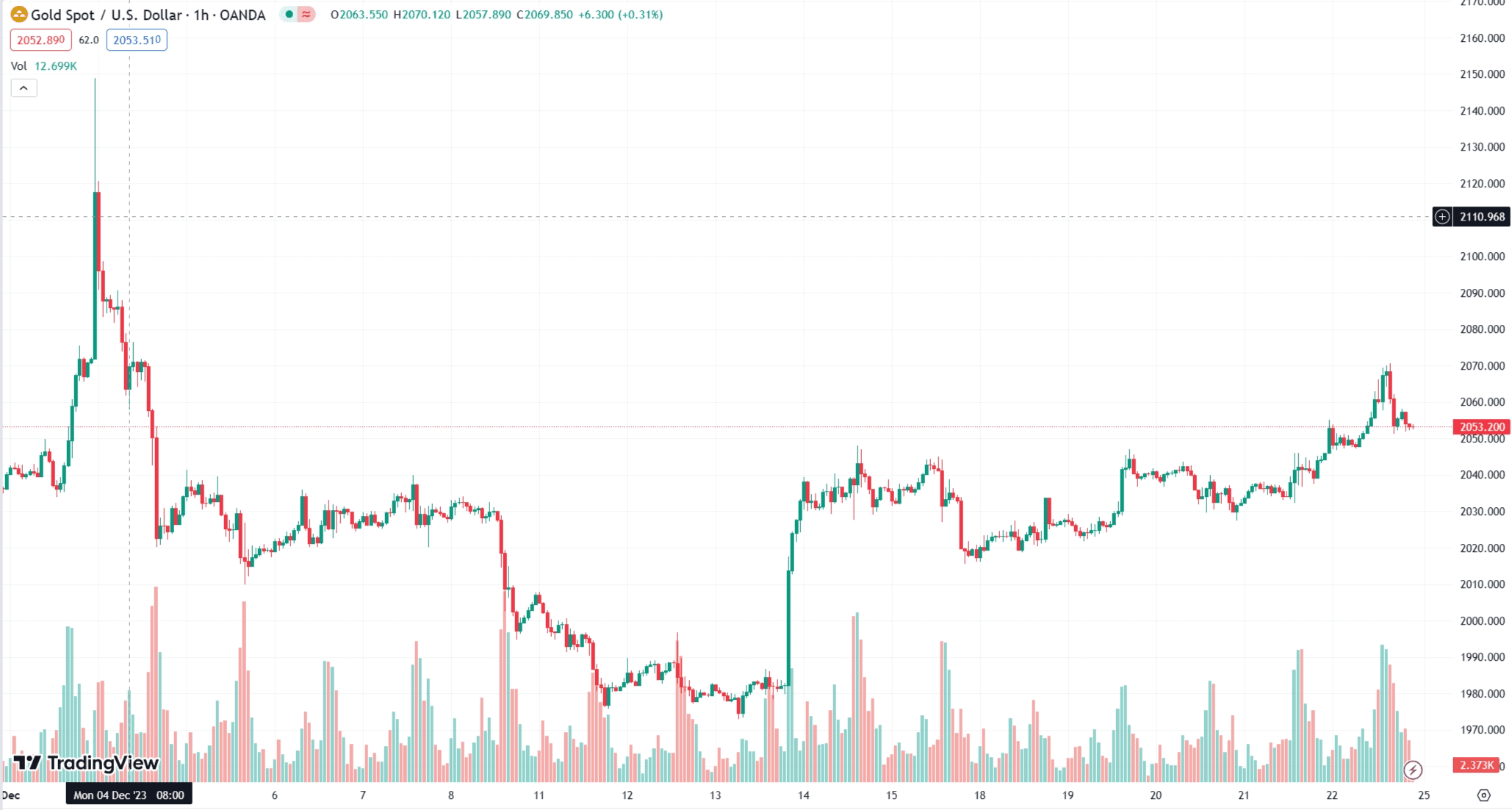

Gold (XAU/USD) reached a nearly three-week high, hovering around $2,055 on Friday. Despite this, it struggled to capitalize on the gain due to a slight increase in the US Dollar (USD). The USD Index (DXY), which measures the Greenback against other currencies, partially reversed a recent slide after the US GDP was revised downward, showing a 4.9% annualized growth compared to the previous 5.2% estimate.

The market quickly factored in a higher likelihood of the Federal Reserve (Fed) cutting rates starting in March 2024, with an expected 155 basis points of easing by the end of the next year. Traders are cautious about making aggressive bets against the USD and are waiting for the US Core Personal Consumption Expenditure (PCE) Price Index, to be released in the early North American session. The headline index is predicted to decrease to a 2.8% YoY rate in November, while the core figure, excluding volatile food and energy prices, is expected to fall to 3.3% YoY.

Despite the market's anticipation of more interest rate cuts in 2024, a softer PCE reading might not cause a significant immediate reaction. However, a stronger report could lead to USD short-covering and weigh on the USD-denominated Gold price.

The potential downside for gold seems limited due to expectations of a global rate-cutting cycle, suggesting that the non-yielding yellow metal is likely to move upward. Any corrective decline could be viewed as a buying opportunity. Despite fluctuations, gold is set to record modest gains for the second consecutive week.