Article by: ETO Markets

The FOMC minutes that were made public on Tuesday had a more expansionist tone. In addition, expectations that the Fed would maintain higher interest rates for an extended period of time were stoked by Wednesday's positive US labour market and consumer confidence data. This turns out to be a major element acting as a headwind for the non-yielding gold price on the final day of the week, along with a decent increase in US Treasury bond yields.

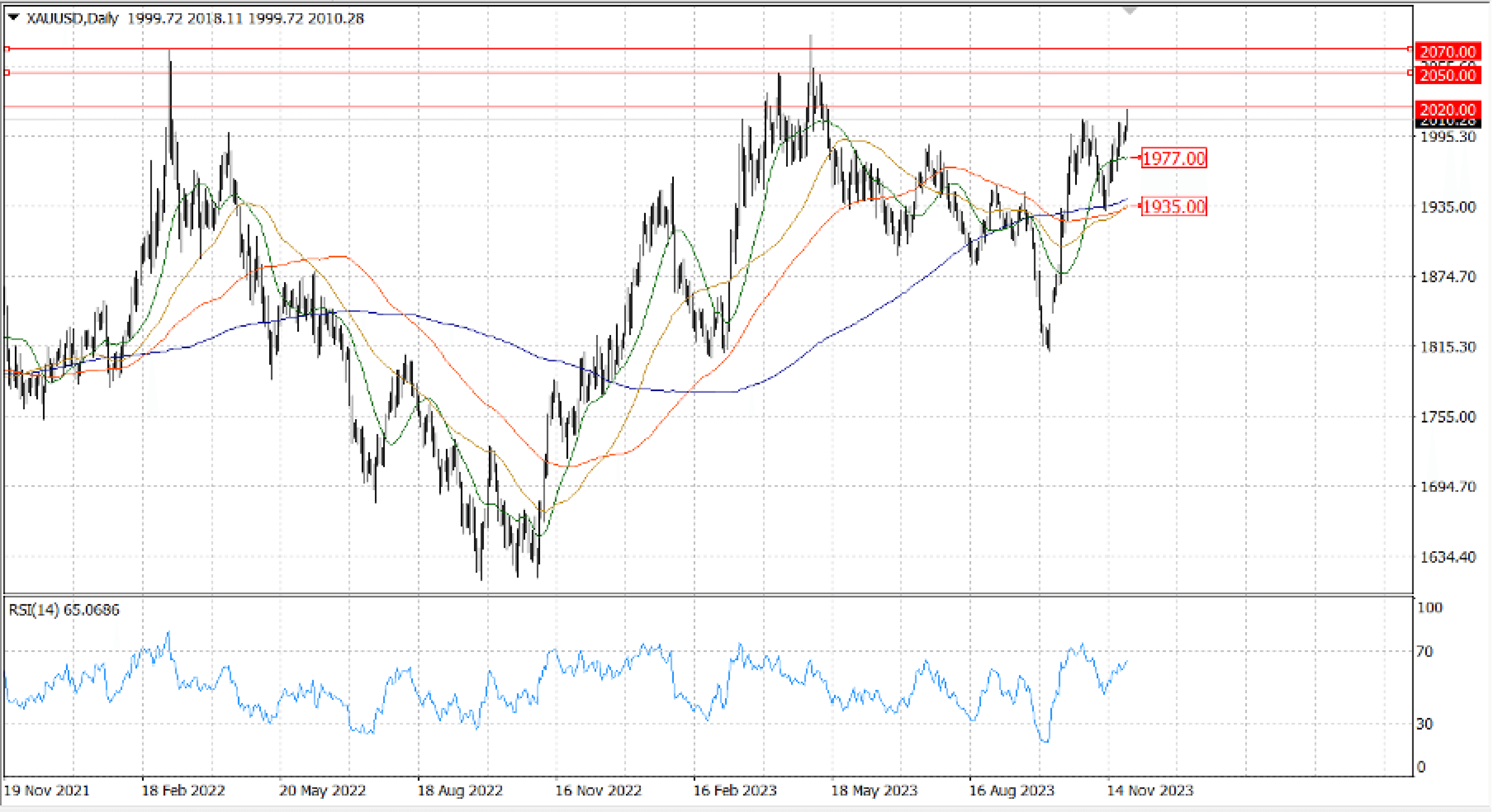

Although maintaining the positive bias, the Relative Strength Index on the daily chart turned an uptrend momentum near 60. The $… where the key resistance is situated. Technical purchasers may act after the pair certifies it as support. In this case, the next optimistic goals might be $… and $...

On the other hand, the 20-DMA creates dynamic resistance around roughly $… on the downside. A daily closure below this mark may allow for a longer decline toward $…, the position of confluence of 50- and 100-DMAs.