Article by: ETO Markets

Gold prices (XAU/USD) remained near two-week lows during Thursday's European session, trading around the $2,300 mark without achieving any meaningful recovery. The Federal Reserve (Fed) maintained its hawkish stance and the assertion of only one rate cut by 2024. However, signs of easing US inflationary pressures left uncertainty about a Fed rate cut in September unresolved. This did not help the US dollar (USD) capitalise on the strong rally seen the previous day, pushing it to near two-month highs. Furthermore, subdued stock market sentiment, ongoing geopolitical tensions, and political uncertainty provided some support for safe-haven gold prices. US Q1 GDP and Personal Consumption Expenditures (PCE) Price Index will be crucial for determining the dollar's trajectory.

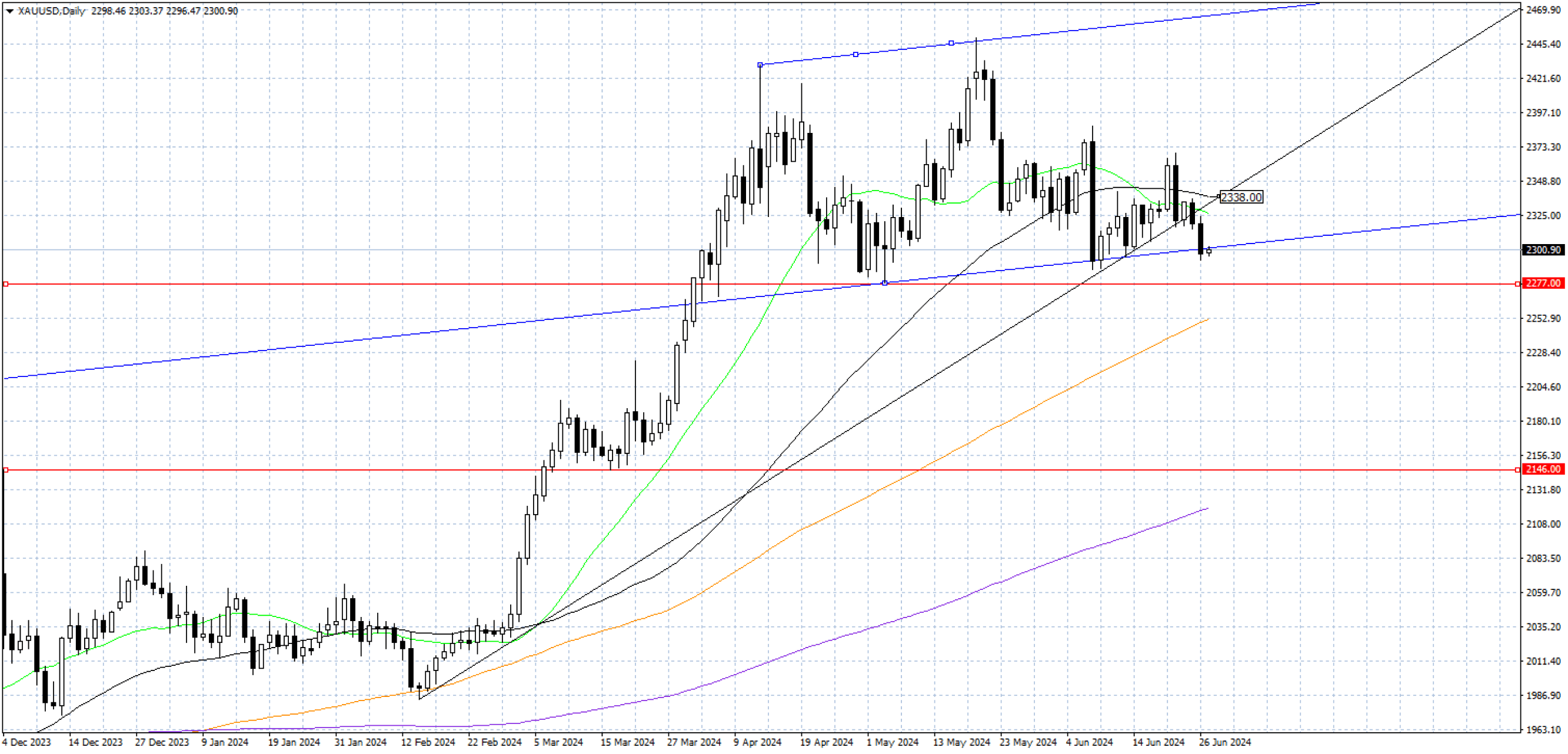

From a technical perspective, XAU/USD has failed twice to complete a head and shoulders pattern and has gradually formed a complex head and shoulders formation, challenging the neckline once again. Despite hovering around $…, the uptrend line has been breached. Any rebound in prices could potentially trigger a stronger bearish reversal. Only pushing prices above $… could alleviate negative sentiment towards gold. If prices fall below $…, sellers may target the $... range.