Article by: ETO Markets

At the start of the new week, gold (XAU/USD) came under renewed selling pressure, slipping to the $…–… area in Asian trading—nearly testing Friday’s swing low—as receding safe-haven demand and mixed US-China signals weighed on prices. A key headwind has been China’s first-quarter gold consumption, which fell 5.96 percent year-on-year to 290.49 tonnes, led by a 26.85 percent plunge in jewelry demand despite a 29.81 percent jump in bar and coin purchases. At the same time, tentative hopes for a de-escalation of US-China trade tensions—fueled by President Trump’s assertions of ongoing talks and Beijing’s reported exemptions of some US imports, even as China officially denies tariff negotiations—failed to spark a sustained rally. The US dollar, buoyed by last week’s recovery from multi-year lows and bets on Federal Reserve rate cuts beginning in June (and totaling about a full percentage point in 2025), has capped further upside in gold; yet lingering geopolitical risks—from the protracted Russia-Ukraine war, now exacerbated by North Korea’s admission of troop deployments, to shifting US peace-effort commitments—continue to underpin bullion’s floor. With gold off last Tuesday’s all-time peak but lacking clear follow-through selling, traders would do well to await a decisive move before positioning for a deeper correction, especially as this week’s US JOLTS jobs report, Personal Consumption Expenditures data, and non-farm payrolls will be pivotal for the Fed outlook and broader commodity flows.

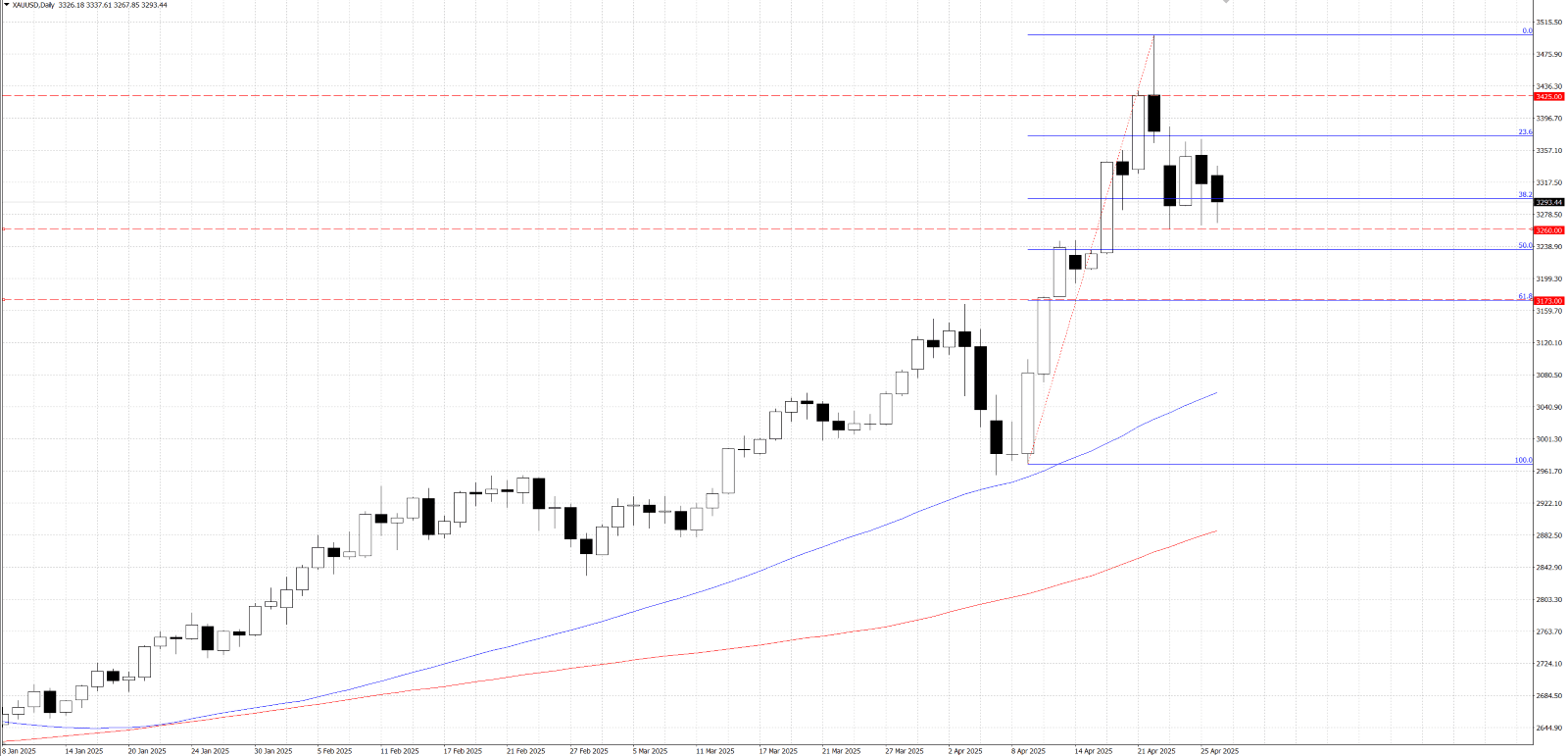

From a technical perspective, bears will need to see gold (XAU/USD) convincingly trade and hold below the 38.2% Fibonacci retracement of the recent rally from the mid-$…—near last month’s swing low—before committing to fresh short positions; a sustained break under the $…–… support zone would confirm that breakdown and open the way for a deeper pullback toward the 50% retracement around $… and ultimately the $… level, where a breach would signal that the metal has likely topped out in the near term. Conversely, any rebound above $…—particularly if it clears the Asian-session high at $…–…—may run into stiff supply at $…–…, making rallies in that area potential selling opportunities; only a decisive push past that zone would pave the way for a return to $…, with subsequent hurdles at $…–… before bulls can realistically target the $… psychological ceiling once again.