Article by: ETO Markets

The US GDP data could provide the USD some momentum and create possibilities for short-term trading around the price of gold ahead of US Personal Consumption Expenditures Price Index on Friday. The important inflation statistics will be critical in determining the next leg of a directional move for the XAU/USD and in shaping market expectations about the Fed's future policy actions. It will be advisable to hold off on declaring that the precious metal has made a near-term bottom unless there is significant follow-through buying.

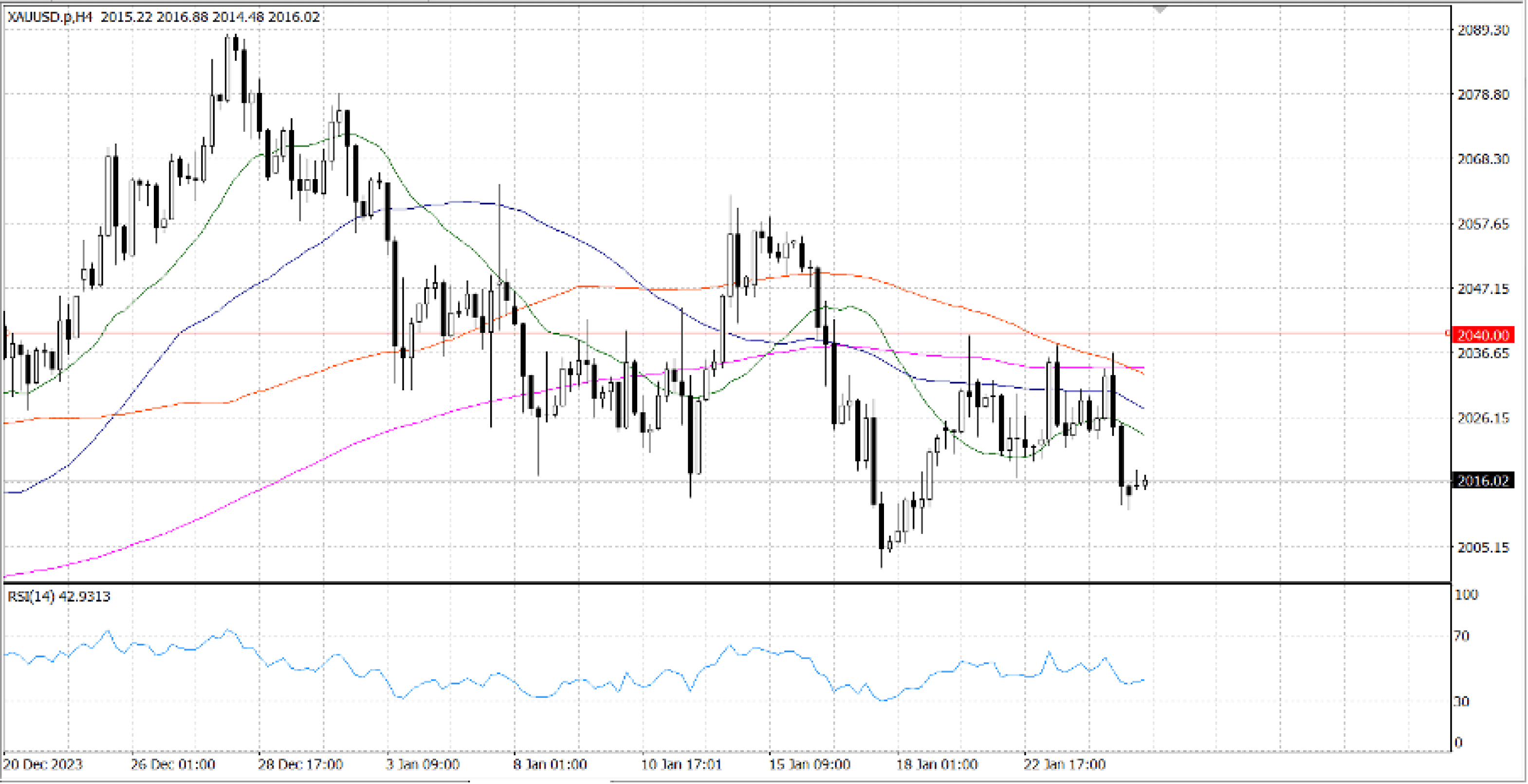

Bearish traders are favoured by the overnight decline and the recent string of failures close to the $… supply zone. Furthermore, oscillators on the daily chart have just begun to move negatively, indicating that the price of gold is likely to follow the path of least resistance to the downside. Nevertheless, it will still be wise to hold off on making any more moves until there is some follow-through selling below the psychological $… barrier.

On the upside, above the $… zone, or the 50-DMA, immediate resistance is located, and a bounce back to the $… barrier is possible for the price of gold. Should the gold price continue to rise above this level, short-covering rallies might be sparked, pushing the metal up to $...