Article by: ETO Markets

Gold prices (XAU/USD) remain subdued near $… during Tuesday's Asian session as profit-taking emerges amid slightly overbought conditions. Trade war fears continue to underpin the precious metal as US President Donald Trump confirmed that tariffs on Canadian and Mexican imports are "on time and on schedule," with reciprocal tariffs on other countries to follow as planned. This trade tension provides a safety net for gold despite today's pullback. Meanwhile, Federal Reserve rate cut expectations offer additional support, though Chicago Fed President Goolsbee's recent comments suggesting a wait-and-see approach have tempered immediate easing hopes. Traders now await today's US Consumer Confidence and Richmond Manufacturing data for short-term direction, while keeping their primary focus on Friday's PCE inflation figures that could significantly influence the Fed's rate path. Gold ETF inflows remain robust, with the largest weekly inflow since March 2022 reported by the World Gold Council, reflecting strong institutional interest in the precious metal.

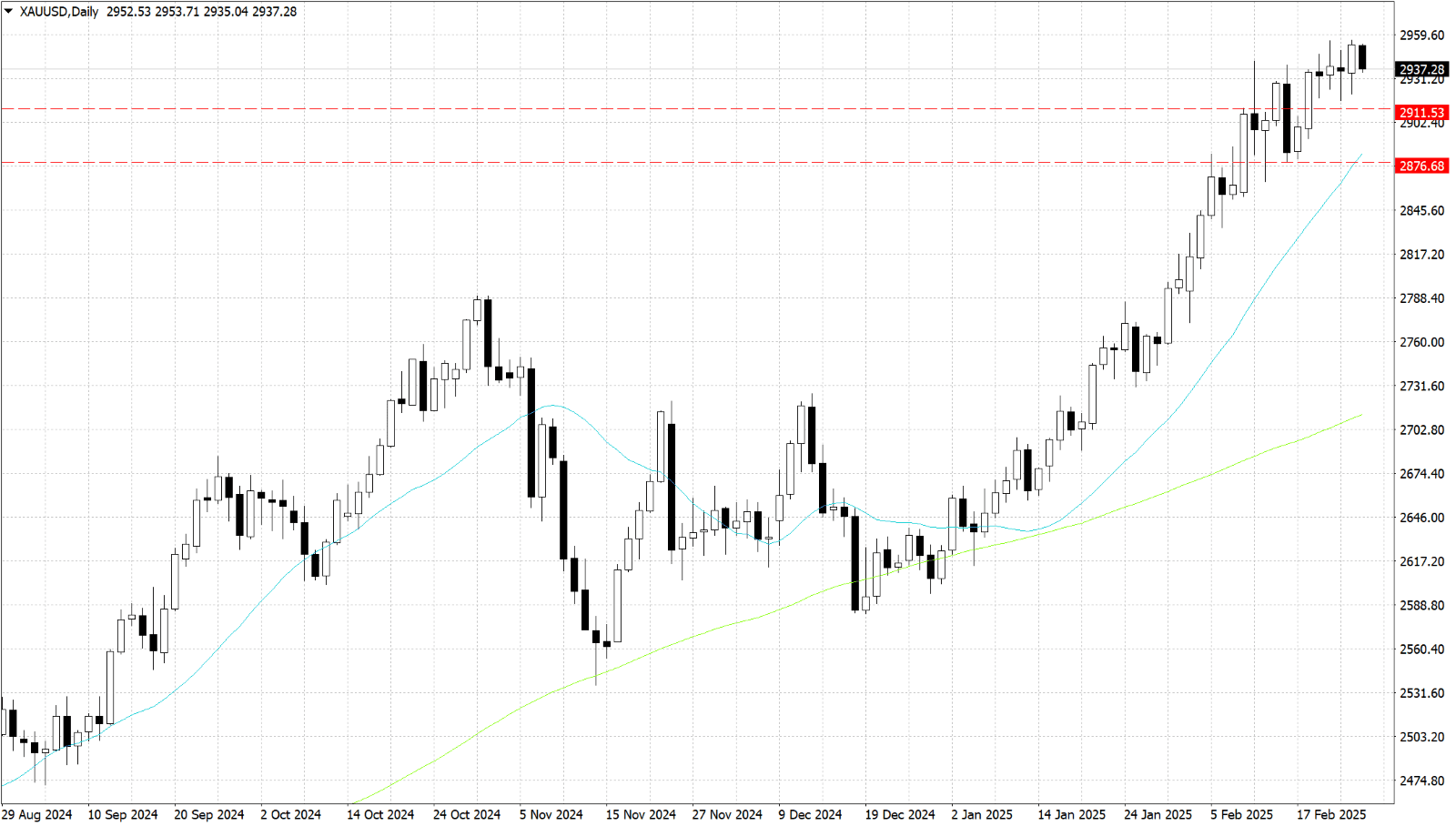

From a technical perspective, gold prices have found support multiple times at the 20-day Simple Moving Average (SMA) at $…. For the record rally to resume, a sustained move above the resistance level at $… is necessary on recent high basis. The Relative Strength Index (RSI) is currently positioned well above the midline at 68.12, indicating strong bullish momentum with potential for further upside. A convincing break above the immediate resistance of $… could open the door to the next resistance at the Bollinger Upper Band at $…, followed by the psychological $… level. However, if buying momentum weakens at higher levels, the price may revisit the immediate support at $…, and a failure to defend this support could lead to a decline toward the 20-day SMA at $…. Prices may also find significant support at the Bollinger Lower Band at $… in case of a deeper correction, though this scenario has a lower probability given the strong underlying trend structure.