Article by: ETO Markets

Gold (XAU/USD) fell slightly in Asian trading on Monday, but downside may be limited due to rising expectations of a Fed rate cut. The Fed is widely expected to kick off a rate-cutting cycle at its September meeting, which would normally be positive for gold as lower rates reduce the opportunity cost of holding non-interest-bearing assets. In addition, the continued escalation of geopolitical tensions, especially the conflict between Hezbollah and Israel, has increased market uncertainty, thus driving demand for safe-haven assets such as gold. However, weak economic demand from China, which is the world's largest producer and consumer of gold, could undermine gold's upside potential. Meanwhile, the market will also be closely watching the upcoming release of the US durable goods orders for July, the preliminary second quarter GDP and personal consumption expenditure (PCE) data. These economic data will provide more guidance on the Fed's future policy path and could have a further impact on gold prices.

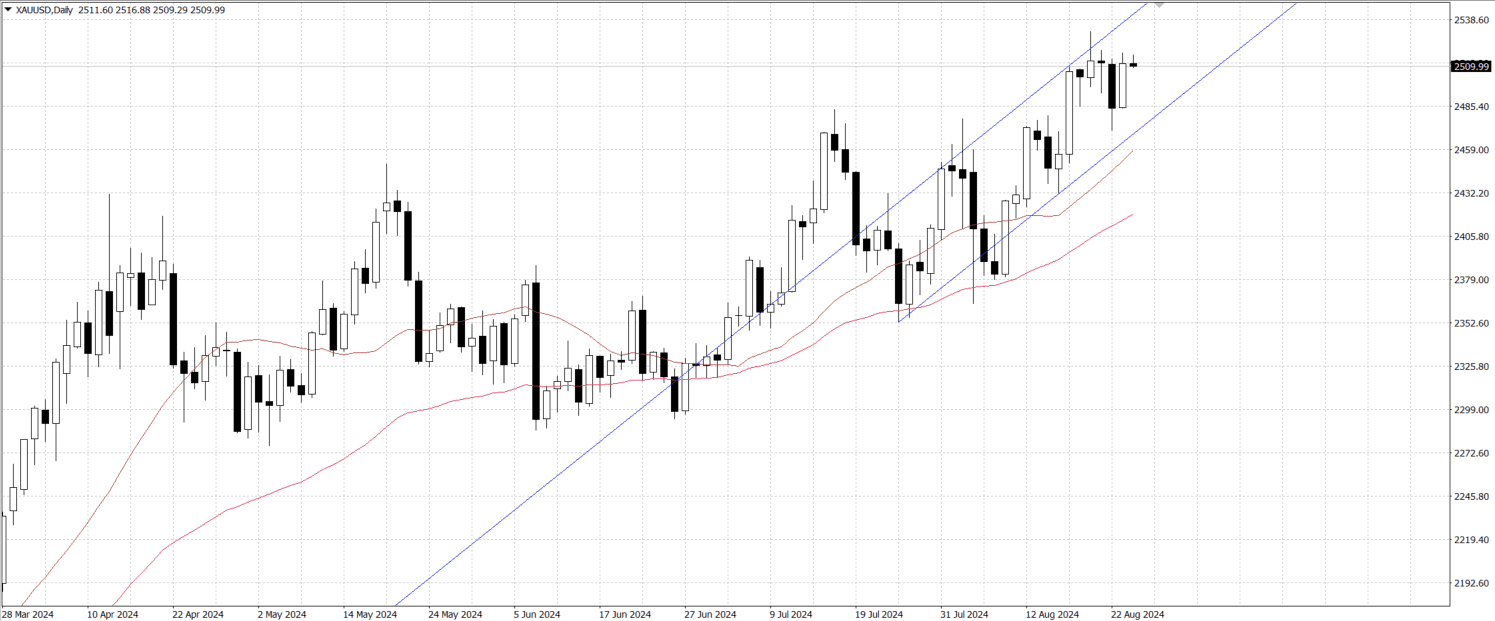

From a technical point ot view, gold prices remain within the long-term uptrend channel, indicating that the overall trend remains in favor of the bulls. Gold prices remained above the 100-day exponential Moving average (EMA), showing strong support. In addition, the 14-day Relative Strength Index (RSI) stands at 62.70, indicating that market momentum is tilted towards the bullish side. In the near term, if gold can continue to hold at current levels and rise further, it could test the all-time high of $…-… and the upper boundary of the trend channel. Once that level is broken, gold is poised to challenge the psychological $… barrier. On the other hand, initial support is at $…. If gold breaks below this support, further selling pressure could drag it down to the $… level and possibly even down to the lower end of the trend channel area of $…- $…, which coincides with the 100-day EMA.